Alcoa 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Alcoa

Won’t Wait

Taking Decisive Action in a Turbulent World

2011 Annual Report

Table of contents

-

Page 1

Alcoa Won't Wait Taking Decisive Action in a Turbulent World 2011 Annual Report -

Page 2

... investment castings, and building systems in addition to its expertise in other light metals such as titanium and nickel-based superalloys. ® $5.4 49% 27% $7.6 • Sustainability is an integral part of Alcoa's operating practices and the product design and engineering it provides to customers... -

Page 3

... (as of 2010) and some publicly traded shares: Aluminum Corporation of China Limited, United Company RUSAL, Norsk Hydro ASA, Alumina Limited, National Aluminum Company Limited, and Shandong Nanshun Aluminium Co., Ltd. 2011 Financial Performance The theme of this report, "Alcoa Won't Wait", is... -

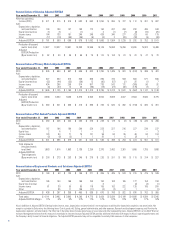

Page 4

...2009 2010 2011 2008 2009 Debt-to-Cap (%) 2010 2011 Every one of our four business segments delivered for Alcoa. Flat-Rolled Products and Engineered Products and Solutions each achieved historic highs in proï¬tability and drove strong organic growth in 2011. In our upstream operations, the Alumina... -

Page 5

... the aluminum and alumina cost curves while beneï¬tting from cleaner power. Saudi Arabia As I discussed in last year's annual report, at the end of 2009, Alcoa formed a joint venture with the Saudi Arabian Mining Company, Ma'aden, to build the largest and lowest-cost integrated aluminum facility... -

Page 6

... gas turbine market, OEMs are looking for efï¬ciencies, reduced nitrogen oxide, and an improvement in the number of start-stop cycles and operating hours. Our Alcoa Power and Propulsion business has developed an advanced platform core technology that allows us to direct cooling air in a gas turbine... -

Page 7

..., a Chinese "green energy" technology manufacturer, we developed an all-aluminum bus space frame that also incorporates Alcoa forged aluminum wheels and fasteners. Our prototype reduces the weight of the BYD electric bus body by 40 percent (nearly one ton) versus steel options. BYD plans to produce... -

Page 8

..., labor standards, waste management, and human rights policy, and conï¬rms the Values that Alcoans have lived for generations. Around the world, in virtually every Alcoa community, the Company has received recognition for the good work of our employees. Alcoa Australia employees planted trees... -

Page 9

...25), a gain on the sale of land in Australia ($18), costs related to acquisitions of the aerospace fastener business of TransDigm Group Inc. and full ownership of carbothermic smelting technology from ORKLA ASA ($8), and the write off of inventory related to the permanent closure of a smelter in the... -

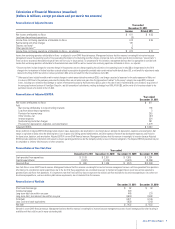

Page 10

... on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP ï¬nancial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa's operating performance and the Company's ability to meet its... -

Page 11

...specified in its charter) Pennsylvania 25-0317820 (State of incorporation) (I.R.S. Employer Identification No.) 390 Park Avenue, New York, New York 10022-4608 (Address of principal executive offices) (Zip code) Registrant's telephone numbers: Investor Relations 212) 836-2674 Office of the Secretary... -

Page 12

.... Item 14. Part IV Item 15. Exhibits, Financial Statement Schedules ...157 167 Signatures ...Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and... -

Page 13

... country where the point of sale occurred, the U.S. and Europe generated 49% and 27%, respectively, of Alcoa's sales in 2011. In addition, Alcoa has investments and operating activities in, among others, Australia, Brazil, China, Guinea, Iceland, Russia, and Saudi Arabia, all of which Business. 3 -

Page 14

...Engineered Products and Solutions. Description of the Business Information describing Alcoa's businesses can be found on the indicated pages of this report: Item Page(s) Discussion of Recent Business Developments: Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 15

...the bauxite that it mines into alumina. The company obtains bauxite from its own resources and from those belonging to the AWAC enterprise, located in the countries listed in the chart below, as well as pursuant to both long-term and short-term contracts and mining leases. In 2011, Alcoa consumed 43... -

Page 16

... AWA LLC purchase bauxite from MRN under long-term supply contracts. 6 In September 2009, development of a new bauxite mine was completed in Juruti, state of Para in northern Brazil. The mine is fully operational and produced 2.6 million mt in 2010 and 3.8 million mt in 2011. In 2012 production is... -

Page 17

...an alumina refinery in the Kingdom of Saudi Arabia. Initial capacity of the refinery is expected to be 1.8 million mtpy. First production is expected in 2014. For additional information regarding the joint venture, see the Equity Investments section of Note I to the Consolidated Financial Statements... -

Page 18

...been extended to November 2012. Pre-feasibility studies were completed in 2008. Additional feasibility study work was completed in 2011, and further activities are planned for 2012. In September 2006, Alcoa received environmental approval from the Government of Western Australia for expansion of the... -

Page 19

... Lista Mosjøen Avilés La Coruña San Ciprián Evansville, IN (Warrick) Massena East, NY Massena West, NY Mount Holly, SC Alcoa, TN Rockdale, TX Ferndale, WA (Intalco) Wenatchee, WA Canada Iceland Italy Norway Spain United States Owners (% Of Ownership) AofA (100%) AofA (55%) CITIC4 (22... -

Page 20

...new joint venture will target growth opportunities in the Chinese automotive, aerospace, packaging and consumer electronics markets. As noted above, at the end of 2009 Alcoa and Ma'aden entered into an agreement that involves development of an aluminum smelter in the Kingdom of Saudi Arabia. In 2010... -

Page 21

... and plate used in the aerospace, automotive, commercial transportation, and building and construction markets. As noted above, Alcoa and Ma'aden entered into an agreement that involves development of a rolling mill in the Kingdom of Saudi Arabia. In 2010, the joint venture entity, Ma'aden Rolling... -

Page 22

... investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. These products are sold directly to customers... -

Page 23

... Fasteners Architectural Products Fasteners Fasteners Aerospace and Industrial Gas Turbine Castings/Forgings Forgings Aerospace and Industrial Gas Turbine Castings Architectural Products Aerospace Castings/Fasteners Forgings Fasteners Extrusions and Forgings Extrusions and Forgings Extrusions China... -

