Assurant 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT AND FORM 10-K

Table of contents

-

Page 1

2010 ANNUAL REPORT AND FORM 10-K -

Page 2

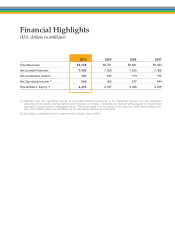

... measure of the company's operating performance. Net operating income equals net income, excluding net realized gains (losses) on investments and other unusual and/or infrequent items. Please see page 4 at the back of this Assurant 2010 Annual Report for more information and a reconciliation of... -

Page 3

... of products and services that we can build on in 2011 and beyond. 2010 RESULTS FROM OPERATIONS Assurant Solutions Assurant Solutions focused on developing new client relationships and distribution channels in 2010. Net operating income for the year was $103.2 million and net earned premiums were... -

Page 4

... our customers and long-term value for our shareholders. Assurant Health In 2010, Assurant Health delivered solid results while transforming to operate in an environment of new regulations and changing market dynamics. Net operating income for the year was $54.0 million and net earned premiums were... -

Page 5

FORM 10-K ASSURANT - 2010 - 2010 Annual Annual Report Report ASSURANT 3 3 -

Page 6

......57 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...58 Controls and Procedures...58 Other Information ...58 PART III ITEM 10 ITEM 11 ITEM 12 ITEM 13 ITEM 14 59 Directors, Executive Officers and Corporate Governance...59 Executive Compensation...59 Security... -

Page 7

...June 30, 2010 based on the closing sale price of $34.70 per share for the common stock on such date as traded on the New York Stock Exchange. The number of shares of the registrant's Common Stock outstanding at February 15, 2011 was 99,936,080. DOCUMENTS INCORPORATED BY REFERENCE Certain information... -

Page 8

...credit risk of some of our agents in Assurant Specialty Property and Assurant Solutions; (xx) failure to effectively maintain and modernize our information systems; (xxi) failure to protect client information and privacy; (xxii) failure to ï¬nd and integrate suitable acquisitions and new insurance... -

Page 9

... insurance, manufactured housing homeowners insurance, individual health and small employer group health insurance, group dental insurance, group disability insurance, and group life insurance. Assurant's mission is to be the premier provider of specialized insurance products and related services... -

Page 10

...extended service contracts and warranties. These contracts provide consumers with coverage on appliances, consumer electronics, personal computers, cellular phones, automobiles and recreational vehicles, protecting them from certain covered losses. We pay the cost of repairing or replacing customers... -

Page 11

... those policies. To manage these spreads, we regularly adjust pricing to reï¬,ect changes in new money yields. Assurant Specialty Property December 31, 2010 Net earned premiums and other considerations by major product grouping: Homeowners (lender-placed and voluntary) Manufactured housing (lender... -

Page 12

... performed by Assurant Specialty Property using a proprietary insurance tracking administration system, or by the lenders themselves. A number of manufactured housing retailers in the U.S. use our proprietary premium rating technology to assist them in selling property coverages at the point of sale... -

Page 13

... and short-term medical insurance to individuals and families. Our products are offered with different plan options to meet a broad range of customer needs and levels of affordability. Assurant Health also offers medical insurance to small employer groups. In March 2010, President Obama signed... -

Page 14

... relationships with brokers who work primarily with small businesses give us a competitive advantage versus other carriers. We offer group disability, dental, vision, life and supplemental worksite products as well as individual dental products. The group products are offered with funding options... -

Page 15

...Security Insurance Company Assurant Life of Canada Caribbean American Life Assurance Company Caribbean American Property Insurance Company John Alden Life Insurance Company Reliable Lloyds Standard Guaranty Insurance Company Time Insurance Company UDC Dental California Union Security Dental Care New... -

Page 16

... regulating companies' ability to enter and exit markets or to provide, terminate or cancel certain coverages; • imposing statutory accounting and annual statement disclosure requirements; • approving policy forms and mandating certain insurance beneï¬ts; • regulating premium rates, including... -

Page 17

... who applies for such coverage; increased costs to modify and/or sell our products; intensiï¬ed competitive pressures that limit our ability to increase rates due to state insurance exchanges; signiï¬cant risk of customer loss; new and higher taxes and fees; and the need to operate with a lower... -

Page 18

...insurance coverage for individuals and small groups (generally groups with 50 or fewer employees) and limitations on exclusions based on pre-existing conditions. HIPAA also imposes requirements on health insurers, health plans and health care providers to ensure the privacy and security of protected... -

Page 19

... our preneed insurance policies. In Assurant Specialty Property, we have exclusive relationships with mortgage lenders and manufactured housing lenders, manufacturers and property managers. In Assurant Health, we have exclusive distribution relationships for our individual health insurance products... -

