Airtran 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

2004 Annual Report

Standards No. 109 (SFAS 109), “Accounting for Income Taxes,” the effect of changes in tax laws or rates is included in income in the period that

includes the enactment date, resulting in recognition of the change in the first quarter of 2002.

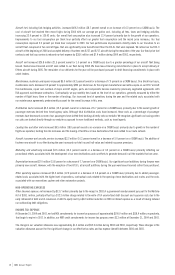

LIQUIDITY AND CAPITAL RESOURCES

Our primary source of funds are accumulated cash and cash equivalents, short-term investments and cash provided by operations. Our primary uses

of cash are for working capital (including labor and fuel costs), capital expenditures and general corporate purposes, which may include acquisitions

of other airlines and their assets, whether in connection with bankruptcy proceeding relating to such carriers of their assets or otherwise in other

investments in strategic alliances, code-share agreements or other business arrangements.

Our cash and cash equivalents, including restricted cash, totaled $315.3 million at December 31, 2004 compared to $348.5 million at December 31,

2003. At year-end 2004, we also held $27.0 million in short-term investments, representing auction rate securities with auction reset periods less

than 12 months.

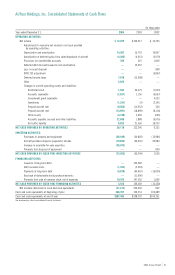

Operating activities generated $38.1 million of cash in 2004 compared to $133.2 million in 2003. Our operating cash inflows are primarily derived

from the sale of transportation for passengers aboard our airline. In most cases our passengers pay us prior to the dates of their travel. We record

these advance payments as Air Traffic Liability on our Consolidated Balance Sheets. The routine expenses of operating our aircraft to provide the

transportation purchased by our customers represent the majority of our operating cash outflows. For 2004, the $95.1 million decrease in cash flows

generated by our operating activities was primarily due to the $12.7 million reduction in our Air Traffic Liability due to the timing of our customers’

advance payments relative to when the transportation was provided, the receipt of $38.1 million during 2003 pursuant to the Wartime Act, which

was not received in 2004, a $22.4 million reduction in restricted cash related to the release of a credit card holdback in 2003, a $53.4 million

reduction in operating income in 2004 over 2003 due to increases in aircraft rent and fuel and a $20.9 million increase in our accrued liabilities.

Investing activities used $73.3 million of cash in 2004 compared to $65.2 million in 2003. Our investing activities primarily consist of capital

expenditures, aircraft purchase deposits required for aircraft scheduled for delivery in future periods and an increase in available-for-sale securities.

The primary increase in our investing activities for 2004 was related to the acquisition of support equipment, building improvements and upgrades

to our computer systems. Our overall aircraft purchase deposits requirements were lower for 2004 due to the timing of payments relative to refunds

received for aircraft deliveries. We invested a net amount of approximately $27.0 million in auction rate securities.

Financing activities generated $3.9 million of cash in 2004 compared to $166.6 million in 2003. Our 2004 financing activities primarily consisted

of proceeds from the sale of stock offset by debt payments and debt issuance costs. During 2003, we issued new convertible debt of $125.0 million

and paid down existing debt of $90.5 million. Additionally in 2003, we issued 9.1 million shares of stock in a secondary offering in 2003, receiving

net proceeds of $139.2 million.

COMMITMENTS

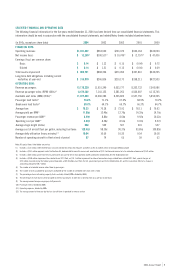

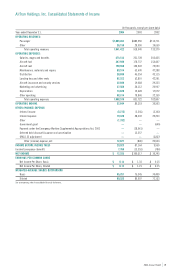

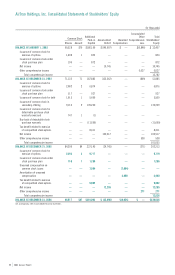

Our expected contractual commitments to be paid were the following as of December 31, 2004 (in millions):

2006 2008

Nature of commitment Total 2005 -2007 -2009 Thereafter

Operating lease payments for aircraft

and facility obligations(1) $5,239.3 $229.9 $587.6 $682.5 $3,739.3

Aircraft fuel purchases 65.8 65.8 ———

Long-term debt obligations(1) 429.0 13.8 47.2 38.5 329.5

Total contractual obligations and Commitments $5,734.1 $309.5 $634.8 $721.0 $4,068.8

(1) Excludes related interest payments and assumes that we will lease all aircraft except for four aircraft committed under debt financing, even though financing has not been arranged for

all aircraft.

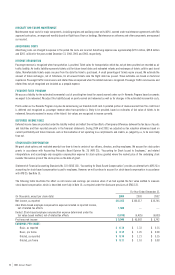

A variety of assumptions were necessary in order to derive the information described in the paragraph herein, including, but not limited to: (i) the timing

of aircraft delivery dates; (ii) estimated rental factors which are correlated to floating interest rates prior to delivery; and (iii) future fuel prices, including

fuel refining, transportation and into-plane costs. Our actual results may differ from these estimates under different assumptions or conditions.

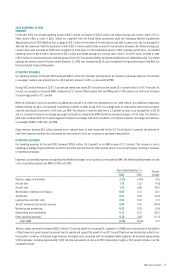

AIRCRAFT PURCHASE COMMITMENTS

As of December 31, 2004, Airways had firm commitments with an aircraft manufacturer to purchase eight B717 aircraft in 2005 and 2006 and 44

B737 aircraft with delivery dates between 2005 and 2008. Additionally, Airways has options and purchase rights to acquire an additional 48 B737

aircraft with delivery dates between 2006 and 2010. In January 2005, we exercised options for the delivery of two additional B737 aircraft with

delivery dates in 2006. The B717 aircraft are to be financed through an affiliate of the aircraft manufacturer. Pursuant to Airways’ arrangement with

an aircraft leasing company, Airways entered into individual operating leases for 22 of the B737 aircraft of which six were delivered during 2004,

and has entered into sale/leaseback transactions with that aircraft leasing company with respect to six related spare engines, to be delivered

between 2005 and 2010. Additionally, Airways has obtained debt financing commitments for six B737 aircraft of which two were delivered during

2004. Airways has obtained financing commitments from an affiliate of the aircraft manufacturer for up to 80 percent of the purchase price of 16

of the B737 aircraft should Airways be unable to secure financing from the financial markets on acceptable terms. During 2005, Airways is scheduled

to take delivery of six B717 aircraft to be leased through an affiliate of the aircraft manufacturer and 13 B737 aircraft with nine such aircraft subject