Page 24

...Forgings Architectural Products Architectural Products Aerospace Ceramic Products Fasteners Aerospace and Industrial Gas Turbine Castings Aerospace and Industrial Gas Turbine Castings 1 2 Facilities with ownership described as "Alcoa (100%)" are either leased or owned by the company. The operating... -

Page 25

...Natural gas Generally, other materials are purchased from third party suppliers under competitively-priced supply contracts or bidding arrangements. The company believes that the raw materials necessary to its business are and will continue to be available. Energy Employing the Bayer process, Alcoa... -

Page 26

... first quarter of 2010 when Alcoa announced the permanent closure of the Badin, North Carolina smelter, power generated from APGI's Yadkin system is largely being sold to an affiliate, Alcoa Power Marketing LLC, and then sold into the wholesale market. Proceeds from sales to the wholesale market are... -

Page 27

... cost of power purchased from the market to partially operate the Intalco smelter, Alcoa and BPA signed a new contract providing for the sale of physical power at the Northwest Power Act mandated industrial firm power (IP) rate, for the period from December 22, 2009 - May 26, 2011 (17 months). That... -

Page 28

...-term power purchase agreement expiring in December 2024. Eletronorte has supplied the Alumar smelter from the beginning of its operations in 1984. Since 2006, Alcoa AlumÃnio S.A.'s (AlumÃnio) remaining power needs for the smelter are supplied from self-generated energy. Beginning in March 2012... -

Page 29

...through 2015. North America - Natural Gas In order to supply its refineries and smelters in the U.S. and Canada, Alcoa generally procures natural gas on a competitive bid basis from a variety of sources including producers in the gas production areas and independent gas marketers. For Alcoa's larger... -

Page 30

... benefits. The company also has a number of domestic and international registered trademarks that have significant recognition within the markets that are served. Examples include the name "Alcoa" and the Alcoa symbol for aluminum products, Howmet metal castings, Huck® fasteners, Kawneer® building... -

Page 31

...). Energy saving sensing devices are being integrated in company manufacturing plants. Integrated thermal management products for consumer electronics have been developed and are being validated by our customers. A number of products were commercialized in 2011 including new fasteners, new aerospace... -

Page 32

... a series of accounting and financial management positions in Alcoa's Australian smelting, rolling, extrusion, foil and alumina businesses and Alcoa's corporate office. Mr. Bottger was Chief Financial Officer of Alcoa's Engineered Products and Solutions business group from 2005 to August 2010. From... -

Page 33

... named Group President, Global Rolled Products effective November 14, 2011. Before his most recent appointment, he led Alcoa's Business Excellence/ Corporate Strategy resource unit and was also responsible for overseeing Alcoa's Asia-Pacific region. He joined Alcoa in February 2010 as Vice President... -

Page 34

... the price of aluminum. A sustained weak aluminum pricing environment or a deterioration in aluminum prices could have a material, adverse effect on Alcoa's business, financial condition, results of operations or cash flow. Alcoa's operations consume substantial amounts of energy; profitability may... -

Page 35

... mine, the ongoing Estreito hydroelectric power project in Brazil and the China and Russia growth projects. Management believes that these projects will be beneficial to Alcoa; however, there is no assurance that these benefits will be realized, whether due to unfavorable global economic conditions... -

Page 36

... aluminum smelter and rolling mill) in the Kingdom of Saudi Arabia. In 2011, Alcoa entered into a Memorandum of Understanding followed by a Letter of Intent with China Power Investment Corporation (CPI) which provides a framework for the creation of a joint venture entity with plans to target growth... -

Page 37

... for the joint venture project in the Kingdom of Saudi Arabia, a downgrade of Alcoa's credit ratings below investment grade by at least two rating agencies would require Alcoa to provide a letter of credit or fund an escrow account for a portion or all of Alcoa's remaining equity commitment to the... -

Page 38

... things, potential claims relating to product liability, health and safety, environmental matters, intellectual property rights, government contracts, taxes, and compliance with U.S. and foreign export laws, anti-bribery laws, competition laws and sales and trading practices. Alcoa could be subject... -

Page 39

... charge to shareholders' equity. For a discussion regarding how Alcoa's financial statements can be affected by pension and other postretirement benefits accounting policies, see Part II, Item 7. (Management's Discussion and Analysis of Financial Condition and Results of Operations) under the... -

Page 40

... business development data. The above list of important factors is not all-inclusive or necessarily in order of importance. Item 1B. Unresolved Staff Comments. None. Item 2. Properties. Alcoa's principal office is located at 390 Park Avenue, New York, New York 10022-4608. Alcoa's corporate center... -

Page 41

... Products and Solutions Facilities section on pages 12-14 of this report. CORPORATE See the table and related text in the Corporate Facilities section on page 15 of this report. Item 3. Legal Proceedings. In the ordinary course of its business, Alcoa is involved in a number of lawsuits and claims... -

Page 42

...13,000 retired former employees of Alcoa or Reynolds Metals Company and spouses and dependants of such retirees alleging violation of the Employee Retirement Income Security Act (ERISA) and the Labor-Management Relations Act by requiring plaintiffs, beginning January 1, 2007, to pay health insurance... -

Page 43

...As previously reported, on March 6, 2009, the Philadelphia Gas Works Retirement Fund filed a shareholder derivative suit in the civil division of the Court of Common Pleas of Philadelphia County, Pennsylvania. This action was brought against certain officers and directors of Alcoa claiming breach of... -

Page 44

... comply with EU state aid rules. At the time the EC opened its investigation, Alcoa had been operating in Spain for more than nine years under a power supply structure approved by the Spanish Government in 1986, an equivalent tariff having been granted in 1983. The investigation is limited to the... -

Page 45

... damages liability in this matter. In January 2011, the Trustees, representing the United States, the State of New York and the Mohawk tribe, and Alcoa reached an agreement in principle to resolve the natural resource damage claims. The agreement is subject to final approval of the respective... -

Page 46

... Government. Alcoa also acquired the extrusion plants located in Feltre and Bolzano, Italy. At the time of the acquisition, Alumix indemnified Alcoa for pre-existing environmental contamination at the sites. In 2004, the Italian Ministry of Environment (MOE) issued orders to Alcoa Trasformazioni... -

