Ameriprise 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2005

What’s next.

SM

Table of contents

-

Page 1

What's next. SM Annual Report 2005 -

Page 2

... Investors Mutual Fund 1894 John Tappan founds Investors Syndicate 1937 Assets under management reach $100 million 1949 Investors Syndicate changes its name to Investors Diversified Services, Inc. (IDS) 1957 Investors Syndicate Life Insurance and Annuity Company is formed 1984 American Express... -

Page 3

... acquires Wisconsin Employers Casualty Company and renames it IDS Property Casualty Insurance Company 1994 IDS reaches $100 billion in assets under management 1995 IDS changes name to American Express Financial Advisors (AEFA) 2003 Company completes acquisition of Londonbased Threadneedle Asset... -

Page 4

Ameriprise Financial Services branded advisor network ranks among Securities Industry Association members.* #4 Ameriprise Financial Services has more ï¬nancial planning clients than any other company.** breadth and depth of Ameriprise Financial and RiverSource products and solutions: Asset ... -

Page 5

-

Page 6

...rst of the baby boomers turns 60. In the next 15 years, 78 million Over the next ï¬ve years, of them will reach retirement age.* $1.7 trillion in retirement assets will be in transition.** * Source: U.S. Census Bureau. ** Source: Cerulli Associates, Quantitative Update Retirement Markets 2005. -

Page 7

-

Page 8

... the sixthlargest spin-off in U.S. history. Throughout our history as IDS and American Express Financial Advisors, we have had a long tradition of serving clients. Today, I am excited about our opportunities as an independent company, and I believe that we are poised to usher in a new era for... -

Page 9

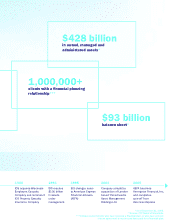

...result of addressing clients' needs, we had more than $428 billion of owned, managed and administered assets as of December 31, 2005. With the legacy of more than 110 years of experience in financial services and a strong, experienced advisor network, I believe Ameriprise Financial is the firm best... -

Page 10

... RiverSource funds, access to more than 200 unaffiliated mutual fund families, the nation's largest non-discretionary mutual fund and other securities "wrap program," variable and fixed annuity products, investment certificates, brokerage services, individual stocks and bonds, as well as deposit... -

Page 11

... processes is key to helping advisors meet more clients' financial planning and advice needs. Third is to increase the productivity and size of our advisor force. We will seek to accomplish this by developing local marketing programs, strengthening our advisor leadership, providing greater levels of... -

Page 12

... and one of the largest branded advisor networks in the country, Ameriprise Financial helps clients pursue their dreams with greater confidence and the increased peace of mind that can come from having a long-term financial planning relationship. Our clients share their hopes and dreams with us... -

Page 13

... agreement, and more than 1,700 operate as non-branded advisors and registered representatives under our Securities America, Inc. broker-dealer. We provide each advisor affiliation group with a range of options to meet their needs. Our employee advisors receive a full support model. Franchise... -

Page 14

..., financial planning tools, training, national and local marketing programs, and innovative product solutions. Advisors affiliated with our Securities America subsidiary receive less centralized support. This flexible affiliation strategy, combined with our substantial and ongoing investment in... -

Page 15

.... Ameriprise Financial's comprehensive planning approach is centered around our clients' needs. This approach works for clients, advisors and shareholders because our research indicates that clients with a financial plan are more satisfied, choose to hold three times more assets with the company and... -

Page 16

... Needs Asset Accumulation and Income Investments and Brokerage > Mutual Funds > IRAs > REITs > Stocks/Bonds > Certificates Investment Advisory > Wrap Accounts > Separately Managed Accounts Annuities > Variable Annuities > Fixed Annuities Banking > Money Market > Checking Accounts > Savings Accounts... -

Page 17

... products and solutions are described on the following pages. Asset Accumulation and Income Solutions Investments Brokerage and Investment Advisory Products and Solutions Certificates Annuities Banking Solutions Retirement Services Protection Solutions Life Auto & Home Health Ameriprise Financial... -

Page 18

...core and specialty investment management strategies. At year- end 2005, these solutions included more than 60 mutual funds, 20 variable portfolio mutual funds, separately managed institutional and individual accounts, alternative investments and sub-advisory services for institutional clients. As of... -

Page 19

... access to fee-based investment advice across more than 1,800 proprietary and non-proprietary mutual funds and individual securities. As of year-end 2005, we managed more than $47 billion in client assets in this program. Through Premier Portfolio Services, we also offer separately managed accounts... -

