Ameriprise 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

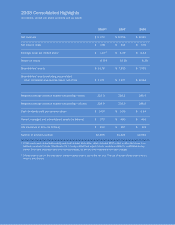

2 Ameriprise Financial 2008 Annual Report

lowering fee revenue. As our clients sought safety,

their desire for conservative investment products,

as well as their reduced activity, further impacted

our revenue. Credit market instability resulted in

impairments to our investment portfolio. And we took

necessary steps to position the company for our lower

2009 market expectations, which led to significant

non-cash charges late in the year. These market

forces drove our $38 million loss for the full year.

While our results were disappointing, I am encouraged

by the continued strength of our business model.

At the heart of our company are long-lasting, personal

and deep client-advisor relationships. These relation-

ships remain as strong as ever, for many reasons:

because of the excellent support we provide to

advisors and clients; because of our advisors’ personal

commitment to their clients; because of our unique

comprehensive approach to financial planning; and

because our broad and innovative product offerings

provide a range of solutions to meet clients’ goals.

Our advisor support continues to be extensive. Early

in the year, we brought about 8,000 of our advisors

to our Minneapolis headquarters for training to help

them deliver a more consistent and compelling client

experience by using new products, services and tech-

nology. As the markets deteriorated later in the year,

we developed a new online market resource center

to help advisors provide current information to their

clients. In addition, we broadened market resources

and perspectives on our public website. As a result

of these and other efforts, our client retention remains

strong and our advisor retention is at an all-time high.

Strong Balance Sheet

Fundamentals

• $34 billion diversied asset portfolio,

including $6 billion in cash and cash

equivalents

• $0.7 billion in excess capital

• Conservative debt ratios