Airtran 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

36

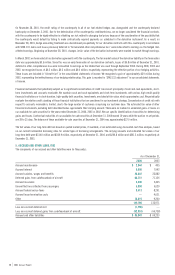

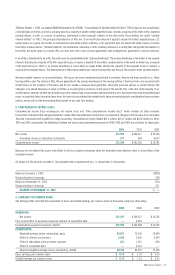

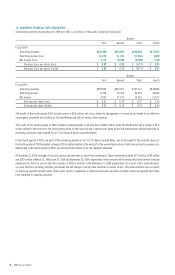

14. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly financial data for 2004 and 2003 is as follows (in thousands, except per share data):

Quarter

First Second Third Fourth

Fiscal 2004

Operating revenues $241,406 $275,004 $245,640 $279,372

Operating income (loss) 10,276 31,018 (11,992) 3,542

Net income (loss) 4,113 16,786 (9,769) 1,125

Earnings (loss) per share, basic $ 0.05 $ 0.20 $ (0.11) $ 0.01

Earnings (loss) per share, diluted $ 0.05 $ 0.18 $ (0.11) $ 0.01

Quarter

First Second Third Fourth

Fiscal 2003

Operating revenues $208,002 $233,901 $237,311 $238,826

Operating income 8,378 30,703 26,393 20,844

Net income 2,036 57,191 19,613 21,677

Earnings per share, basic $ 0.03 $ 0.79 $ 0.27 $ 0.26

Earnings per share, diluted $ 0.03 $ 0.74 $ 0.24 $ 0.24

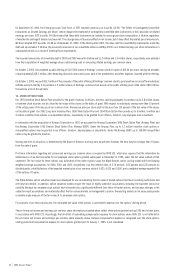

The results of the fourth quarter 2004 include income of $0.8 million, net of tax, related to the payment of a break up fee related to our efforts to

secure gates, properties and facilities at Chicago Midway and slots at various other locations.

The results of the second quarter of 2003 included a reimbursement of security fees of $38.1 million under the Wartime Act and a charge of $1.8

million related to the write off of the unamortized portion of debt discount and issuance costs when an aircraft manufacturer affiliate exercised its

remaining conversion rights related to our 7.75% Series B Senior Convertible Notes.

In the fourth quarter of 2003, we paid off the remaining balance of our 11.27% Senior Secured Notes. Due to the payoff of this note the results of

the fourth quarter of 2003 included a charge of $10.4 million related to the write off of the unamortized portion of debt discount and issuance costs.

Additionally in the fourth quarter of 2003, we reversed $15.9 million of our tax valuation allowance.

At December 31, 2004, we began to classify auction rate securities as short-term investments. These investments totaled $175 million, $246 million

and $267 million at March 31, 2004, June 20, 2004 and September 30, 2004, respectively. These amounts will be reclassified in the interim financial

statements for the first, second and third quarters of 2005 to conform to the December 31, 2004 presentation. As a result of this reclassification,

our cash flow from investing activities will include the net change in auction rate securities in current assets. This reclassification has no impact

on previously reported current assets, total assets, results of operations or financial covenants and does not affect previously reported cash flows

from operating or financing activities.