Page 20

...by Ameriprise Financial are currently provided by American Express Bank, FSB.6 Estate planning and personal trust services, also provided by American Express Bank, FSB and offered through Personal Trust Services, enable clients to develop strategies designed to help reduce taxes, preserve assets and... -

Page 21

...to secure a death benefit in a life insurance policy, coupled with a vehicle for asset accumulation with tax deferral on gains. RiverSource Insurance also provides universal life, whole life and term life solutions. Auto & Home To address a range of personal protection needs, Ameriprise Auto & Home... -

Page 22

... Life Insurance Company of New York, Albany, New York. Auto and home insurance is underwritten by AMEX Assurance Company or IDS Property Casualty Insurance Company. Ameriprise Certificates are issued by Ameriprise Certificate Company. These companies are part of Ameriprise Financial, Inc. Long-term... -

Page 23

...Accounting and Financial Disclosure 54 Report of Independent Registered Public Accounting Firm 55 Consolidated Statements of Income 56 Consolidated Balance Sheets 57 Consolidated Statements of Cash Flows 58 Consolidated Statements of Shareholders' Equity 60 Notes to Consolidated Financial Statements... -

Page 24

... brokerage capabilities through Ameriprise Financial Services, Inc., including wrap accounts, and banking through a transitional agreement with American Express Company (American Express). In 2006, we expect to reestablish our own Federal Savings Bank (FSB). We also offer short-term, cash management... -

Page 25

...retail clients address identified financial objectives related to asset accumulation and income management. Products and services in this segment are related to financial advice, asset management, brokerage and banking, and include mutual funds, wrap accounts, variable and fixed annuities, brokerage... -

Page 26

... efficient access to the capital markets and support the current financial strength ratings of our insurance subsidiaries. We contributed $650 million of the capital contribution from American Express to our subsidiary IDS Life Insurance Company (IDS Life) to absorb non-recurring separation costs... -

Page 27

...in return for an arm's length ceding fee. As of September 30, 2005, we entered into an agreement to sell the AMEX Assurance legal entity to American Express within two years after the Distribution. IDS Property Casualty Insurance Company (IDS Property Casualty Co.), doing business as Ameriprise Auto... -

Page 28

... statements of income. For annuity and life, disability income and long-term care insurance products, key assumptions underlying these long-term projections include interest rates (both earning rates on invested assets and rates credited to policyholder accounts), equity market performance... -

Page 29

... to project our best estimate of long-term growth. The near-term growth rate is reviewed to ensure consistency with our management's assessment of anticipated equity market performance. Our management is currently assuming a 7% long-term client asset value growth rate. If we increased or decreased... -

Page 30

... fees from managed assets and variable annuity fees, including support payments from other companies whose funds are held in separate accounts, as well as wrap account fees and fees received for financial planning and other services. Management and service fees are generally based on the market... -

Page 31

... products (including life, disability, auto and home and long-term care insurance). It also includes changes in the related insurance reserves. Amortization of deferred acquisition costs. DAC represents the costs of acquiring new protection, annuity and mutual fund business, principally direct sales... -

Page 32

...and service fees Distribution fees Net investment income Premiums Other revenues Total revenues Expenses Compensation and benefits Field Non-field Total compensation and benefits Interest credited to account values Benefits, claims, losses and settlement expenses Amortization of deferred acquisition... -

Page 33

... Assets: Managed owned assets Separate accounts Investments Total managed owned assets Other(b) Total owned assets Managed Assets: Managed Assets-Retail RiverSource (RVS) Mutual Funds Threadneedle Mutual Funds Ameriprise Financial Wrap Account Assets-Other company products SAI Total managed assets... -

Page 34

... Information Years Ended December 31, 2005 2004 % Change(a) Separation Costs 2005 % Change(a) (in millions, except percentages) (in millions, except percentages, unaudited) Revenues Management, financial advice and service fees Distribution fees Net investment income Premiums Other revenues... -

Page 35

... Assurance were $852 million, up $74 million, or 10% from $778 million in 2004. Our auto and home insurance premiums increased $71 million in 2005, driven by a 15% growth in average property and casualty policies in force. Most of the increase in policies in force was generated through the Costco... -

Page 36

..., benefits, claims, losses and settlement expenses increased $106 million, or 13% to $892 million in 2005 from $786 million in 2004. Higher average auto and home insurance policies in force resulted in an increase of $69 million and an increase in benefit expenses and reserves on life and long-term... -