Page 47

...As previously reported, on November 30, 2010, Alcoa AlumÃnio S.A. (AlumÃnio) received service of a lawsuit that had been filed by the public prosecutors of the State of Pará in Brazil in November 2009. The suit names the company and the State of Pará, which, through its Environmental Agency, had... -

Page 48

... all of the claim dismissals that have occurred in the trial court over the life of the case. The company anticipates that this appeal will be filed within 60 days following entry of such settlement. Alcoa's share of the settlement is fully insured. Contract Action. As previously reported, on April... -

Page 49

..., and cross-claims against SCRG and certain agencies of the Virgin Islands Government. During July 2009, each defendant except SCRG filed a partial motion for summary judgment seeking dismissal of the CERCLA cause of action on statute of limitations grounds. In July 2010, the court granted in part... -

Page 50

... as a third amended complaint, and defendants have moved to dismiss the case for failure to state a claim upon which relief can be granted. On March 17, 2011, the court granted plaintiffs' motion to remand to territorial court. Thereafter, Alcoa filed a motion for allowance of appeal. The motion was... -

Page 51

... information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K (17 CFR 229.104 is included in Exhibit 95 of this report, which is incorporated herein by reference... -

Page 52

... and Issuer Purchases of Equity Securities. The company's common stock is listed on the New York Stock Exchange where it trades under the symbol AA. The company's quarterly high and low trading stock prices and dividends per common share for 2011 and 2010 are shown below. 2011 Low Dividend $15.42... -

Page 53

... 31, 2006 2007 2008 2009 2010 2011 Alcoa Inc. $100 $124 $39 $58 $ 56 $ 32 S&P 500® Index 100 105 66 84 97 99 ® S&P 500 Materials Index 100 123 67 99 121 109 © Copyright 2012 Standard & Poor's, a division of The McGraw-Hill Companies Inc. All rights reserved. Source: Research Data Group, Inc. (www... -

Page 54

... for quarter ended December 31, 2011 Total Number of Shares Purchased (a) 2,582 2,462 5,044 - (a) This column includes the deemed surrender of existing shares of Alcoa common stock to the company by stock-based compensation plan participants to satisfy the exercise price of employee stock options... -

Page 55

...) Shipments of alumina (kmt) Shipments of aluminum products (kmt) Alcoa's average realized price per metric ton of aluminum Cash dividends declared per common share Total assets Short-term borrowings Commercial paper Long-term debt, including amounts due within one year 2011 $24,951 $ $ 2010 $21,013... -

Page 56

... the country where the point of sale occurred, the U.S. and Europe generated 49% and 27%, respectively, of Alcoa's sales in 2011. In addition, Alcoa has investments and operating activities in, among others, Australia, Brazil, China, Guinea, Iceland, Russia, and Saudi Arabia, all of which present... -

Page 57

... on them throughout 2010. Also, a further reduction in capital expenditures was planned in order to achieve the level necessary to sustain operations without sacrificing the quality of Alcoa's alumina and aluminum products. In 2011, management continued its previous actions to maintain the achieved... -

Page 58

... long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. Also, at the end of 2011, management approved a partial or full curtailment of three European smelters as follows: Portovesme, Italy (150 kmt-per-year); Avilés, Spain... -

Page 59

...result of the assets placed into service during the second half of 2009 related to the Juruti bauxite mine development and São LuÃs refinery expansion in Brazil, the smelters in Norway (acquired on March 31, 2009), the new Bohai (China) flat-rolled product facility, and a high-quality coated sheet... -

Page 60

... economically viable, long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. The asset impairments of $127 represent the write off of the remaining book value of properties, plants, and equipment related to these facilities... -

Page 61

...); an aluminum fluoride plant in Point Comfort, TX; a paste plant and cast house in Massena, NY; and one potline at the smelter in Warrick, IN (capacity of 40 kmt-per-year). This decision was made after a comprehensive strategic analysis was performed to determine the best course of action for each... -

Page 62

...sale of an equity investment and an equity loss related to Alcoa's former 50% equity stake in Elkem; and a net favorable change of $25 in mark-to-market derivative contracts. Income Taxes-Alcoa's effective tax rate was 24.0% (provision on income) in 2011 compared with the U.S. federal statutory rate... -

Page 63

...% to 18%) in Iceland; a $31 benefit related to a Canadian tax law change allowing a tax return to be filed in U.S. dollars; a $10 benefit related to a change in the sale structure of two locations included in the Global Foil business than originally anticipated; and a $7 benefit related to the Elkem... -

Page 64

... sales Total sales ATOI This segment represents a portion of Alcoa's upstream operations and consists of the Company's worldwide refinery system, including the mining of bauxite, which is then refined into alumina. Alumina is mainly sold directly to internal and external smelter customers worldwide... -

Page 65

..., alumina production across the global system will be reduced to reflect smelter curtailments as well as prevailing market conditions. Furthermore, in the second half of 2012, Alcoa's refineries in Australia will be subject to a carbon tax recently approved by the Australian government related to... -

Page 66

... long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. Also, at the end of 2011, management approved a partial or full curtailment of three European smelters as follows: Portovesme, Italy (150 kmt-per-year); Avilés, Spain... -

Page 67

... small number of customers. Third-party sales for the Flat-Rolled Products segment climbed 22% in 2011 compared with 2010, primarily driven by better pricing; higher volumes across most businesses, particularly related to the packaging, aerospace, and commercial transportation markets; favorable... -

Page 68

... investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. These products are sold directly to customers... -

Page 69

... 2010 compared with 2009, mainly due to productivity improvements and cost reduction initiatives across all businesses, partially offset by unfavorable pricing and mix. In 2012, the aerospace market is expected to remain strong and incremental gains are anticipated for the commercial transportation... -

Page 70

... former Sapa AB joint venture, and a smaller improvement in the cash surrender value of company-owned life insurance; partially offset by the absence of a $118 realized loss on the sale of an equity investment and favorable changes in mark-to-market derivative contracts. • • • • • 60 -

Page 71

... on them throughout 2010. Also, a further reduction in capital expenditures was planned in order to achieve the level necessary to sustain operations without sacrificing the quality of Alcoa's alumina and aluminum products. In 2011, management continued its previous actions to maintain the achieved... -