Page 20

...ordable Care Act have compelled health insurers to decrease broker commission levels. Similarly, the Company recently decreased its commission levels for distribution channels that market Assurant Health's individual medical and small employer group medical products. Although the Company believes... -

Page 21

... Assurant Specialty Property's lender-placed homeowners and lender-placed manufactured housing insurance products are designed to automatically provide property coverage for client portfolios, our concentration in certain catastrophe-prone states like Florida, California and Texas may increase... -

Page 22

... of the disability or for a stated period, during which time the life insurance coverage continues. If interest rates decline, reserves for open and/or new claims in Assurant Employee Beneï¬ts would need to be calculated using lower discount rates, thereby increasing the net present value of those... -

Page 23

... the long term. If, in response, we choose to increase our product prices, our ability to compete and grow may be diminished. Environmental liability exposure may result from our commercial mortgage loan portfolio and real estate investments. Liability under environmental protection laws resulting... -

Page 24

..., in 2001 we sold the insurance operations of our Fortis Financial Group ("FFG") division to The Hartford Financial Services Group, Inc. ("The Hartford") and in 2000 we sold our Long Term Care ("LTC") division to John Hancock Life Insurance Company ("John Hancock"), now a subsidiary of Manulife... -

Page 25

... we contract in Assurant Solutions and Assurant Specialty Property. We advance agents' commissions as part of our preneed insurance product offerings. These advances are a percentage of the total face amount of coverage. There is a one-year payback provision against the agency if death or lapse... -

Page 26

... we have succession plans for key executives, this does not guarantee that they will stay with us. Risks Related to Our Industry Reform of the health insurance industry could make our health insurance business unproï¬table. In March 2010, President Obama signed the Affordable Care Act into law... -

Page 27

...of review for claims denials or coverage determinations; • guaranteed-issue requirements restricting our ability to limit or deny coverage; • new beneï¬t mandates; • increased regulation relating to lender-placed insurance; • limitations on our ability to build appropriate provider networks... -

Page 28

... volatility. Company-speciï¬c issues and market developments generally in the insurance industry and in the regulatory environment may have caused this volatility. Our stock price could materially ï¬,uctuate or decrease in response to a number of events and factors, including but not limited to... -

Page 29

... preneed business also has a headquarters building in Rapid City, South Dakota. Assurant Employee Beneï¬ts has a headquarters building in Kansas City, Missouri. Assurant Health has a headquarters building in Milwaukee, Wisconsin. We lease office space for various offices and service centers located... -

Page 30

... 400 Midcap Index, as the broad equity market index, and the S&P COMPARISON OF CUMULATIVE TOTAL RETURN $200 400 Multi-Line Insurance Index and S&P 500 Multi-Line Insurance Index, as the published industry indexes. The graph assumes that the value of the investment in the common stock and each index... -

Page 31

... 5 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Annual return percentage Years Ending 12/31/09 12/31/10 0.56 33.09 37.38 26.64 36.35 23.23 15.52 17.17 Company/Index Assurant, Inc. S&P 400 MidCap Index S&P 500 Multi-line Insurance Index... -

Page 32

... costs and value of businesses acquired Underwriting, general and administrative expenses Interest expense Goodwill impairment (3) TOTAL BENEFITS, LOSSES AND EXPENSES Income before provision for income taxes and cumulative effect of change in accounting principle Provision for income taxes (4) Net... -

Page 33

...a cumulative adjustment of $1,547. (6) Policy liabilities include future policy benefits and expenses, unearned premiums and claims and benefits payable. (7) Total stockholders' equity divided by the basic shares of common stock outstanding. At December 31, 2010, 2009 and 2008 there were 103,227,238... -

Page 34

... experience to revert to more traditional levels. We plan to lower our discount rate for new long-term disability claims in 2011, as interest rates remain at low levels. This low interest rate environment will also continue to pressure our investment income. 28 ASSURANT, INC.  2010 Form 10K -

Page 35

... and short-term investments. Beginning January 1, 2011, Assurant Health will be required to start accruing for rebates to customers if the minimum loss ratio for some of its products is less than 80%. The rebate accrual will be reï¬,ected as a reduction to net earned premiums in the Statement of... -

Page 36

...in which such increases are made. The following table provides reserve information of our major product lines for the years ended December 31, 2010 and 2009: December 31, 2010 Claims and Beneï¬ts Payable Incurred But Future Policy Not Reported Beneï¬ts and Unearned Reserves Expenses Premiums Case... -