Page 37

... insurance and card related business was ceded to American Express effective July 1, 2005 and was deconsolidated on a U.S. GAAP basis effective September 30, 2005. GAAP Consolidated Statements of Income Years Ended December 31, 2004 2003 Non-GAAP Supplemental Information AMEX Assurance Years Ended... -

Page 38

... and annuity and separate account fees increased by $67 million, both due to equity market improvements and net inflows, which were only partially offset by decreases in mutual fund performance-based fees. The impact of excluding AMEX Assurance from management, financial advice and service fees was... -

Page 39

... of premium deficiency on our long-term care products; and a $12 million net increase across our universal life, variable universal life and annuity products, primarily reflecting lower than previously assumed interest rate spreads, separate account fee rates and account maintenance expenses... -

Page 40

...the Notes to our consolidated financial statements for the periods indicated. Years ended December 31, 2005 Amount % Change(a) 2004 Amount % Change(a) (in millions, except percentages) 2003 Amount Total revenues by segment Asset Accumulation and Income Protection Corporate and Other Eliminations... -

Page 41

.... Management, financial advice and service fees increased $257 million, or 13% to $2,243 million primarily as a result of strong inflows and market appreciation driving a $135 million increase in fees attributable to our wrap accounts, a $72 million rise due to increases in variable annuity asset... -

Page 42

... securities class action lawsuit, partially offset by a decrease in mutual fund industry regulatory costs of approximately $40 million. Management, financial advice and service fees increased $509 million, or 35% as a result of higher average managed assets and the acquisition of Threadneedle... -

Page 43

... Years Ended December 31, 2005 2004 % Change(a) (in millions, except percentages, unaudited) Revenues Management, financial advice and service fees Distribution fees Net investment income Premiums Other revenues Total revenues Expenses Compensation and benefits-field Interest credited to account... -

Page 44

... average auto and home insurance policies in force, a $17 million increase due to higher life insurance in force levels, and a $13 million increase in the expense for future policy benefits in 2005 related to the inclusion of an explicit maintenance reserve for long-term care insurance. Amortization... -

Page 45

...) Revenues Management, financial advice and service fees Distribution fees Net investment income Premiums Other revenues Total revenues Expenses Compensation and benefits-field Interest credited to account values Benefits, claims, losses and settlement expenses Amortization of deferred acquisition... -

Page 46

...Ameriprise Financial, Inc. The total increase was offset by $22 million of declines related to premium revenues. Management, financial advice and service fees grew $64 million, or 32%, to $268 million for the year ended December 31, 2005, including an increase of $34 million due to growth in assets... -

Page 47

... Condition The following table presents selected information from our audited consolidated balance sheets as of December 31 for the years indicated. 2005 Investments(b) Separate account assets(c) Total assets Future policy benefits and claims(c) Investment certificate reserves Payable to American... -

Page 48

... benefit of variable annuity and variable life insurance contract holders. These assets are generally carried at market value, and separate account liabilities are equal to separate account assets. We earn investment management, administration and other fees from the related accounts. The increase... -

Page 49

... years after the Distribution. Ameriprise Financial, Inc. IDS Property Casualty Insurance Company Threadneedle Asset Management Holdings Ltd. Ameriprise Financial Services, Inc. American Enterprise Investment Services Securities America Financial Corporation AMEX Assurance Company IDS Life... -

Page 50

... For the year ended December 31, 2005, net cash provided by operating activities was $945 million compared to $683 million for the same period in 2004. This increase reflects a net decrease in trading securities and equity method investments in hedge funds and a net increase in accounts payable and... -

Page 51

... billion increase in cash flows from unsettled securities transactions payable and receivable, related to investment transactions near the end of 2002 that settled in 2003. Positive net flows on investment certificate, fixed annuity and universal life products were $1.8 billion for the year ended... -

Page 52

... portfolio, both by sector and issuer, with 7.2% rated below investment grade as of December 31, 2005. We manage our investment portfolio with an emphasis on investment income and capital preservation. Our current strategy focuses on cash-flow certainty and credit quality. 50 | Ameriprise Financial... -

Page 53

...Rates credited to clients' accounts generally reset at shorter intervals than the yield on underlying investments. Further, the expected maturities on the investment assets may not align with the certificate maturities and surrender or other benefit payments from fixed annuity and insurance products... -

Page 54

... rate credited to clients' accounts. We do not trade in securities to generate short-term profits for our own account. We regularly review models projecting various interest rate scenarios and risk/return measures and their effect on profitability. We structure our investment security portfolios... -

