Amgen 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

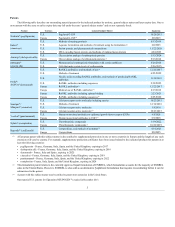

(2) Lonquex® is a long-acting filgrastim product recently launched in Europe.

(3) Approved via the EU biosimilar regulatory pathway.

(4) Dermatology only.

(5) PROCRIT® competes with Aranesp® in the supportive cancer care and pre-dialysis settings.

(6) Competes with Aranesp® in the nephrology segment only.

(7) Teva and Barr Pharmaceuticals have received approval from the U.S. Food and Drug Administration (FDA) for generic versions of Sensipar ® that

could compete with Sensipar® in the future. There is an injunction prohibiting them from commercializing in the United States until expiration of the

patents.

We anticipate EPOGEN® and Aranesp® may begin to face competition during the second half of 2014 from the launch of MIRCERA ® in the United

States. Pursuant to a December 2009 settlement agreement between Amgen and Roche, Roche is allowed to begin selling MIRCERA ® in the United States in

mid-2014 under terms of a limited license agreement. MIRCERA ® has been approved by the FDA for the treatment of anemia associated with chronic renal

failure in patients on and not on dialysis.

Sales of our principal products are dependent on the availability and extent of coverage and reimbursement from third-party payers. In the United

States, healthcare providers are reimbursed for covered services and products they use through Medicare, Medicaid and other government healthcare programs

as well as through private payers. We are required to provide specified rebates or discounts to certain of these government funded programs. For many years,

federal and state governments in the United States have pursued methods to reduce the cost of these programs. For example, in 2010 the United States enacted

major healthcare reform legislation (known as the “Patient Protection and Affordable Care Act” or “ACA”) that had significant impacts which include: an

increase in the rebates we pay for our products that are covered and reimbursed by state Medicaid programs, a requirement to pay rebates on Medicaid

managed care utilization, the expansion of entities eligible for discounts under the 340B Drug Program, and a new fee (the U.S. healthcare reform federal excise

fee). Such changes have had, and are expected to continue to have, a material adverse impact on our business. At present, Medicare payment rates are affected

by across-the-board federal budget cuts commonly referred to as “sequestration”. Under sequestration, the Centers for Medicare & Medicaid Services (CMS),

the federal agency responsible for administering Medicare and Medicaid, reduced Medicare payments to providers by 2% beginning in 2013. In addition, in

the effort to contain the U.S. federal deficit, our industry could be considered a potential source of savings via legislative proposals that have been debated but

not enacted. It remains uncertain as to what proposals, if any, may be included as part of future federal budget deficit reduction actions that would directly or

indirectly affect us and our business.

Particular legislative proposals that would have a significant impact on Amgen include: changes to how the Medicare program covers and reimburses

oral-only drugs for patients with End-Stage Renal Disease (ESRD) (including Sensipar ®) and changes in the payment rate or new rebate requirements for

covered drugs (which could impact many of our principal products, including Aranesp ®, Neulasta®, NEUPOGEN®, Prolia® and XGEVA®).

Efforts are also being made in the private sector to reduce healthcare costs, notably by healthcare payers and providers, which have instituted various

cost reduction and containment measures. We expect insurers and providers to continue efforts to reduce the cost and/or utilization of healthcare products,

including our products.

Generally, in countries outside the United States, government-sponsored healthcare systems are the primary payers for drugs and biologics. With

increased budgetary constraints, payers in many countries employ a variety of measures to exert downward price pressure. These measures can include

mandatory price controls, price referencing, therapeutic reference pricing, increasing mandates or incentives for generic substitution and biosimilar usage, and

government-mandated price cuts. In addition, healthcare reform and related legislative proposals in such countries as France, Germany and Poland, as well as

austerity plans in a number of countries, including Spain, Greece, Italy, Ireland and Portugal, have targeted the pharmaceutical sector with multiple

mechanisms to reduce government healthcare expenditures. We expect that countries will continue to take aggressive actions to reduce expenditures on drugs

and biologics. Similarly, fiscal constraints may also impact the extent to which countries are willing to approve new innovative therapies and/or allow access to

new technologies. For example, many Health Technology Assessment (HTA) organizations use formal economic metrics such as cost-effectiveness to determine

coverage and reimbursement of new therapies, and these organizations are proliferating in established and emerging markets.

See Item 1A. Risk Factors — Our sales depend on coverage and reimbursement from third-party payers.

7