Airtran 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

2004 Annual Report

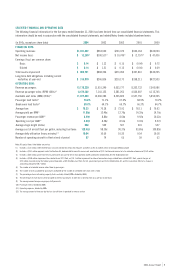

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

General. The discussion and analysis of our financial condition and results of operations are based upon the consolidated financial statements,

which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial

statements requires us to make estimates and judgments that affect the reported amount of assets and liabilities, revenues and expenses, and

related disclosure of contingent assets and liabilities at the date of our financial statements. Our actual results may differ from these estimates

under different assumptions or conditions. Critical accounting policies are defined as those that are reflective of significant judgments and

uncertainties, and are sufficiently sensitive to result in materially different results under different assumptions and conditions. The following is a

description of what we believe to be our most critical accounting policies and estimates (see Note 1 to the Consolidated Financial Statements).

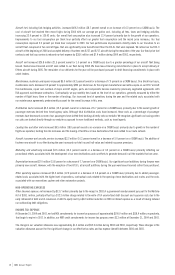

Revenue Recognition. Passenger revenue is recognized when transportation is provided. Ticket sales for transportation which has not yet been

provided are recorded as air traffic liability. Air traffic liability represents tickets sold for future travel dates and estimated refunds and exchanges

of tickets sold for past travel dates. Nonrefundable tickets expire one year from the date the ticket is purchased. A small percentage of tickets expire

unused. We estimate the amount of future exchanges, net of forfeitures, for all unused tickets once the flight date has passed. These estimates are

based on historical experience. Passenger traffic commissions and related fees are expensed when the related revenue is recognized. Passenger

traffic commissions and related fees not yet recognized are included as a prepaid expense.

Frequent Flyer Program. We accrue a liability for the estimated incremental cost of providing free travel for awards earned under our A+ Rewards

Program based on awards we expect to be redeemed. We adjust this liability based on points earned and redeemed as well as for changes in the

estimated incremental costs.

Points under our A+ Rewards Program may also be earned using our branded credit card. A prorated portion of revenue earned from this credit card

is deferred and recognized as passenger revenue when transportation is likely to be provided, based on estimates of fair value of tickets to be

redeemed. Amounts received in excess of the tickets’ fair values are recognized in income currently.

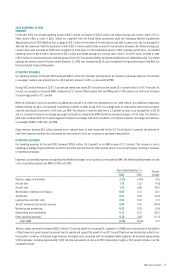

Accounting for Long-Lived Assets. When appropriate, we evaluate our long-lived assets in accordance with Statement of Financial Accounting

Standards No. 144 (SFAS 144), “Accounting for the Impairment or Disposal of Long-Lived Assets.” We record impairment losses on long-lived assets

used in operations when events or circumstances indicate that the assets may be impaired and the undiscounted cash flows estimated to be

generated by those assets are less than the net book value of those assets. In making these determinations, we utilize certain assumptions,

including, but not limited to: (i) estimated fair market value of the assets; and (ii) estimated future cash flows expected to be generated by these

assets, which are based on additional assumptions such as asset utilization, length of service the asset will be used in our operations, and estimated

salvage values.

We have approximately $377.8 million of long-lived assets as of December 31, 2004 on a cost basis, including approximately $295.0 million of flight

equipment and related equipment on a cost basis.

Inventories. Inventories consist of expendable aircraft spare parts, supplies, and prepaid aircraft fuel. These items are stated at the lower of cost or

market using the first-in, first-out method (FIFO). These items are charged to expense when used. Allowances for obsolescence are provided over the

estimated useful life of the related aircraft and engines for spare parts expected to be on hand at the date aircraft are retired from service.

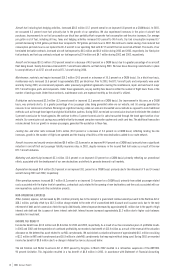

Financial Derivative Instruments. During 2001 we utilized derivative instruments, including crude oil and heating oil based derivatives, to hedge a

portion of our exposure to jet fuel price increases. These instruments consisted primarily of fixed-price swap agreements and collar structures.

During 2002 we terminated these agreements. Upon early termination of a derivative contract, gains and losses deferred in other comprehensive

income (loss) would continue to be reclassified to earnings as the related fuel is used. Gains and losses deferred in other comprehensive gain (loss)

related to derivative instruments hedging forecasted transactions would be recognized into earnings immediately when the anticipated transaction

is no longer likely to occur.

RECENTLY ISSUED ACCOUNTING STANDARDS

In December 2004, the FASB issued Statement of Financial Standards 123R (SFAS 123R), “Share-Based Payment.” SFAS 123R is a revision of SFAS

123, “Accounting for Stock-Based Compensation,” and supersedes APB 25. Among other items SFAS 123R eliminates the use of APB 25 and the

intrinsic value method of accounting for stock-based compensation, and requires companies to recognize the cost of employee services received in

exchange for awards of equity instruments based on the grant date fair value of those awards, in the financial statements. The effective date of

SFAS 123R is the first reporting period beginning after June 15, 2005, which is the third quarter 2005 for calendar year companies, although early

adoption is allowed. SFAS 123R permits companies to adopt its requirements using either a “modified prospective” method, or a “modified

retrospective” method. Under the “modified prospective” method, compensation cost is recognized in payments granted after that date based on the

requirements of SFAS 123 for all unvested awards granted prior to the effective date of SFAS 123R. Under the “modified retrospective” method, the

requirements are the same as under the “modified prospective” method, but also permits entities to restate financial statements of previous periods

based on pro forma disclosures made in accordance with SFAS 123.