Page 55

... impact of the separation from American Express; our ability to establish our new brands; our capital structure as a stand-alone company, including our ratings and indebtedness, and limitations on our subsidiaries to pay dividends; changes in the interest rate and equity market environments; changes... -

Page 56

... financial statements for the years ended December 31, 2005, 2004 and 2003 have been audited by Ernst & Young LLP, our independent registered public accounting firm. Through 2004, Ernst & Young LLP provided audit services to our company as part of the audit services it provided to American Express... -

Page 57

... of Ameriprise Financial, Inc. (formerly known as American Express Financial Corporation) (the Company) as of December 31, 2005 and 2004, and the related consolidated statements of income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2005. These... -

Page 58

... Ameriprise Financial, Inc. Years Ended December 31, 2005 2004 2003 (in millions, except per share amounts) Revenues Management, financial advice and service fees Distribution fees Net investment income Premiums Other revenues Total revenues Expenses Compensation and benefits Interest credited... -

Page 59

... acquisition costs Separate account assets Restricted and segregated cash Other assets Assets of discontinued operations Total assets Liabilities Future policy benefits and claims Investment certificate reserves Accounts payable and accrued expenses Payable to American Express Debt Separate account... -

Page 60

... Deferred income taxes Net realized investment gains Changes in operating assets and liabilities: Segregated cash Trading securities and equity method investments in hedge funds, net Future policy benefits and claims, net Receivables Other assets, other liabilities, accounts payable and accrued... -

Page 61

Consolidated Statements of Cash Flows (Continued) Ameriprise Financial, Inc. Years Ended December 31, 2005 2004 (in millions) 2003 Cash Flows from Financing Activities Investment certificates: Payments from certificate owners Interest credited to account values Certificate maturities and cash ... -

Page 62

Consolidated Statements of Shareholders' Equity Ameriprise Financial, Inc. Years Ended December 31, 2005, 2004 and 2003 Number of Shares Total Common Shares Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) (in millions, except number of shares) ... -

Page 63

... travel insurance and card related business offered to American Express customers, to an American Express subsidiary in return for an arm's length ceding fee. As of September 30, 2005, the Company entered into an agreement to sell the AMEX Assurance legal entity to American Express within two years... -

Page 64

... various life, disability income, long-term care, and brokered insurance products through the Company's advisor network. The Company offers auto and home insurance products on a direct basis to retail clients principally through its strategic marketing alliances. The Company has a Corporate and... -

Page 65

...primarily to managed assets for proprietary mutual funds, separate account and wrap account assets, as well as employee benefit plan and institutional investment management and administration services. The Company's management and risk fees are generally computed as a contractual rate applied to the... -

Page 66

... in the business, including comparisons of actual and assumed experience. The customer asset value growth rate is the rate at which variable product contract values are assumed to appreciate in the future. The rate is net of asset fees and anticipates a blend of equity and fixed income investments... -

Page 67

...-for-Sale securities portfolio also contains structured investments of various asset quality, including CDOs (backed by high-yield bonds and bank loans), which are not readily marketable. As a result, the carrying values of these structured investments are based on future cash flow projections that... -

Page 68

... implicit in the annuity contracts. The Company makes periodic fund transfers to, or withdrawals from, the separate account assets for such actuarial adjustments for variable annuities that are in the benefit payment period. The Company also guarantees that the rates at which administrative... -

Page 69

... gross deposits, credited interest and fund performance less withdrawals and mortality and expense risk charges. The majority of the variable annuity contracts offered by the Company contain guaranteed minimum death benefit (GMDB) provisions. When market values of the customer's accounts decline... -

Page 70

... discount rates for long-term care policy reserves are currently 5.3% at December 31, 2005 grading up to 9.4% over 40 years. Claim reserves on disability income and long-term care products are the amounts needed to meet obligations for continuing claim payments on already incurred claims. Claim... -

Page 71

...2006. The Company is currently evaluating partnership interests, particularly certain property funds managed by Threadneedle, to determine whether there will be an impact on its consolidated results of operations and financial condition. In May 2005, the FASB issued SFAS 154, "Accounting Changes and... -

Page 72

... Available-for-Sale securities, at fair value Mortgage loans on real estate, net Trading securities, at fair value and equity method investments in hedge funds Policy loans Other investments Total $34,217 3,146 676 616 445 $39,100 $34,979 3,249 858 602 544 $40,232 70 | Ameriprise Financial, Inc. -

