Alcoa 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Every one of our four business segments delivered for Alcoa. Flat-Rolled Products and Engineered

Products and Solutions each achieved historic highs in profi tability and drove strong organic growth

in 2011. In our upstream operations, the Alumina business continued to return to historic high profi t

levels, and our Primary Metals business, where the LME price drop and rise in raw materials cost

had the greatest impact, fi nished the year about 20 percent below the 10-year average profi tability.

For each of our three operating groups, 2011 also created a strong base to meet our longer term

growth goals.

Global Primary Products (GPP): In our upstream business, we have been driving operational

effi ciencies and aggressively managing energy costs to drive our smelters and refi neries down

the cost curve and improve our cash fl ow. For example, in 2011, GPP reduced “Days Working

Capital” (DWC) by four days and reduced its total working capital by $130 million, or 12 percent.

Our long-term objective is to improve our refi nery position from the 30th percentile in 2010 to

the 23rd percentile in 2015, and our smelter position from the 51st percentile in 2010 to the 41st

percentile in 2015. Given the long-term nature of this business, these 2015 targets cannot be

reached overnight; restructuring and investment programs are in place to achieve them.

Flat-Rolled Products (FRP): In our midstream business, we achieved $1.4 billion in organic

growth in 2011, which is 55 percent of our $2.5 billion 2013 incremental revenue growth target. A

seven percent increase in volume, along with shifts in the Group’s portfolio towards higher margin

products, drove FRP’s historic profi t performance and record adjusted EBITDA/MT. Growth projects

in Russia, China, and Davenport, Iowa, are capturing global opportunities that will contribute to our

top-line growth while achieving higher profi tability.

Engineered Products and Solutions (EPS): Our downstream business achieved 44 percent of

its 2013 revenue increase target of $1.6 billion, with approximately $700 million in organic growth

in the fi rst year. Every downstream business unit – Fasteners, Forgings, Power and Propulsion,

Wheels, and Building and Construction – contributed to that success by driving revenue growth

through new product introductions and share gains. EPS also acquired the aerospace fastener

manufacturer TransDigm, which contributed $58 million in revenue in 2011.

2

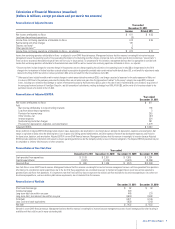

Balance Sheet Shows Strong Liquidity and Financial Positions

Improved Free Cash Flow Generation

($ Millions) ($ Millions)($ Millions)

2008 2009 2010 2011

Significant Cash on Hand

Disciplined Capital Spending

Sustaining Capital Growth Capital

$1.2b Less Debt and 8% pts. Lower Debt-to-Cap

Gross Debt ($ Millions) Debt-to-Cap (%)

(2,204)

(257)

1,246 906

($ Millions)

2008 2009 2010 2011 2008 2009 2010 2011

762

1,481 1,543

1,939 10,578

1,431

516 570

924

2,007

1,106

445 363

9,819

9,165

9,371

43%

39%

35% 35%

2008 2009 2010 2011 2008 2009 2010 2011

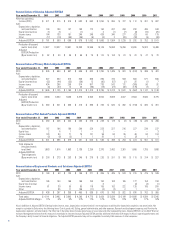

Alumina: Remains Strong

Adjusted EBITDA/MT – LME

10 Yr. Average ~ $66/MT

2001

62

1,447 1,350 1,433

1,719

1,900

2,570 2,641 2,572

1,664

2,173 2,398

44 48 68 75

110 104 81

20

47 70

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Primary Metals: Margin Compression

Adjusted EBITDA/MT – LME

10 Yr. Average ~ $390/MT

460

1,447 1,350 1,433

1,719

1,900

2,570 2,641 2,572

1,664

2,173 2,398

321 336 418 398

784 626

392

(159)

320 301

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Flat-Rolled Products: Continued Strength

Adjusted EBITDA/MT

10 Yr. Average ~ $231/MT

2001

290 273 253 249 276 201226

108 119

314 327

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Eng. Products & Solutions: Improved Margins

Adjusted EBITDA Margin

2001

11%

8% 9%

12% 11% 13%

12%

15%

13%

17% 18%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011