Alcoa 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

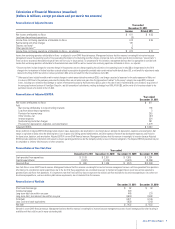

Alumina Refining Facilities and Capacity

Alcoa is the world’s leading producer of alumina. Alcoa’s alumina refining facilities and its worldwide alumina

capacity are shown in the following table:

Alcoa Worldwide Alumina Refining Capacity

Country Facility

Owners

(% of Ownership)

Nameplate

Capacity1

(000 MTPY)

Alcoa

Consolidated

Capacity2

(000 MTPY)

Australia Kwinana AofA3(100%) 2,190 2,190

Pinjarra AofA (100%) 4,234 4,234

Wagerup AofA (100%) 2,555 2,555

Brazil Poços de Caldas Alumínio4(100%) 390 390

São Luís (Alumar) AWA Brasil3(39%)

Rio Tinto Alcan Inc.5(10%)

Alumínio (15%)

BHP Billiton5(36%) 3,500 1,890

Jamaica Jamalco Alcoa Minerals of Jamaica, L.L.C.3(55%)

Clarendon Alumina Production Ltd.6(45%) 1,478 841

Spain San Ciprián Alúmina Española, S.A.3(100%) 1,500 1,500

Suriname Suralco Suralco3(55%)

AMS7(45%) 2,20782,207

United States Point Comfort, TX AWA LLC3(100%) 2,30592,305

TOTAL 20,359 18,112

1Nameplate Capacity is an estimate based on design capacity and normal operating efficiencies and does not necessarily

represent maximum possible production.

2The figures in this column reflect Alcoa’s share of production from these facilities. For facilities wholly-owned by

AWAC entities, Alcoa takes 100% of the production.

3This entity is part of the AWAC group of companies and is owned 60% by Alcoa and 40% by Alumina Limited.

4This entity is owned 100% by Alcoa.

5The named company or an affiliate holds this interest.

6Clarendon Alumina Production Ltd. is wholly-owned by the Government of Jamaica.

7AWA LLC owns 100% of N.V. Alcoa Minerals of Suriname (AMS). AWA LLC is part of the AWAC group of

companies and is owned 60% by Alcoa and 40% by Alumina Limited.

8In May 2009, the Suralco alumina refinery announced curtailment of 870,000 mtpy. The decision was made to protect

the long-term viability of the industry in Suriname. The curtailment was aimed at deferring further bauxite extraction

until additional in-country bauxite resources are developed and market conditions for alumina improve. The refinery

currently has approximately 793,000 mtpy of idle capacity.

9Reductions in production at Point Comfort resulted mostly from the effects of curtailments initiated in late 2008 through

early 2009, as a result of overall market conditions. The reductions included curtailments of approximately 1,500,000

mtpy. Of that original amount, 384,000 mtpy remain curtailed.

As noted above, Alcoa and Ma’aden entered into an agreement that involves the development of an alumina refinery in

the Kingdom of Saudi Arabia. Initial capacity of the refinery is expected to be 1.8 million mtpy. First production is

expected in 2014. For additional information regarding the joint venture, see the Equity Investments section of Note I

to the Consolidated Financial Statements in Part II, Item 8. (Financial Statements and Supplementary Data).

7