Page 73

...88% and 87%, respectively, of the Company's total investments. These securities are rated by Moody's and Standard & Poor's (S&P), except for approximately $1.2 billion of securities at both December 31, 2005 and 2004, which are rated by the Company's internal analysts using criteria similar to Moody... -

Page 74

... Total Fair Value Unrealized Losses (in millions) Corporate debt securities Mortgage and other asset-backed securities Structured investments State and municipal obligations U.S. government and agencies obligations Foreign government bonds and obligations Common and preferred stocks Total $ 8,445... -

Page 75

... year through 5 years Due after 5 years through 10 years Due after 10 years Mortgage and other asset-backed securities Structured investments Common and preferred stocks Total $ 948 6,024 11,423 1,825 20,220 14,071 37 11 $34,339 The expected payments on mortgage and other asset-backed securities... -

Page 76

...-yield bonds and loans. The Company manages the portfolio of high-yield bonds and loans for the benefit of CDO debt held by investors and retains an interest in the residual and rated debt tranches of the CDO structure. This CDO primarily included below investment grade corporate debt securities... -

Page 77

...$116 Concentrations of credit risk of mortgage loans on real estate by property type at December 31 were: 2005 On-Balance Sheet Funding Commitments On-Balance Sheet 2004 Funding Commitments (in millions) Mortgage loans by U.S. property type: Office buildings Shopping centers and retail Apartments... -

Page 78

... Company, as well as publicly traded mutual funds and other hedge funds managed by third parties. There were $27 million, $50 million, and $71 million of net pretax gains for the years ended December 31, 2005, 2004 and 2003, respectively, related to trading securities and equity method investments... -

Page 79

... for a ceding fee. AMEX Assurance entered into separate reinsurance agreements with IDS Property Casualty Co. and American Express to transfer insurance related risks to the respective companies. As described in Note 1, effective September 30, 2005, the Company entered into an agreement to sell its... -

Page 80

...or loss was recorded. In connection with the AEIDC transfer, American Express made a cash capital contribution of $164 million to the Company. The assets, liabilities and operations of AEIDC are shown as discontinued operations in the accompanying Consolidated Financial Statements. The components of... -

Page 81

... capital for other general corporate purposes. On September 30, 2005 the Company obtained an unsecured revolving credit facility for $750 million expiring in September 2010 from various third-party financial institutions. Under the terms of the credit agreement the Company may increase the amount of... -

Page 82

..., 2005. In the ordinary course of business, the Company obtains investment advisory or sub-advisory services from Davis or its affiliates. The Company, or the mutual funds or other clients that we provide advisory services to, pay fees to Davis for its services. The Company's executive officers and... -

Page 83

... per year. A summary of the conversion of American Express stock options to the Company's stock options under the EBA as of September 30, 2005 is presented below (shares in millions): Weighted Average Exercise Price $46.45 .6233 $28.95 10. Share-Based Compensation The Ameriprise Financial 2005... -

Page 84

... (shares in millions): Weighted Average Grant Date Fair Value $47.48 .6233 $29.59 The total income tax benefit recognized by the Company for stock options and restricted stock awards granted to the Company's employees was $19 million, $13 million and $7 million for the years ended December 31, 2005... -

Page 85

... Insurance Company(1) American Enterprise Life Insurance Company(1) IDS Property Casualty Insurance Company(1) Ameriprise Certificate Company(2) AMEX Assurance Company(1) IDS Life Insurance Company of New York(1) Threadneedle Asset Management Holdings Ltd.(3) American Enterprise Investment Services... -

Page 86

... for variable annuity death benefits and GMIB, the Company projects these benefits and contract assessments using actuarial models to simulate various equity market scenarios. Significant assumptions made in projecting future benefits and assessments relate to customer asset value growth rates... -

Page 87

... in benefits, claims, losses and settlement expenses in the Consolidated Statements of Income. Contract values in separate accounts were invested in various equity, bond and other funds as directed by the contractholder. No gains or losses were recognized on assets transferred to separate accounts... -

Page 88

...DSIC associated with separate account liabilities of $2.0 billion and $1.7 billion as of December 31, 2005 and 2004, respectively. 14. Retirement Plans and Profit Sharing Arrangements On September 30, 2005, the Company entered into an Employee Benefits Agreement (the EBA) with American Express that... -

Page 89

... and plan assets associated with the American Express Retirement Plan, Supplemental Retirement Plan and a retirement plan including employees from Threadneedle were split. The split resulted in an allocation of unrecognized net losses to the surviving plans administered separately by the Company and... -