Page 37

... life waiver of premium reserves. Group term life, discount rate decreased by 100 basis points Group term life, as reported Group life, discount rate increased by 100 basis points $ $ $ Claims and Beneï¬ts Payable 255,162 246,000 237,765 Medical IBNR reserves calculated using generally accepted... -

Page 38

... disputes involving ARIC and an affiliate, Assurant General Insurance Limited (formerly Bankers Insurance Company Limited ("AGIL")), for the 1995 and 1996 program years are subject to working group settlements negotiated with other market participants. Negotiations, arbitrations and litigation are... -

Page 39

... premiums over the premium-paying period. These acquisition costs consist primarily of ï¬rst year commissions paid to agents and sales and policy issue costs. For preneed investment-type annuities, preneed life insurance policies with discretionary death beneï¬t growth issued after January 1, 2009... -

Page 40

... plan and its assets. The assumptions we use may differ materially from actual results. See Note 22 to our consolidated ï¬nancial statements for more information on our retirement and other employee beneï¬ts, including a sensitivity analysis for changes in the assumed health care cost trend rates... -

Page 41

... unit: 2010 379,935 239,844 - - 619,779 December 31, 2009 380,291 239,726 204,303 102,078 926,398 Assurant Solutions Assurant Specialty Property Assurant Health Assurant Employee Beneï¬ts TOTAL $ $ $ $ For each reporting unit, we ï¬rst compare its estimated fair value with its net book value... -

Page 42

... an increased net book value, primarily related to their investment portfolio. Management remains conï¬dent in the long-term prospects of both the Assurant Employee Beneï¬ts and Assurant Health reporting units. See Note 6 and 11 for further information. The two reporting units that passed the 2010... -

Page 43

...events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. If Step 1 of the impairment test indicates that the net book value of the reporting unit is greater than the estimated fair value, then Step 2 test is required. Step 2 requires that the Company... -

Page 44

... are deï¬ned as costs that are related directly to the successful acquisition of new or renewal insurance contracts. The amendments are effective for ï¬scal years, and interim periods within those ï¬scal years, beginning after December 15, 2011. Therefore, the Company is required to adopt this... -

Page 45

...goodwill impairment charge of $83,000. These negative items were partially offset by lower net realized losses on investments of $243,803 (after-tax) as Twelve Months 2009 includes $34,838 (after-tax) compared with $278,641 (after-tax) in Twelve Months 2008. ASSURANT, INC.  2010 Form 10K 39 -

Page 46

...received on preneed policies is presented separately as net earned premiums, with policyholder benefits expense being shown separately. The change from reporting certain preneed life insurance policies in accordance with the universal life insurance guidance versus the limited pay insurance guidance... -

Page 47

...of $142,366, primarily resulting from the application of universal life insurance accounting guidance, in our Preneed business. Absent this item, net earned premiums increased $35,000, or 1%, due to our domestic and international service contract business from ASSURANT, INC.  2010 Form 10K 41 -

Page 48

... from our domestic credit insurance business decreased $77,569, due to the continued runoff of this product line. Gross written premiums from our international service contract business decreased $14,688, primarily the result of unfavorable changes in foreign exchange rates. This was partially... -

Page 49

... client contract changes that resulted in lower commission expenses and a release of a premium tax reserve. General expenses increased $3,144 primarily due to increased employee related expenses. Year Ended December 31, 2009 Compared to the Year Ended December 31, 2008 Net Income Segment net income... -

Page 50

... losses in Twelve Months 2009. Commissions, taxes, licenses and fees decreased $32,022, primarily due to the decline in net earned premiums. General expenses increased $46,702 primarily due to additional services provided to our clients, such as loss drafts, along with investment in technology and... -

Page 51

...continued high level of policy lapses and lower sales. Net earned premiums and other considerations from our small employer group business decreased $16,075, or 3%, due to a continued high level of policy lapses, partially offset by premium rate increases. Short-term medical net earned premiums and... -

Page 52

... 2009. The increase in net income was primarily attributable to favorable loss experience in all product lines. Favorable disability results and life mortality, as well as dental pricing actions, contributed to the improvement. Twelve Months 2010 includes restructuring charges of $4,349 (after-tax... -

Page 53

... investment yields. In addition, net income includes a reserve release related to annual reserve adequacy studies of $2,102 (after-tax) in Twelve Months 2009 compared with $3,485 (after-tax) in Twelve Months 2008. venture partnership income while Twelve Months 2009 includes a loss of $237 from real... -

Page 54

... for Twelve Months 2010 compared with $161,846 for Twelve Months 2009. tax expense from the change in deferred tax asset valuation allowance, previously disclosed executive compensation expense (severance and special retirement bonus) of $4,550 (after-tax) and a decline in net investment income of... -

