Airtran 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

16

to individual operating leases mentioned above and four B737 aircraft financed through debt. There can be no assurance that sufficient financing

will be available for all B737 aircraft and other capital expenditures not covered by firm financing commitments.

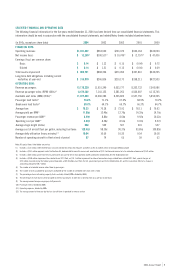

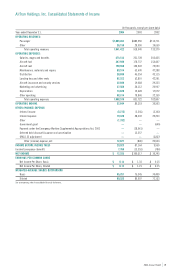

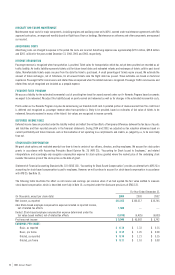

The following table details our firm orders for aircraft and options as of December 31, 2004.

B737 Deliveries B717 Deliveries

Firm Options Firm Options

2005 13 —6—

2006 15 42—

2007 12 5——

2008 4 14 ——

Total* 44 23 8—

*We have purchase rights to acquire up to 25 B737 aircraft in addition to the totals shown above.

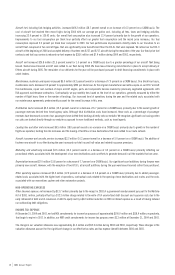

During 2004, in connection with Airways’ agreements with an aircraft manufacturer, Airways was refunded $7.7 million in previously paid aircraft

deposits and paid $44.0 million in aircraft deposits under the new agreement with an aircraft manufacturer for the acquisition of B737 aircraft.

CREDIT AGREEMENT

We currently have a $15 million credit agreement with our bank. The agreement allows us to obtain letters of credit and enter into hedge agreements

with the bank. The agreement contains certain covenant requirements including liquidity tests. We are in compliance with these covenants. At

December 31, 2004 and 2003, we had $10.4 million and $13.3 million, respectively, in letters of credit drawn against the credit agreement.

OTHER COMMITMENTS

In May 2004, we opened a two-bay hangar facility at Hartsfield-Jackson Atlanta International Airport. The 56,700-square-foot hangar will hold two

of our B717 aircraft simultaneously and has a 20,000-square-foot, two-story office building attached to the hangar to house engineers and other

support staff. We have a 20-year lease on the facility which expires in 2024.

OFF-BALANCE SHEET ARRANGEMENTS

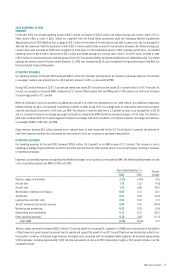

An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an unconsolidated entity under which

a company has (1) made guarantees, (2) a retained or a contingent interest in transferred assets, (3) an obligation under derivative instruments

classified as equity or (4) any obligation arising out of a material variable interest in an unconsolidated entity that provides financing, liquidity,

market risk or credit risk support to the company, or that engages in leasing, hedging or research and development arrangements with the company.

We have no arrangements of the types described in the first three categories that we believe may have a material current or future effect on

our financial condition, liquidity or results of operations. Certain guarantees that we do not expect to have a material current or future effect on our

financial condition, liquidity or resulted operations are disclosed in Note 7 to our consolidated financial statements.

Effective October 1, 2003, we adopted Financial Accounting Standards Board (FASB) Interpretation 46 (FIN 46), “Consolidation of Variable Interest

Entities.” FIN 46 requires the consolidation of certain types of entities in which a company absorbs a majority of another entity’s expected losses,

receives a majority of the other entity’s expected residual returns, or both, as a result of ownership, contractual or other financial interests in the

other entity. These entities are called “variable interest entities” or “VIEs.” The principal characteristics of VIEs are (1) an insufficient amount of

equity to absorb the entity’s expected losses, (2) equity owners as a group are not able to make decisions about the entity’s activities, or (3) equity

that does not absorb the entity’s losses or receive the entity’s residual returns. “Variable interests” are contractual, ownership or other monetary

interests in an entity that change with fluctuations in the entity’s net asset value. As a result, VIEs can arise from items such as lease agreements,

loan arrangements, guarantees or service contracts.

If an entity is determined to be a VIE, the entity must be consolidated by the “primary beneficiary.” The primary beneficiary is the holder of the variable

interests that absorb a majority of the VIE’s expected losses or receive a majority of the entity’s residual returns in the event no holder has a majority

of the expected losses. There is no primary beneficiary in cases where no single holder absorbs the majority of the expected losses or receives a

majority of the residual returns. The determination of the primary beneficiary is based on projected cash flows at the inception of the variable interest.

We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase, finance and lease aircraft to us. These

leasing entities meet the criteria of VIEs. We are generally not the primary beneficiary of the leasing entities if the lease terms are consistent with

market terms at the inception of the lease and do not include a residual value guarantee, a fixed-price purchase option or similar feature that

obligates us to absorb decreases in value or entitles us to participate in increases in the value of the aircraft. This is the case in the majority of our

aircraft leases; however, we have two aircraft leases that contain fixed-price purchase options that allow us to purchase the aircraft at predetermined

prices on specified dates during the lease term. We have not consolidated the related trusts because even taking into consideration these purchase

options, we are still not the primary beneficiary based on our cash flow analysis.