Alpine 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- 4 -

II. Operational Review

Audio Products Segment

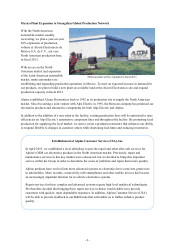

In the Audio Products segment, Alpine worked to expand sales in the North American aftermarket through

sales of head units, chiefly CD players, and sound systems that combine high-quality speakers and

amplifiers, as well as the start of sales of products to the Brazilian market, where a commercial distribution

network was newly acquired. However, as the market environment continued to be harsh, sales remained at

the same level as the previous year. In the European aftermarket, Alpine launched new digital audio

broadcast (DAB)-related products and developed CD player sales promotions to expand sales, but the

market slowed down more than expected, and conditions remained harsh. In the domestic aftermarket,

conditions remained generally difficult as a result of intensifying competition due to reduced market scale

and sluggish sales of speakers that had previously maintained a high market share.

In the OEM market, sales to automakers increased on the back of recovering production and sales at

Japanese automakers, and favorable sales at major U.S. automakers.

Accordingly, segment sales increased 6.0% compared with the previous fiscal year, to ¥59.1 billion.

Information and Communications Products Segment

The Information and Communication Products segment sought to expand sales, through broadening the

appeal of total coordination as “Alpine Style,” proposing unique car interior layouts on the Japanese

aftermarket, in addition to the “BIG-X series” and “Perfect Fit” systems, which gained the No. 1 position

in terms of customer satisfaction in a survey conducted by an external ratings agency. The segment also

strengthened its lineup of new products that meets user needs, such as by launching onto the market the

REARVISION in-car monitor fitted with an ion-generating system, a world first, and navigation systems

with a 9-inch display. However, sales suffered a decline as a result of new products launched onto the

market by competitors and the intensifying price competition. Sales in the European and U.S. aftermarkets

were sluggish due to a sales decline resulting from deteriorating market conditions, as well as the

later-than-planned introduction of new products.

In the OEM market, sales to automakers increased on the back of favorable sales at high-end car

manufacturers in Europe and at major U.S. automakers. Also contributing to the increased sales were the

recovering production and sales at Japanese automakers and the rising proportion of cars that have

navigation or display products installed.

Owing to these factors, sales in this segment grew 10.9% compared with the previous fiscal year, to ¥163.2

billion.

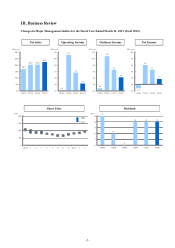

Net Sales by Region Ratio of Net Sales by

Business Segment

Ratio of Net Sales by

Product Segment

36.5

23.6

91.8

51.0

96.1

28.7

29.9

67.6

0

20

40

60

80

100

Americas Europe Asia and

other

Japan

46th fiscal year

47th fiscal year

(billion yen)

27%

73%

Information and

communications

products segment

Audio products

segment

80%

20%

Alpine brand

consumer

products

OEM

automakers