Page 55

... Equity securities Commercial mortgage loans on real estate Policy loans Short-term investments Other investments Cash and cash equivalents Total investment income Investment expenses NET INVESTMENT INCOME $ $ Net investment income increased $4,352, or 1%, to $703,190 at December 31, 2010 from... -

Page 56

... received, generally in investments of high credit quality that are designated as available-forsale. The Company monitors the fair value of securities loaned and Liquidity and Capital Resources Regulatory Requirements Assurant, Inc. is a holding company, and as such, has limited direct operations... -

Page 57

... to pay insurance claims, agent commissions, operating expenses and taxes. We generally invest our subsidiaries' excess funds in order to generate investment income. We conduct periodic asset liability studies to measure the duration of our insurance liabilities, to develop optimal asset portfolio... -

Page 58

... 2009, respectively. The change in underfunded status is mainly due to a decrease in the discount rate used to determine the projected beneï¬t obligation, which is partially offset by better than expected asset performance. In prior years we established a funding policy in which service cost plus... -

Page 59

.... Net cash provided by (used in) investing activities was $141,467 and $(329,003) for the years ended December 31, 2009 and 2008, respectively. The change in investing activities was primarily due to fewer purchases of short-term investments, commercial mortgage loans, ï¬xed maturity securities and... -

Page 60

... Disclosures About Market Risk As a provider of insurance products, effective risk management is fundamental to our ability to protect both our customers' and stockholders' interests. We are exposed to potential loss from various market risks, in particular interest rate risk and credit risk... -

Page 61

... on our reported portfolio yield as of the dates indicated: INTEREST RATE MOVEMENT ANALYSIS OF PORTFOLIO YIELD OF FIXED MATURITY SECURITIES INVESTMENT PORTFOLIO As of December 31, 2010 Portfolio yield Basis point change in portfolio yield As of December 31, 2009 Portfolio yield Basis point change in... -

Page 62

... 9% of Assurant preneed insurance policies, with reserves of $316,033 and $341,956 as of December 31, 2010 and 2009, respectively, have death beneï¬ts that are guaranteed to grow with the CPI. In times of rapidly rising inï¬,ation, the credited death beneï¬t growth on these liabilities increases... -

Page 63

... exchange rates, ï¬nancial indices or the prices of securities or commodities. Derivative ï¬nancial instruments may be exchange-traded or contracted in the over-the-counter market and include swaps, futures, options and forward contracts. Under insurance statutes, our insurance companies may... -

Page 64

...provide reasonable assurance regarding the reliability of ï¬nancial reporting and the preparation of ï¬nancial statements for external purposes in accordance with accounting principles generally accepted in the United States. A company's internal control over ï¬nancial reporting includes policies... -

Page 65

...Matters The information in the 2011 Proxy Statement under the captions "Securities Authorized for Issuance Under Equity Compensation Plans," "Security Ownership of Certain Beneï¬cial Owners" and "Security Ownership of Management" is incorporated herein by reference. ASSURANT, INC.  2010 Form 10... -

Page 66

...Corporate Governance" is incorporated herein by reference. ITEM 14 Principal Accounting Fees and Services The information in the 2011 Proxy Statement under the caption "Fees of Principal Accountants" in "Audit Committee Matters" is incorporated herein by reference. 60 ASSURANT, INC.  2010 Form... -

Page 67

... section of our website, located at www.assurant.com. Pursuant to the rules and regulations of the SEC, the Company has ï¬led or incorporated by reference certain agreements as exhibits to this Annual Report on Form 10-K. These agreements may contain representations and warranties by the parties... -

Page 68

... 17, 2010).* Form of Assurant, Inc. Restricted Stock Unit Award Agreement for Time-based Awards under the Assurant, Inc. Long Term Equity Incentive Plan (incorporated by reference from Exhibit 10.1 to the Registrant's Form 8-K, originally ï¬led on March 16, 2009).* Form of Assurant, Inc. Restricted... -

Page 69

... Registration Statement on Form S-1 (File No. 333-109984) and amendments thereto, originally ï¬led on October 24, 2003).* Reinsurance Agreement, dated May 5, 2009, by and between American Security Insurance Company, American Bankers Insurance Company of Florida, Standard Guaranty Insurance Company... -

Page 70

...thereunto duly authorized on February 23, 2011. ASSURANT, INC. /s/ROBERT B. POLLOCK By: Name: Title: Robert B. Pollock President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons on... -

Page 71

... of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. New York, New York February 23, 2011 ASSURANT, INC.  2010 Form 10K F-1 -