Page 72

...-market energy contract that ended in September 2011; an additional inflow of $66 in accounts payable, trade, principally the result of higher purchasing needs and timing of vendor payments; a lower outflow of $201 in accrued expenses, mostly related to fewer cash payments for restructuring programs... -

Page 73

... of which are to be used to provide working capital or for other general corporate purposes of Alcoa, including support of Alcoa's commercial paper program. Subject to the terms and conditions of the Credit Agreement, Alcoa may from time to time request increases in lender commitments under the... -

Page 74

... aerospace fastener business); slightly offset by $54 in sales of investments, primarily related to available-for-sale securities held by Alcoa's captive insurance company; and $38 in proceeds from the sale of assets, mainly attributable to the sale of land in Australia. The use of cash in 2010 was... -

Page 75

... various contracts, including long-term purchase obligations, debt agreements, and lease agreements. Alcoa also has commitments to fund its pension plans, provide payments for other postretirement benefit plans, and finance capital projects. As of December 31, 2011, a summary of Alcoa's outstanding... -

Page 76

... 2012. Equity contributions represent Alcoa's committed investment related to a joint venture in Saudi Arabia. In December 2009, Alcoa signed an agreement to enter into a joint venture to develop a new aluminum complex in Saudi Arabia, comprised of a bauxite mine, alumina refinery, aluminum smelter... -

Page 77

... parties at market rates; therefore, no servicing asset or liability was recorded. Critical Accounting Policies and Estimates The preparation of the Consolidated Financial Statements in accordance with accounting principles generally accepted in the United States of America requires management to... -

Page 78

...asset retirement obligations (AROs) related to legal obligations associated with the normal operation of Alcoa's bauxite mining, alumina refining, and aluminum smelting facilities. These AROs consist primarily of costs associated with spent pot lining disposal, closure of bauxite residue areas, mine... -

Page 79

...153) and Alcoa Power and Propulsion (APP) ($1,627) businesses, both of which are included in the Engineered Products and Solutions segment, and Primary Metals ($1,841). These amounts include an allocation of Corporate's goodwill. In September 2011, the Financial Accounting Standards Board issued new... -

Page 80

...operations and shareholders' equity. During the 2011 annual review of goodwill, management proceeded directly to the two-step quantitative impairment test for three reporting units as follows: the Primary Metals segment, building and construction systems, which is included in the Engineered Products... -

Page 81

... cash flows of the Company's reporting units. Accordingly, management does not believe that the comparison of Alcoa's market capitalization and total shareholders' equity as of December 31, 2011 is an indication that goodwill is impaired. Equity Investments. Alcoa invests in a number of privately... -

Page 82

... significantly between grant dates because of changes in the actual results of these inputs that occur over time. As part of Alcoa's stock-based compensation plan design, individuals who are retirement-eligible have a six-month requisite service period in the year of grant. Equity grants are issued... -

Page 83

... under relevant tax law until such time that the related tax benefits are recognized. Related Party Transactions Alcoa buys products from and sells products to various related companies, consisting of entities in which Alcoa retains a 50% or less equity interest, at negotiated arms-length prices... -

Page 84

... of the Company's internal control over financial reporting as of December 31, 2011 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report, which is included herein. Klaus Kleinfeld Chairman and Chief Executive Officer Charles... -

Page 85

... on these financial statements and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 86

...income (loss) Earnings per Share Attributable to Alcoa Common Shareholders (S): Basic: Income (loss) from continuing operations Loss from discontinued operations Net income (loss) Diluted: Income (loss) from continuing operations Loss from discontinued operations Net income (loss) 2011 2010 2009 $24... -

Page 87

... Properties, plants, and equipment, net (H) Goodwill (E) Investments (I) Deferred income taxes (T) Other noncurrent assets (J) Total Assets Liabilities Current liabilities: Short-term borrowings (K & X) Commercial paper (K & X) Accounts payable, trade Accrued compensation and retirement costs Taxes... -

Page 88

... in commercial paper (K) Additions to long-term debt (K) Debt issuance costs (K) Payments on long-term debt (K) Proceeds from exercise of employee stock options (R) Excess tax benefits from stock-based payment arrangements Issuance of common stock (R) Dividends paid to shareholders Distributions... -

Page 89

... per-share amounts) Alcoa Inc. Shareholders Accumulated Preferred Common Additional Retained Treasury other compre- Noncontrolling stock stock capital earnings stock hensive loss interests Total equity Balance at December 31, 2008 Net (loss) income Other comprehensive income Cash dividends declared... -

Page 90

... actuarial loss and prior service cost/benefit related to pension and other postretirement benefits (W) Foreign currency translation adjustments (A) Unrealized gains on available-for-sale securities (I): Unrealized holding (losses) gains Net amount reclassified to earnings Net change in unrealized... -

Page 91

... per-share amounts) A. Summary of Significant Accounting Policies Basis of Presentation. The Consolidated Financial Statements of Alcoa Inc. and subsidiaries ("Alcoa" or the "Company") are prepared in conformity with accounting principles generally accepted in the United States of America (GAAP... -

Page 92

...153) and Alcoa Power and Propulsion (APP) ($1,627) businesses, both of which are included in the Engineered Products and Solutions segment, and Primary Metals ($1,841). These amounts include an allocation of Corporate's goodwill. In September 2011, the Financial Accounting Standards Board issued new... -

Page 93

...operations and shareholders' equity. During the 2011 annual review of goodwill, management proceeded directly to the two-step quantitative impairment test for three reporting units as follows: the Primary Metals segment, building and construction systems, which is included in the Engineered Products... -

Page 94

...years): Segment Alumina Primary Metals Flat-Rolled Products Engineered Products and Solutions Software 10 10 9 9 Other intangible assets 40 10 17 Equity Investments. Alcoa invests in a number of privately-held companies, primarily through joint ventures and consortia, which are accounted for on the... -

Page 95

... their remaining useful life. Certain conditional asset retirement obligations (CAROs) related to alumina refineries, aluminum smelters, and fabrication facilities have not been recorded in the Consolidated Financial Statements due to uncertainties surrounding the ultimate settlement date. A CARO is... -

