Ameriprise 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

On September 30, 2005, we launched Ameriprise Financial, Inc., successfully completing the sixth-

largest spin-off in U.S. history. Throughout our history as IDS and American Express Financial Advisors,

we have had a long tradition of serving clients. Today, I am excited about our opportunities as an

independent company, and I believe that we are poised to usher in a new era for our clients and

our shareholders.

Helping clients realize their financial goals and dreams is the key principle upon which our company

was founded more than a century ago, and it endures as our core mission today. Since 1894, we have

focused on shaping financial solutions designed to meet clients’ needs. This began with our earliest

products, the investment certificate and our first mutual funds in the 1940s, and continues today with

our ongoing position as one of the industry’s leaders in insurance and annuities. We helped pioneer

financial planning in the 1970s, and this remains our core consumer value proposition today.

Our history of serving clients, strong capital base, broad capabilities, proven business model and

experienced management team position us well to build on our legacy as one of the nation’s leading

financial services companies.

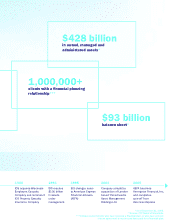

Our Opportunity: Meeting the Financial Needs of the Mass Affluent

While our advisors and financial solutions serve a broad range of client segments, from the mass

market to the high-net-worth market, the mass affluent segment is our core focus. This segment,

currently comprising approximately 29 million U.S. households with $100,000 to $1 million in

investable assets, holds more than 50 percent of the nation’s investable funds.1 It’s a large and

fast-growing demographic group2, and our research shows that 54 percent of this group prefers a

face-to-face, long-term financial planning relationship to help them define and reach their goals.

Along with the mass affluent segment, baby boomers — the 78 million Americans born between

1946 and 1964 — consistently rank planning for retirement as their most important financial need.

The first wave of boomers turned 60 on January 1, 2006, signaling the beginning of a strong market

need as the baby boomer generation faces retirement over the next two decades.

1Source: Macro Monitor 2004–2005 consumer survey prepared by SRI Consulting Business Intelligence.

2Source: BCG Wealth Market Sizing Database.

| Ameriprise Financial, Inc. 6