Page 72

... value (cost-$452,648 in 2010 and $514,349 in 2009) Commercial mortgage loans on real estate, at amortized cost Policy loans Short-term investments Collateral held under securities lending Other investments Total investments Cash and cash equivalents Premiums and accounts receivable, net Reinsurance... -

Page 73

... costs and value of business acquired Underwriting, general and administrative expenses Interest expense Goodwill impairment TOTAL BENEFITS, LOSSES AND EXPENSES Income before provision for income taxes Provision for income taxes NET INCOME Earnings per share Basic Diluted Dividends per share Share... -

Page 74

... unrecognized net periodic beneï¬t cost and change in funded status, net of taxes of $6,579 Total other comprehensive income Total comprehensive income: Balance, December 31, 2009 $ Stock plan exercises Stock plan compensation expense Change in tax beneï¬t from share-based payment arrangements... -

Page 75

... and postretirement unrecognized net periodic beneï¬t cost and change in funded status, net of taxes of $7,303 Total other comprehensive income Total comprehensive income: Balance, December 31, 2010 $ See the accompanying notes to the consolidated financial statements. - - - 218,705 - 218... -

Page 76

... and warranty business, net of cash transferred (2) Change in commercial mortgage loans on real estate Change in short-term investments Change in other invested assets Change in policy loans Change in collateral held under securities lending NET CASH USED IN PROVIDED BY INVESTING ACTIVITIES... -

Page 77

..., manufactured housing homeowners insurance, individual health and small employer group health insurance, group dental insurance, group disability insurance and group life insurance. Assurant, Inc. ("Assurant" or the "Company") is a Delaware corporation, whose common stock trades on the New York... -

Page 78

... value of the underlying policies. Short-term investments include money market funds and short maturity investments. These amounts are reported at cost, which approximates fair value. The Company engages in collateralized transactions in which ï¬xed maturity securities, especially bonds issued... -

Page 79

...The Company classiï¬es net interest expense related to tax matters and any applicable penalties as a component of income tax expense. Short Duration Contracts Acquisition costs relating to property contracts, warranty and extended service contracts and single premium credit insurance contracts are... -

Page 80

...we conducted our annual assessments of goodwill. Based on the results of the 2010 assessment, the Company concluded that the net book values of the Assurant Employee Beneï¬ts and Assurant Health reporting units exceeded their estimated fair values and therefore performed a Step 2 test. Based on the... -

Page 81

... group term life contracts, group disability contracts, medical contracts, dental contracts, property and warranty contracts, credit life and disability contracts and extended service contracts. For short duration contracts, claims and beneï¬ts payable reserves are recorded when insured events... -

Page 82

... fourth quarter of 2010, the Company re-established $8,158 of the FFG deferred gain based on its annual review. life, group disability, medical, dental, property and warranty, credit life and disability, and extended service contracts and individual medical contracts issued from 2003 through 2006... -

Page 83

... the non-credit component of previously recognized OTTI securities which resulted in an increase of $43,117 (after-tax) in retained earnings and a decrease of $43,117 (after-tax) in AOCI. See Note 5 for further information. On April 1, 2009, the Company adopted the new guidance on determining... -

Page 84

..., on a coinsurance basis, 100% of the group life, disability, dental and vision insurance business During the years of 2009 and 2008, the Company made several acquisitions with available cash. There were three acquisitions made in 2010 that individually and in the aggregate are immaterial. The... -

Page 85

...the Company sold a subsidiary, United Family Life Insurance Company ("UFLIC"), to a third party for proceeds of $32,715. The Company recognized a pre-tax gain of $3,175 and an associated net tax beneï¬t of $84,864 from the sale. 5. Investments The following tables show the cost or amortized cost... -

Page 86

... Fixed maturity securities Equity securities Commercial mortgage loans on real estate Policy loans Short-term investments Other investments Cash and cash equivalents Total investment income Investment expenses NET INVESTMENT INCOME $ $ $ $ No material investments of the Company were non-income... -

Page 87

..., recognized in the statement of operations as follows: 2010 Net realized gains (losses) related to sales and other: Fixed maturity securities Equity securities Commercial mortgage loans on real estate Other investments Collateral held under securities lending TOTAL NET REALIZED GAINS LOSSES... -

Page 88

... amount and timing of projected future cash ï¬,ows. The net present value is calculated by discounting the Company's best estimate of projected future cash ï¬,ows at the effective interest rate implicit in the security at the date of acquisition. For residential and commercial mortgage-backed and... -

Page 89

5 Investments The investment category and duration of the Company's gross unrealized losses on ï¬xed maturity securities and equity securities at December 31, 2010 and 2009 were as follows: Less than 12 months Fair Value Unrealized Losses Fixed maturity securities: United States Government and ... -