Page 96

.... Alcoa recognizes compensation expense for employee equity grants using the non-substantive vesting period approach, in which the expense (net of estimated forfeitures) is recognized ratably over the requisite service period based on the grant date fair value. The fair value of new stock options is... -

Page 97

...with these businesses following their divestiture, primarily in the form of equity participation, or ongoing aluminum or other significant supply contracts. Recently Adopted Accounting Guidance. On September 30, 2009, Alcoa adopted changes issued by the Financial Accounting Standards Board (FASB) to... -

Page 98

... measurement date under current market conditions. The adoption of these changes had no impact on the Consolidated Financial Statements. On June 30, 2009, Alcoa adopted changes issued by the FASB to fair value disclosures of financial instruments. These changes require a publicly traded company to... -

Page 99

...the Consolidated Financial Statements. Effective January 1, 2010, Alcoa adopted changes issued by the FASB on January 6, 2010 for a scope clarification to the FASB's previously-issued guidance (see directly below) on accounting for noncontrolling interests in consolidated financial statements. These... -

Page 100

...review of Alcoa's goodwill (2011 fourth quarter), the adoption of these changes had no impact on the Consolidated Financial Statements. In September 2011, the FASB issued changes to the testing of goodwill for impairment. These changes provide an entity the option to first assess qualitative factors... -

Page 101

... from customers and Short-term borrowings on the accompanying Consolidated Balance Sheet. Effective January 1, 2010, Alcoa adopted changes issued by the FASB on February 24, 2010 to accounting for and disclosure of events that occur after the balance sheet date but before financial statements are... -

Page 102

...and presentation of earnings per share. These changes become effective for Alcoa on January 1, 2012. Other than the change in presentation, management has determined that the adoption of these changes will not have an impact on the Consolidated Financial Statements. In December 2011, the FASB issued... -

Page 103

... sale included the electronics portion of the EES business (working capital components) and the Hawesville, KY automotive casting facility. In late 2011, management made the decision to no longer commit to a plan to sell the one remaining plant of the Global Foil business located in Brazil. Instead... -

Page 104

... held for sale were included in Other noncurrent liabilities and deferred credits on the accompanying Consolidated Balance Sheet. C. Asset Retirement Obligations Alcoa has recorded AROs related to legal obligations associated with the normal operations of bauxite mining, alumina refining, and... -

Page 105

... economically viable, long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. The asset impairments of $127 represent the write off of the remaining book value of properties, plants, and equipment related to these facilities... -

Page 106

...); an aluminum fluoride plant in Point Comfort, TX; a paste plant and cast house in Massena, NY; and one potline at the smelter in Warrick, IN (capacity of 40 kmt-per-year). This decision was made after a comprehensive strategic analysis was performed to determine the best course of action for each... -

Page 107

... new power agreement at the Portovesme smelter in Italy - see 2010 Actions above), natural attrition, and other factors. The remaining terminations are expected to be completed by the end of 2012. In 2011 and 2010, cash payments of $13 and $60, respectively, were made against layoff reserves related... -

Page 108

... business as Platinum Equity assumed these obligations (see Note F). The remaining reserves are expected to be paid in cash during 2012, with the exception of approximately $45 to $50, which is expected to be paid over the next several years for lease termination costs, ongoing site remediation work... -

Page 109

... 31, 2011, $1,349 of the amount reflected in Corporate is allocated to each of Alcoa's four reportable segments ($163 to Alumina, $850 to Primary Metals, $63 to Flat-Rolled Products, and $273 to Engineered Products and Solutions) included in the table above for purposes of impairment testing (see... -

Page 110

...doors for the commercial building and construction market and generated sales of approximately $100 in 2009. The assets and liabilities of this business were included in the Engineered Products and Solutions segment as of the end of July 2010 and this business' results of operations were included in... -

Page 111

... Consolidated Operations. These two transactions are no longer subject to post-closing adjustments. This business generated sales of $78 in 2009 and, at the time of divestiture, had approximately 360 employees at three locations. 2009 Acquisitions. In March 2009, Alcoa completed a non-cash exchange... -

Page 112

... 2015 based upon the achievement of various financial and operating targets. Any such payment would be reflected as additional goodwill. G. Inventories December 31, Finished goods Work-in-process Bauxite and alumina Purchased raw materials Operating supplies 2011 $ 537 911 656 532 263 $2,899 2010... -

Page 113

... 31, 2011 and 2010, Equity investments included an interest in a project to develop a fully-integrated aluminum complex in Saudi Arabia (see below), hydroelectric power projects in Brazil (see Note N), a smelter operation in Canada (25.05% of Pechiney Reynolds Quebec, Inc.), bauxite mining interests... -

Page 114

...part of the construction of the fully-integrated aluminum complex. At December 31, 2011, Alcoa has an outstanding receivable of $25 from the smelting, rolling mill, and refining and mining companies for labor and other employee-related expenses. Capital investment in the project is expected to total... -

Page 115

... of Alcoa's credit ratings below investment grade by at least two agencies would require Alcoa to provide a letter of credit or fund an escrow account for a portion or all of Alcoa's remaining equity commitment to the joint venture project in Saudi Arabia. Power for the refinery, smelter, and... -

Page 116

...December 31, Intangibles, net (E) Value-added tax receivable Cash surrender value of life insurance Prepaid gas transmission contract Deferred mining costs, net Unamortized debt expense Fair value of derivative contracts (X) Prepaid pension benefit (W) Other 2011 2010 $ 494 $ 524 510 495 455 464 346... -

Page 117

... early retirement of $881 in outstanding notes (see below), early repayment of $101 in outstanding loans related to the bauxite mine development in Brazil (see BNDES Loans below), and the remainder was used for general corporate purposes. The original issue discount and financing costs were deferred... -

Page 118

... average cost incurred by BNDES in raising capital outside of Brazil, 3.59% and 4.16% as of December 31, 2011 and 2010, respectively, plus a margin of 2.40%. Principal and interest were payable monthly beginning in September 2009 and ending in November 2014 for the four subloans totaling $233 (R$470... -

Page 119

...31, 2011. Alcoa had no outstanding commercial paper at December 31, 2010. In 2011 and 2010, the average outstanding commercial paper was $197 and $166. Commercial paper matures at various times within one year and had an annual weighted average interest rate of 0.6%, 0.7%, and 3.1% during 2011, 2010... -