Page 90

... assets are determined by each plan's investment committee. The asset classes typically include domestic and foreign equities, emerging market equities, domestic and foreign investment grade and high-yield bonds and domestic real estate. The Company's retirement plans expect to make benefit payments... -

Page 91

... relate to the employee profit sharing plan. The EPP is a cash award program for certain key personnel who are granted awards based on a formula tied to Threadneedle's financial performance. The EPP provides for 50% vesting after three years, 50% vesting after four years and required cash out after... -

Page 92

... uses interest rate products, primarily swaps and swaptions, to manage funding costs related to the Company's debt, investment certificate and fixed annuity businesses. The interest rate swaps are used to hedge the exposure to interest rates on the forecasted interest payments associated with debt... -

Page 93

... in the interest credited to account values as it relates to annuity and investment certificate products with returns tied to the performance of equity markets. The changes in fair values of the GMWB and GMAB embedded derivatives are reflected in benefits, claims, losses and settlement expenses. The... -

Page 94

... non-life insurance companies required to be included in a consolidated income tax return. On September 30, 2005, the Company entered into a Tax Allocation Agreement (the Tax Allocation Agreement) with American Express. The Tax Allocation Agreement governs the allocation of consolidated U.S. federal... -

Page 95

... issues; and sales of, or brokerage or revenue sharing practices relating to, other companies' REIT shares, mutual fund shares or other investment products. The number of reviews and investigations has increased in recent years with regard to many firms in the financial services industry, including... -

Page 96

... 2005 the Company reached settlements with four states in regulatory matters regarding supervisory practices, financial advisor misappropriations of customer funds, 529 plan and Class B mutual fund sales practices, incentives for AEFA's branded financial advisors to sell both its proprietary mutual... -

Page 97

... the Company offers to address its clients' needs. The Asset Accumulation and Income business offers mutual funds, annuities and other asset accumulation and income management products and services to retail clients through its financial advisor network. The Company also offers its annuity products... -

Page 98

... of segment operating results for the years ended December 31: Asset Accumulation and Income Corporate and Other (in millions) Protection Eliminations Consolidated 2005-Segment Data Revenue from external customers Intersegment revenue Total revenues Amortization expense All other expenses Total... -

Page 99

... for deferred acquisition costs, deferred sales inducement costs and intangible assets. 21. Quarterly Financial Data (Unaudited) 2005 2004 12/31(a)(f) Revenues 9/30(b)(f) 6/30(b) 3/31(b) 12/31(b) 9/30(b) 6/30(b) 3/31(b)(c) (in millions, except per share data) Separation costs(d) Income... -

Page 100

... The fourth quarter of 2005 reflects the costs of certain corporate and other support services provided by American Express to the Company after the Distribution pursuant to a transition services agreement. Other than technology-related expenses, the Company's management believes that the aggregate... -

Page 101

... 31, 377 - 170 - 2005 Balance Sheet Data: Investments Separate account assets Total assets(g) Future policy benefits and claims Investment certificate reserves Payable to American Express Debt Separate account liabilities Total liabilities(h) Shareholders' equity (a) (e) 2004 (b)(e) 2003... -

Page 102

...on certain structured investments; $344 million to write down lower-rated securities (most of which were sold in 2001) in connection with our decision to lower our risk profile by reducing the size of our high-yield portfolio, allocating our investment portfolio toward stronger credits, and reducing... -

Page 103

... assets and do not earn a management fee. These assets are not reported on our Consolidated Balance Sheets. AMEX Assurance Company- This company is a legal entity owned by IDS Property Casualty Insurance Company that offers travel and other card insurance to American Express customers. This business... -

Page 104

... Center, Minneapolis, MN 55474. Trademarks and Service Marks The following trademarks and service marks of Ameriprise Financial, Inc., and its affiliates may appear in the report: Ameriprise FinancialSM AmeripriseSM Auto & Home Insurance AmeripriseSM Brokerage AmeripriseSM Certificates Ameriprise... -

Page 105

... Sharan Executive Vice President and Chief Marketing Officer Joseph E. Sweeney President Financial Planning, Products and Services William F. Truscott President U.S. Asset Management and Chief Investment Officer John R. Woerner Senior Vice President Strategic Planning and Business Development Board... -

Page 106

ameriprise.com © 2006 Ameriprise Financial, Inc. All rights reserved. 400425 A (3/06)