Page 90

... to one individually impaired commercial mortgage loan with a loan valuation allowance of $22,092 and $6,320, and a net loan value of F-20 ASSURANT, INC.  2010 Form 10K $0 and $15,772 at December 31, 2010 and December 31, 2009, respectively. At December 31, 2010, the Company had mortgage loan... -

Page 91

... of cash collateral received is unrestricted. The Company reinvests the cash collateral received, generally in investments of high credit quality that are designated as available-forsale. The Company monitors the fair value of securities loaned and the collateral received, with additional collateral... -

Page 92

...assets and liabilities within these line items are measured at estimated fair value. Other investments and Other liabilities are comprised of investments in the Assurant Investment Plan, American Security Insurance Company Investment Plan, Assurant Deferred Compensation Plan and the related deferred... -

Page 93

... "Net transfers" line below. Transfers between Level 2 and Level 3 most commonly occur when market observable inputs that were previously available become unavailable in the current period. The remaining unpriced securities are submitted to independent brokers who provide non-binding broker quotes... -

Page 94

... in the pricing evaluation of Level 2 securities: benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers and reference data. To price municipal bonds, the pricing service uses material event notices and new issue data inputs... -

Page 95

... 31, 2010 and 2009, respectively, on one individually impaired commercial mortgage loan with a principal balance of $22,092 for both periods. Due to the continued decline in the regional commercial real estate market, the value of the loan was determined ASSURANT, INC.  2010 Form 10K F-25 -

Page 96

... Company's policy reserves under the investment products are determined using discounted cash ï¬,ow analysis. Funds withheld under reinsurance The carrying value reported approximates fair value due to the short maturity of the instruments. Debt The fair value of debt is based upon matrix pricing... -

Page 97

... sheets as of December 31, 2010 and 2009. Carrying Value Financial assets Commercial mortgage loans on real estate Policy loans Financial liabilities Policy reserves under investment products (Individual and group annuities, subject to discretionary withdrawal) Funds withheld under reinsurance Debt... -

Page 98

... 20.5 % Federal income tax rate: Reconciling items: Tax exempt interest Dividends received deduction Foreign earnings Foreign tax credit Change in valuation allowance Loss on sale of subsidiary Goodwill Other EFFECTIVE INCOME TAX RATE: During 2008, the Company recorded a tax beneï¬t of $174,864... -

Page 99

... the Company has not provided deferred income taxes is $128,842. Upon distribution of such earnings in a taxable event, the Company would incur additional U.S. income taxes of $31,421 net of anticipated foreign tax credits. At December 31, 2010, the Company and its subsidiaries had net operating... -

Page 100

... 6 for further information. (3) Represents impairment of Assurant Employee Benefits and Assurant Health reporting units. See Notes 2 and 6 for further information. The Company has assigned goodwill to its reportable operating segments for impairment testing purposes. The Corporate and other segment... -

Page 101

...an increased net book value of the reporting unit, primarily related to its investment portfolio. Management remains conï¬dent in the long-term prospects of both the Assurant Employee Beneï¬ts and Assurant Health reporting units. See Note 6 for further information. ASSURANT, INC.  2010 Form 10... -

Page 102

... to the Assurant Solutions segment and is related to a fourth quarter 2010 client notification of non-renewal of a block of domestic service contract business effective June 1, 2011. Other intangible assets that have ï¬nite lives, including customer relationships, customer contracts and other... -

Page 103

...other Short Duration Contracts: Group term life Group disability Medical Dental Property and Warranty Credit Life and Disability Extended Service Contracts All other TOTAL Unearned Premiums Incurred But Case Not Reported Reserves Reserves Future Policy Beneï¬ts and Expenses December 31, 2009 Claims... -

Page 104

...,299 at December 31, 2010, and 2009 and 2008, respectively. Short Duration Contracts The Company's short duration contracts are comprised of group term life, group disability, medical, dental, property and warranty, credit life and disability, extended service contracts and all other. The principal... -

Page 105

... well as favorable litigation settlements. The Company's group disability products are short duration contracts that include short and long term disability coverage. Case reserves and IBNR for long-term disability have been discounted at 5.25% in 2010. The December 31, 2010 and 2009 liabilities net... -

Page 106

... credit exposure are reviewed at the time of execution. The A.M. Best ratings for existing reinsurance agreements are reviewed on a periodic basis, at least annually. The following table provides the reinsurance recoverable as of December 31, 2010 grouped by A.M. Best rating: F-36 ASSURANT... -