Page 120

... of which are to be used to provide working capital or for other general corporate purposes of Alcoa, including support of Alcoa's commercial paper program. Subject to the terms and conditions of the Credit Agreement, Alcoa may from time to time request increases in lender commitments under the... -

Page 121

... and retirement costs Environmental remediation (N) Deferred alumina sales revenue Other 2011 2010 $ 624 $ 703 503 442 395 388 304 314 289 302 116 125 197 302 $2,428 $2,576 M. Noncontrolling Interests The following table summarizes the noncontrolling shareholders' interests in the equity of Alcoa... -

Page 122

...13,000 retired former employees of Alcoa or Reynolds Metals Company and spouses and dependents of such retirees alleging violation of the Employee Retirement Income Security Act (ERISA) and the Labor-Management Relations Act by requiring plaintiffs, beginning January 1, 2007, to pay health insurance... -

Page 123

... Court related to certain pre-trial decisions of the court and of the court's post-trial ruling on the negligence claim. The Third Circuit Court referred this matter to mediation as is its standard practice in appeals. Before 2002, Alcoa purchased power in Italy in the regulated energy market and... -

Page 124

... state aid. On July 29, 2010, Alcoa executed a new power agreement effective September 1, 2010 through December 31, 2012 for the Portovesme smelter, replacing the short-term, market-based power contract that was in effect since early 2010. Additionally in May 2010, Alcoa and the Italian Government... -

Page 125

.... Also, the change in the 2011 reserve reflects an increase of $3 related to the acquisition of an aerospace fasteners business (see Note F). Included in annual operating expenses are the recurring costs of managing hazardous substances and environmental programs. These costs are estimated to be... -

Page 126

... sale that pre-date 1987. As a result of this obligation, Alcoa recorded a reserve for the Vancouver location at that time. Evergreen decommissioned the smelter and cleaned up its portion of the site under a consent order with the Washington Department of Ecology (WDE). In February 2008, Evergreen... -

Page 127

... sites. In 2004, the Italian Ministry of Environment (MOE) issued orders to Alcoa Trasformazioni S.r.l. and Alumix for the development of a clean-up plan related to soil contamination in excess of allowable limits under legislative decree and to institute emergency actions and pay natural resource... -

Page 128

... the agreement for future gas transmission services. Alcoa's maximum exposure to loss on the investment and the related contract is approximately $510 (A$510) as of December 31, 2011. Purchase Obligations. Alcoa is party to unconditional purchase obligations for energy that expire between 2012 and... -

Page 129

... sales Net (gain) loss on mark-to-market derivative contracts (X) Other, net In 2011, Equity income included higher earnings from an investment in a natural gas pipeline in Australia due to the recognition of a discrete income tax benefit by the consortium (Alcoa World Alumina and Chemicals' share... -

Page 130

... operations and consists of the Company's worldwide refinery system, including the mining of bauxite, which is then refined into alumina. Alumina is mainly sold directly to internal and external smelter customers worldwide or is sold to customers who process it into industrial chemical products... -

Page 131

...small number of customers. Engineered Products and Solutions. This segment represents Alcoa's downstream operations and includes titanium, aluminum, and super alloy investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used... -

Page 132

...assets of Alcoa's reportable segments were as follows: FlatRolled Products Engineered Products and Solutions Alumina 2011 Sales: Third-party sales Intersegment sales Total sales Profit and loss: Equity income (loss) Depreciation, depletion, and amortization Income taxes ATOI 2010 Sales: Third-party... -

Page 133

... sales of three soft alloy extrusion facilities located in Brazil. 2011 Net income (loss) attributable to Alcoa: Total segment ATOI Unallocated amounts (net of tax): Impact of LIFO Interest expense Noncontrolling interests Corporate expense Restructuring and other charges Discontinued operations... -

Page 134

... Netherlands include aluminum from Alcoa's smelter in Iceland. Geographic information for long-lived assets was as follows (based upon the physical location of the assets): December 31, Long-lived assets: Brazil U.S. Australia Iceland Canada Norway Russia Spain China Jamaica Other 2011 $ 4,844 4,573... -

Page 135

... registration statement dated February 18, 2011) for resale by the master trust, as selling stockholder. In January 2010, Alcoa contributed 44,313,146 newly issued shares of its common stock to a master trust that holds the assets of certain U.S. defined benefit pension plans in a private placement... -

Page 136

... plans are granted in January each year at not less than market prices on the dates of grant. Prior to 2011, performance stock options were also granted to certain individuals. For performance stock options granted in 2010, the final number of options earned was based on Alcoa's adjusted free cash... -

Page 137

... of interest rates at the time of the grant based on the contractual life of the option. Prior to 2009, the dividend yield was based on a five-year average. For 2009, the dividend yield was based on a three-month average as a result of the significant decline in Alcoa's stock price in 2008, due to... -

Page 138

...72 - $35.49 $35.50 - $47.35 Total Intrinsic Value $4 $4 In addition to stock option awards, the Company grants stock awards and performance share awards, both of which vest three years from the date of grant. Performance share awards are issued at target and the final award amount is determined at... -

Page 139

...of the loss from continuing operations in 2009 was allocated to these participating securities because these awards do not share in any loss generated by Alcoa. Effective January 1, 2010, new grants of stock and performance awards do not contain a nonforfeitable right to dividends during the vesting... -

Page 140

...of diluted EPS. Had Alcoa generated sufficient income from continuing operations in 2009, 69 million and 2 million potential shares of common stock related to the convertible notes and stock options, respectively, would have been included in diluted average shares outstanding. Options to purchase 27... -

Page 141

...* Foreign State and local Deferred: Federal* Foreign State and local Total * Includes U.S. taxes related to foreign income Included in discontinued operations is a tax benefit of $1 in 2011, $3 in 2010, and $55 in 2009. The exercise of employee stock options generated a tax benefit of $6 in 2011 and... -

Page 142

... Health Care and Education Reconciliation Act of 2010 (the "HCERA" and, together with PPACA, the "Acts"), which makes various amendments to certain aspects of the PPACA, was signed into law. The Acts effectively change the tax treatment of federal subsidies paid to sponsors of retiree health benefit... -

