Alcoa 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Whenever someone tells me, “I have good news and bad news,” I always ask for the bad news fi rst. For Alcoa in 2011, the bad news was that

aluminum, one of the world’s most liquid commodity assets, became a proxy for the uncertainty in the world economy. As Europe showed substantial

weakness in the second half of the year, and the forward price of aluminum on the London Metal Exchange (LME) dropped dramatically in May from

$2,800 to roughly $2,000 per metric ton by December, so too did the stock performance of Alcoa and our peer companies.

We are acutely aware of the dramatic impact that Alcoa’s share price drop had on so many people. For you, our shareholders, it was particularly

disappointing given that earlier in the year Alcoa had risen to be one of the top three performers in total shareholder return among all Dow Jones

Industrial Average (DJIA) companies. For our managers and employees, it was frustrating that external factors overshadowed the good work they were

doing on the shop fl oor and with our customers. I have refl ected long and hard on the implications of the unusual events of 2011 for Alcoa and for the

aluminum industry. Let me share my thoughts with you.

The good news is that in an ironic way, Alcoa’s

performance in that volatile year actually validated the

fundamental strength of our Company and the strong

prospects for Alcoa and for aluminum. Even as the LME

price dropped, physical demand for aluminum remained

strong and grew worldwide by 10 percent over the course

of 2011, while regional premiums approached all-time

highs. Because of how we responded to the economic

crisis of 2008-2009 with our Cash Sustainability

Program, we began 2011 with a strong balance sheet

and a solid cash position. Our rise as a top performer in

the DJIA in the beginning of 2011 and the fact that we

ended the year with our stock performing better than our

aluminum peers reinforced Alcoa’s resilience in coping

with adversity and our strong investment fundamentals.

2011 Financial Performance

The theme of this report, “Alcoa Won’t Wait”, is appropriate for Alcoa’s operating performance in 2011. We didn’t allow external forces in the markets,

forces that we couldn’t control, to distract us from doing what we do best: making money by producing quality products. Productivity, volume, and price

mix improvements of more than $1 billion resulted in doubling profi ts over 2010; strong organic growth drove a 19 percent increase in revenues; and

reductions in working capital and capital expenditures helped us to end 2011 with signifi cantly more cash and less net debt than at the end of 2010.

Klaus Kleinfeld

Chairman of the Board and Chief Executive Offi cer

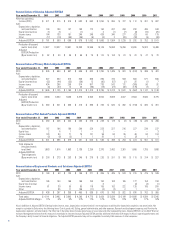

Aluminum peers include aluminum and alumina producing companies with a market

capitalization of at least $3 billion (as of 2010) and some publicly traded shares: Aluminum

Corporation of China Limited, United Company RUSAL, Norsk Hydro ASA, Alumina Limited,

National Aluminum Company Limited, and Shandong Nanshun Aluminium Co., Ltd.

Alcoa 2011 Annual Report 1

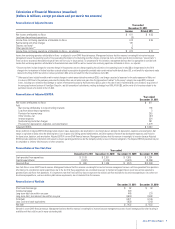

Outstanding

Financial

Performance

in 2011*

• Income from continuing

operations of $614 million,

or $0.55 per share

• Excluding impact of special

items, income from continuing

operations of $812 million,

or $0.72 per share

• Revenue of $25 billion,

up 19 percent vs. 2010

• Adjusted EBITDA of $3.3 billion

• Free cash fl ow of $906 million

• Days working capital at a

record low 27 days

• Debt-to-capital at 35%

• Net debt balance reduced by

$190 million, cash on hand of

$1.9 billion

• Achieved every Cash

Sustainability Target in 2011

2011 Total Shareholder Return

12/31/2010

1/31/2011

2/28/2011

3/31/2011

4/30/2011

5/31/2011

6/30/2011

7/31/2011

8/31/2011

9/30/2011

10/31/2011

11/30/2011

12/31/2011

Aluminum Peers

Alcoa

S&P 500® Materials Index

* See Calculation of Financial Measures following this letter for reconciliations of certain non-GAAP fi nancial measures

(adjusted income, adjusted EBITDA, free cash fl ow, and net debt amounts) presented in this letter.