Page 107

... related to certain reinsurance arrangements. The Company utilizes ceded reinsurance for loss protection and capital management, business dispositions, and in Assurant Solutions and Assurant Specialty Property segments, for client risk and proï¬t sharing. ASSURANT, INC.  2010 Form 10K F-37 -

Page 108

... Re providing up to $150,000 of reinsurance coverage for protection against losses over a three-year period from individual hurricane events in Hawaii and along the Gulf and Eastern Coasts of the United States. The agreements expire in May 2013. Ibis Re ï¬nanced the property catastrophe reinsurance... -

Page 109

..., and the Company has not been obligated to fulï¬ll any of such reinsurers' obligations. Segment Client Risk and Proï¬t Sharing The Assurant Solutions and Assurant Specialty Property segments write business produced by their clients, such as mortgage lenders and servicers, ï¬nancial institutions... -

Page 110

... for letters of credit issued under the agreement of $50,000. The proceeds of these loans may be used for the Company's commercial paper program or for general corporate purposes. The Company did not use the commercial paper program during the twelve months ended December 31, 2010 and 2009 and there... -

Page 111

... also applied the "long form" method to calculate its beginning pool of windfall tax beneï¬ts related to employee stock-based compensation awards as of the adoption date of the guidance. For the years ended December 31, 2010, 2009 and 2008, the Company recognized compensation costs net of a 5% per... -

Page 112

... historical stock prices of the Company's stock and peer insurance group. The expected term for grants issued during the year ended December 31, 2010 and 2009 was assumed to equal the average of the vesting period of the PSUs. The risk-free rate was based on the U.S. Treasury yield curve in effect... -

Page 113

... term of the SARs. The risk-free rate for periods within the contractual life of the option was based on the U.S. Treasury yield curve in effect at the time of grant. The dividend yield is based on the current annualized dividend and share price as of the grant date. ASSURANT, INC.  2010 Form... -

Page 114

... rate for periods within the contractual life of the option is based on the U.S. Treasury yield curve in effect at the time of grant. The dividend yield is based on the current annualized dividend and share price as of the grant date. For awards issued during the years ended December 31, 2010 2009... -

Page 115

...cation adjustments of $(1,034) and $(4,992) net of tax, in 2010 and 2009 respectively, for net realized losses on sales of securities included in net income. 21. Statutory Information The Company's insurance subsidiaries prepare ï¬nancial statements on the basis of statutory accounting practices... -

Page 116

... Retirement and Other Employee Beneï¬ts contract deposits under GAAP, with cost of insurance recognized as revenue when assessed and other contract charges recognized over the periods for which services are provided; 4) the classiï¬cation and carrying amounts of investments in certain securities... -

Page 117

... 31, 2010. Summarized information on the Company's Pension Beneï¬ts and Retirement Health Beneï¬ts plans (together the "Plans") for the years ended December 31 is as follows: 2010 Change in projected beneï¬t obligation Projected beneï¬t obligation at beginning of year Service cost Interest cost... -

Page 118

...ï¬ts 2010 2009 2008 5.73 % 6.29 % 6.28 % - - - Retirement Health Beneï¬ts 2010 2009 2008 6.06 % 6.22 % 6.55 % 7.50 % 7.50 % 8.25 % Discount rate Expected long- term return on plan assets * Assumed rates of compensation increases are also used to determine net periodic benefit cost. Assumed rates... -

Page 119

... care cost trend rates have a signiï¬cant effect on the amounts reported for the health care plans. A one-percentage point change in assumed health care cost trend rates would have the following effects: 2010 One percentage point increase in health care cost trend rate Effect on total of service... -

Page 120

... for the Company's qualiï¬ed pension plan and other post retirement beneï¬t plan assets at December 31, 2010 by asset category, is as follows: Qualiï¬ed Pension Beneï¬ts Financial Assets Cash and cash equivalents: Short-term investment funds Equity securities: Common stock- U.S. listed small cap... -

Page 121

...ï¬ts December 31, 2010 Level 2 Level 3 674 - - 3,724 4,932 11,316 2,206 - 113 22,965 2,878 - 2,878 Retirement Health Beneï¬ts Financial Assets Cash and cash equivalents: Short-term investment funds Equity securities: Common stock- U.S. listed small cap Mutual funds- U.S. listed large cap Common... -

Page 122

22 Retirement and Other Employee Beneï¬ts December 31, 2009 Level 3 2,904 - 2,904 Retirement Health Beneï¬ts Financial Assets Cash and cash equivalents: Short-term investment funds Equity securities: Common stock- U.S. listed small cap Mutual funds- U.S. listed large cap Common/collective trust-... -