Page 143

...have annual limitations on utilization. Other represents deferred tax assets whose expiration is dependent upon the reversal of the underlying temporary difference. A substantial amount of Other relates to employee benefits that will become deductible for tax purposes over an extended period of time... -

Page 144

... impact the annual effective tax rate for 2011, 2010, and 2009 would be approximately 2%, 4%, and 1%, respectively, of pretax book income. Alcoa does not anticipate that changes in its unrecognized tax benefits will have a material impact on the Statement of Consolidated Operations during 2012. 134 -

Page 145

... for cash (up to $250). This program was renewed on October 29, 2009 and was due to expire on October 28, 2010. On March 26, 2010, Alcoa terminated this program and repaid the $250 originally received in 2009. In light of the adoption of accounting changes related to the transfer of financial assets... -

Page 146

... not eligible for postretirement health care benefits. All salaried and certain hourly U.S. employees that retire on or after April 1, 2008 are not eligible for postretirement life insurance benefits. The funded status of all of Alcoa's pension and other postretirement benefit plans are measured as... -

Page 147

...$ At December 31, 2011, the benefit obligation, fair value of plan assets, and funded status for U.S. pension plans were $10,702, $7,988, and $(2,714), respectively. At December 31, 2010, the benefit obligation, fair value of plan assets, and funded status for U.S. pension plans were $9,791, $7,242... -

Page 148

... In 2011, 2010, and 2009, net periodic benefit cost for U.S pension plans was $190, $155, and $135, respectively. In 2011, 2010, and 2009, net periodic benefit cost for other postretirement benefits reflects a reduction of $43, $39, and $42, respectively, related to the recognition of the federal... -

Page 149

... used to determine net periodic benefit cost for most U.S. pension plans for the full annual period. However, the discount rates for a limited number of plans were updated during the respective years to reflect the remeasurement of these plans due to new union labor agreements, settlements, and (or... -

Page 150

...the expected long-term rate of return. Assumed health care cost trend rates for U.S. other postretirement benefit plans were as follows (assumptions for non-U.S plans did not differ materially): 2011 6.5% 5.0% 2016 2010 6.5% 5.0% 2015 2009 6.5% 5.0% 2014 Health care cost trend rate assumed for next... -

Page 151

...risk. A large number of external investment managers are used to gain broad exposure to the financial markets and to mitigate manager-concentration risk. Investment practices comply with the requirements of the Employee Retirement Income Security Act of 1974 (ERISA) and any other applicable laws and... -

Page 152

.... In 2011 and 2010, cash contributions to Alcoa's pension plans were $336 and $113. Also in both 2011 and 2010, Alcoa contributed newly issued shares (see Note R) of its common stock (valued at $600) to a master trust that holds the assets of certain U.S. defined benefit pension plans in a private... -

Page 153

...composed of the chief executive officer, the chief financial officer, and other officers and employees that the chief executive officer selects. The SRMC reports to the Board of Directors on the scope of its activities. The aluminum, energy, interest rate, and foreign exchange contracts are held for... -

Page 154

... Derivatives 2011 2010 Derivatives designated as hedging instruments: Prepaid expenses and other current assets: Aluminum contracts $ 56 $ 48 Foreign exchange contracts 2 Interest rate contracts 8 19 Other noncurrent assets: Aluminum contracts 6 22 Energy contracts 2 9 Interest rate contracts 37... -

Page 155

...Aluminum contracts Embedded credit derivative Energy contracts Foreign exchange contracts Interest rate contracts Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date... -

Page 156

... financial instruments, management uses significant other observable inputs (e.g., information concerning time premiums and volatilities for certain option type embedded derivatives and regional premiums for aluminum contracts). For periods beyond the term of quoted market prices for aluminum, Alcoa... -

Page 157

...curve. The embedded derivatives have been designated as hedges of forward sales of aluminum and their realized gains and losses were included in Sales on the accompanying Statement of Consolidated Operations. In 2011, Alcoa entered into a six-year natural gas supply contract, which has an LME-linked... -

Page 158

... and the financial contract related to this U.S. smelter expired in September 2011. In 2010, Alcoa entered into contracts to hedge the anticipated power requirements at two smelters in Australia. These derivatives hedge forecasted power purchases through December 2036. Beyond the term where market... -

Page 159

... excluded from the assessment of hedge effectiveness in 2011. Aluminum and Energy. Alcoa anticipates the continued requirement to purchase aluminum and other commodities, such as electricity, natural gas, and fuel oil, for its operations. Alcoa enters into futures and forward contracts to reduce... -

Page 160

...see Note F). Interest Rates. Alcoa had no outstanding cash flow hedges of interest rate exposures as of December 31, 2011, 2010, or 2009. An investment accounted for on the equity method by Alcoa has entered into interest rate contracts, which are designated as cash flow hedges. Alcoa's share of the... -

Page 161

...financial contract related to the same U.S. smelter utilized by management to hedge the price of electricity of the aforementioned power contract no longer qualified for cash flow hedge accounting. As such, the existing power contract and the financial contract were marked to market through earnings... -

Page 162

... provide working capital and for other general corporate purposes, including contributions to Alcoa's pension plans ($95 was contributed in January 2012). The two term loans were fully drawn on the same dates as the agreements and are subject to an interest rate equivalent to the 3-month LIBOR plus... -

Page 163

... Financial Information (unaudited) Quarterly Data (in millions, except per-share amounts) First 2011 Sales Amounts attributable to Alcoa common shareholders: Income (loss) from continuing operations (Loss) income from discontinued operations Net income (loss) Earnings per share attributable to Alcoa... -

Page 164

... 74. (c) Attestation Report of the Registered Public Accounting Firm The effectiveness of Alcoa's internal control over financial reporting as of December 31, 2011 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report, which is... -

Page 165

... is incorporated by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. The following table gives information about Alcoa's common stock that could be issued under the company's equity compensation plans as of December 31, 2011. Number... -

Page 166

... Governance- Committees of the Board" and "Corporate Governance-Transactions with Directors' Companies" and "Transactions with Related Persons" of the Proxy Statement and is incorporated by reference. Item 14. Principal Accounting Fees and Services. The information required by Item 9(e) of Schedule... -

Page 167

... 15. Exhibits, Financial Statement Schedules. (a) The consolidated financial statements and exhibits listed below are filed as part of this report. (1) The company's consolidated financial statements, the notes thereto and the report of the Independent Registered Public Accounting Firm are on pages... -

