Ameriprise 2005 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2005 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Products and Solutions

For our clients’ asset accumulation and income needs, our solutions include RiverSource funds,

access to more than 200 unaffiliated mutual fund families, the nation’s largest non-discretionary

mutual fund and other securities “wrap program,” variable and fixed annuity products, investment

certificates, brokerage services, individual stocks and bonds, as well as deposit and credit solutions.

Our comprehensive protection solutions help address our clients’ insurance needs. We are a

leading provider of variable and fixed universal life insurance, term insurance, disability income,

long-term care, and auto and homeowners insurance.

The majority of our proprietary solutions are offered under the RiverSourceSM brand, which we

introduced as part of our spin-off from American Express. The RiverSource brand gives us the flexibility

to deliver these quality solutions through our advisor network and to selectively offer them to institutional

and sub-advisory clients, as well as through agreements with unaffiliated retail distributors such as

banks and broker-dealers. Building on our initial success with RiverSource annuities, we expect to

expand these third-party offerings to include our RiverSource investment products.

Internationally, Threadneedle Investments, our London-based international investment platform, is

one of the United Kingdom’s premier asset management organizations. Threadneedle Investments

offers a wide range of asset management products and services to institutional clients as well as

to retail clients through intermediaries, banks and fund platforms in Europe, and to U.S. clients

through RiverSource Investments.

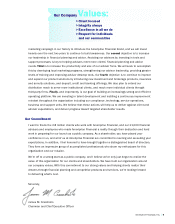

Delivering Results for Shareholders

For this extraordinary transition year, our 2005 financial results demonstrate the strength of our

business and the strategies we’re pursuing to help more clients. For the year, excluding the impact

of the separation, adjusted revenues3 grew 9 percent to $7.3 billion, from $6.8 billion in the same

period of 2004. Adjusted net income3 was $693 million, a decrease of 4 percent from $723 million

in 2004. Adjusted net income for 2005 includes incremental costs associated with becoming an

independent company. Our adjusted return on equity3 was 10.2 percent. Our long-term financial

targets3 for building shareholder value, on average and over time, are revenue growth of 6 to 8

percent, net income growth of 10 to 13 percent and return on equity of 12 to 15 percent.

What’s next.SM

To build on these results, we have set five strategic objectives for 2006. First, to continue to grow

our mass affluent client base. Our efforts include innovative national and local client acquisition

programs, and strengthening our client loyalty programs such as Ameriprise Gold Financial

ServicesSM and Ameriprise Platinum Financial Services.SM In late 2005, we launched the largest

3

Management believes that the financial results,

excluding the effects of the non-recurring separation

costs, the impact of discontinued operations,

cumulative effect of accounting change and AMEX

Assurance, best reflect the basis of evaluating our

performance as an independent company. See

our discussion of non-GAAP financial information

and forward-looking statements included in our

Management’s Discussion and Analysis.

| Ameriprise Financial, Inc. 8

Adjusted revenues grew 9% to

$7.3 billion

in 2005