Page 123

... Solutions provides debt protection administration, credit-related insurance, warranties and service contracts, and pre-funded funeral insurance. Assurant Specialty Property provides lender-placed homeowners insurance and manufactured housing homeowners insurance. Assurant Health provides individual... -

Page 124

... impairment Provision (beneï¬t) for income taxes Segment income (loss) before goodwill impairment Goodwill impairment Net income $ Segment Assets: Segment assets, excluding goodwill $ Goodwill Total assets Specialty Property Health Employee Beneï¬ts Corporate & Other Consolidated 2,671,041 $ 391... -

Page 125

... Companies net earned premiums by segment and product are as follows: 2010 Solutions: Credit Service contracts Preneed Other TOTAL Specialty Property: Homeowners (lender placed and voluntary) Manufactured housing (lender placed and voluntary) Other TOTAL Health: Individual medical Short-term medical... -

Page 126

...Results of Operations (Unaudited) The Company's quarterly results of operations for the years ended December 31, 2010 and 2009 are summarized in the tables below: March 31 2010 Total revenues Income (loss) before provision for income taxes Net income (loss) Basic per share data: Income (loss) before... -

Page 127

.... The disputes involving ARIC and an affiliate, Assurant General Insurance Limited (formerly Bankers Insurance Company Limited) ("AGIL"), for the 1995 and 1996 program years, were the subject of working group settlements negotiated with other market participants. For the 1995 program year, the... -

Page 128

...Equity securities: Common stocks Non-redeemable preferred stocks TOTAL EQUITY SECURITIES Commercial mortgage loans on real estate, at amortized cost Policy loans Short-term investments Collateral held under securities lending Other investments TOTAL INVESTMENTS $ F-58 ASSURANT, INC.  2010 Form... -

Page 129

... and $106,037 in 2009) Equity securities available for sale, at fair value (amortized cost-$4,638 in 2010) Short-term investments Other investments Total investments Cash and cash equivalents Receivable from subsidiaries, net Income tax receivable Accrued investment income Property and equipment, at... -

Page 130

... in undistributed and distributed net income of subsidiaries TOTAL REVENUES Expenses General and administrative expenses Interest expense Goodwill impairment TOTAL EXPENSES Income before beneï¬t for income taxes Beneï¬t for income taxes NET INCOME $ F-60 ASSURANT, INC.  2010 Form 10K -

Page 131

...(gains) losses on investments Change in tax beneï¬t from share-based payment arrangements Stock based compensation expense Goodwill impairment Other NET CASH PROVIDED BY OPERATING ACTIVITIES Investing Activities Sales of: Fixed maturity securities available for sale Property and equipment and other... -

Page 132

... costs expenses Property and Casualty Premiums Written Segment (in thousands) Claims and beneï¬ts Unearned payable premiums Net Premium investment income revenue Other* operating expenses 2010 Solutions Specialty Property Employee Beneï¬ts Health Corporate and Other TOTAL SEGMENTS 2009... -

Page 133

... ASSURANT, INC. FOR THE YEAR ENDED DECEMBER 31, 2010 Percentage of amount assumed to net 8.3% 4.2% 7.9% 1.8% 4.4% 8.9% 9.8% 0.5% 6.5% Life Insurance in Force Premiums: Life insurance Accident and health insurance Property and liability insurance TOTAL EARNED PREMIUMS Beneï¬ts: Life insurance... -

Page 134

... 31, 2010, 2009 AND 2008 Additions Charged to Costs and Charged to Other Expenses Accounts Balance at Beginning of Year 2010: Valuation allowance for foreign NOL deferred tax carryforward Valuation allowance for deferred tax assets Valuation allowance for mortgage loans on real estate Valuation... -

Page 135

... realized gains (losses) on investments that tend to be highly variable and those events that are unusual and/or unlikely to recur. 2010 (dollars in millions, net of tax) Assurant Solutions Assurant Specialty Property Assurant Health Assurant Employee Beneï¬ts Corporate and other Amortization of... -

Page 136

... news releases, please visit our website: http://ir.assurant.com In addition, you also may request public Assurant ï¬nancial information by dialing 866.888.4219. FORWARD-LOOKING STATEMENTS Some of the statements included in this Annual Report are forward-looking statements within the meaning... -

Page 137

... OF DIRECTORS Date following name = Year joined Board Elaine D. Rosen (2009) Chair of the Board, Assurant; Chair of the Board, The Kresge Foundation; former President, UNUM Life Insurance Company of America David B. Kelso (2007) Financial Advisor, Kelso Advisory Services; former Executive Vice... -

Page 138

Assurant, Inc. One Chase Manhattan Plaza 41st Floor New York, NY 10005 Telephone: 212.859.7000 www.assurant.com