Page 168

... Report on Form 8-K, dated April 21, 2011 Alcoa Retirement Savings Plan for Fastener Systems and Commercial Windows Employees, incorporated by reference to exhibit 4(c) to the company's Form S-8 Registration Statement dated November 23, 2010. Alcoa Retirement Savings Plan for Mill Products Employees... -

Page 169

... as duly appointed and acting investment manager of a segregated account held in the Alcoa Master Retirement Plans Trust, incorporated by reference to exhibit 10 to the company's Current Report on Form 8-K dated January 24, 2011. Employees' Excess Benefits Plan, Plan A, incorporated by reference to... -

Page 170

..., 2010. Amendment to Employees' Excess Benefits Plan A, effective January 1, 2012. Alcoa Internal Revenue Code Section 162(m) Compliant Annual Cash Incentive Compensation Plan, incorporated by reference to Attachment D to the company's Definitive Proxy Statement on Form DEF 14A, filed March 7, 2011... -

Page 171

... to the Fee Continuation Plan for Non-Employee Directors, effective September 15, 2006, incorporated by reference to exhibit 10.2 to the company's Current Report on Form 8-K (Commission file number 1-3610) dated September 20, 2006. Deferred Compensation Plan, as amended effective October 30, 1992... -

Page 172

... to Deferred Compensation Plan, effective January 1, 2011, incorporated by reference to exhibit 10(u)(11) to the company's Annual Report on Form 10-K for the year ended December 31, 2010. Summary of the Executive Split Dollar Life Insurance Plan, dated November 1990, incorporated by reference... -

Page 173

... 1, 2011, incorporated by reference to exhibit 10(bb)(4) to the company's Annual Report on Form 10-K for the year ended December 31, 2010. Amendment to Alcoa Supplemental Pension Plan for Senior Executives, effective January 1, 2012. Deferred Fee Estate Enhancement Plan for Directors, effective July... -

Page 174

.... Amendment to Global Pension Plan, effective January 1, 2011, incorporated by reference to exhibit 10(mm)(7) to the company's Annual Report on Form 10-K for the year ended December 31, 2010. Executive Severance Agreement, as amended and restated effective December 8, 2008, between Alcoa Inc. and... -

Page 175

...to the Reynolds Metals Company Benefit Restoration Plan for New Retirement Program, effective January 1, 2012. Global Expatriate Employee Policy (pre-January 1, 2003), incorporated by reference to exhibit 10(uu) to the company's Annual Report on Form 10-K (Commission file number 1-3610) for the year... -

Page 176

...-Q for the quarter ended September 30, 2009. Director Plan: You Make a Difference Award, incorporated by reference to exhibit 10(uu) to the company's Annual Report on Form 10-K for the year ended December 31, 2008. Form of Award Agreement for Stock Options, effective January 1, 2010, incorporated by... -

Page 177

... indicated. Signature Title Date Chairman and Chief Executive Officer (Principal Executive Officer and Director) Klaus Kleinfeld Executive Vice President and Chief Financial Officer (Principal Financial Officer) Charles D. McLane, Jr. February 16, 2012 February 16, 2012 Arthur D. Collins, Jr... -

Page 178

... the year ended December 31, 2011 2010 2009 2008 2007 Earnings: Income (loss) from continuing operations before income taxes Noncontrolling interests' share of earnings of majority-owned subsidiaries without fixed charges Equity income Fixed charges added to earnings Distributed income of less than... -

Page 179

... ACC-Norway, LLC Alcoa Norway ANS Alcoa UK Holdings Limited Alcoa Manufacturing (G.B.) Limited Alcoa Power Generating Inc.2 Alcoa World Alumina LLC1,3 Alcoa Minerals of Jamaica, L.L.C.1 Alumax Inc. Alumax Mill Products, Inc. Aluminerie Lauralco, Inc. Alcoa-Lauralco Management Company Laqmar Québec... -

Page 180

... of Alcoa Inc. and its subsidiaries of our report dated February 16, 2012 relating to the consolidated financial statements and the effectiveness of internal control over financing reporting, which appears in this Form 10-K. PricewaterhouseCoopers LLP Pittsburgh, Pennsylvania February 16, 2012 170 -

Page 181

...financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 16, 2012 3. 4. Name: Klaus Kleinfeld Title: Chairman and Chief Executive Officer... -

Page 182

... Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 16, 2012 3. 4. Name: Charles D. McLane, Jr. Title: Executive Vice President and Chief Financial Officer 172 -

Page 183

..., the financial condition and results of operations of the Company. Dated: February 16, 2012 Name: Klaus Kleinfeld Title: Chairman and Chief Executive Officer Dated: February 16, 2012 Name: Charles D. McLane, Jr. Title: Executive Vice President and Chief Financial Officer A signed original of this... -

Page 184

...-owned by Alcoa, and Alcoa's share of capacity or production of 50-percent or less owned smelters. (4) Properties, plants, and equipment, net was revised for all periods presented to reflect the movement of the one remaining plant of the Global Foil business located in Brazil from held for sale... -

Page 185

...and include registered shareholders and beneficial owners holding stock through banks, brokers, or other nominees. Represents earnings per share on net income (loss) attributable to Alcoa common shareholders. Book value per share = (Total shareholders' equity minus Preferred stock) divided by Common... -

Page 186

... Chief Executive Ofï¬cer Latin America and Caribbean Graeme W. Bottger Vice President and Controller Brenda A. Hart Senior Counsel and Assistant Secretary Tony R. Thene Vice President Chief Financial Ofï¬cer, Engineered Products and Solutions Julie A. Caponi Vice President - Internal Audit... -

Page 187

... corporate center address located on the back cover of this report; or e-mail [email protected]. Dividends Alcoa's objective is to pay common stock dividends at rates competitive with other investments of equal risk and consistent with the need to reinvest earnings for long-term growth. Cash... -

Page 188

Alcoa Corporate Center 201 Isabella Street • Pittsburgh, PA 15212-5858 Telephone: 1 412 553 4545 • Fax: 1 412 553 4498 Internet: www.alcoa.com Alcoa Inc. is incorporated in the Commonwealth of Pennsylvania