Airtran 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

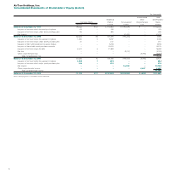

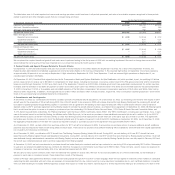

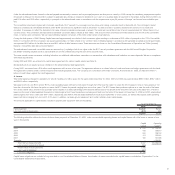

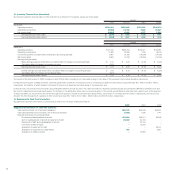

The table below sets forth what reported net income and earnings per share would have been in all periods presented, exclusive of amortization expense recognized in those periods

related to goodwill and other intangible assets that are no longer being amortized.

For the Year Ended December 31,

(In thousands, except per share data) 2002 2001 2000

Reported net income (loss) $10,745 $(2,757) $47,436

Add back: Goodwill amortization –543 548

Add back: Trade name amortization –833 833

Adjusted net income (loss) $10,745 $(1,381) $48,817

Basic earnings per share

Reported net income (loss) $ 0.15 $ (0.04) $ 0.72

Goodwill amortization –0.01 0.01

Trade name amortization –0.01 0.01

Adjusted net income (loss) $ 0.15 $ (0.02) $ 0.74

Diluted earnings per share

Reported net income (loss) $ 0.15 $ (0.04) $ 0.69

Goodwill amortization –0.01 0.01

Trade name amortization –0.01 0.01

Adjusted net income (loss) $ 0.15 $ (0.02) $ 0.71

We completed the required transitional goodwill and trade name impairment testing in the first quarter of 2002 with no resulting impairment. No event or change has occurred that

would indicate the carrying amount has been impaired since our annual test during the fourth quarter of 2002.

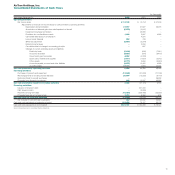

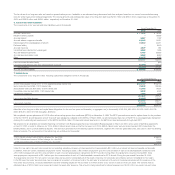

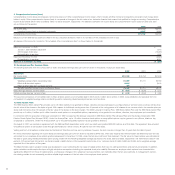

3. Federal Grants and Special Charges Related to Terrorist Attacks

On September 11, 2001, terrorists hijacked and used four aircraft in terrorist attacks on the United States (the September 11 Events). As a result of the September 11 Events, the

Federal Aviation Administration immediately suspended all commercial airline flights on the morning of September 11. We resumed flight activity on September 13 and were operating

at approximately 80 percent of our normal pre-September 11 flight schedule by September 18, 2001. From September 11 until we resumed flight operations on September 13, we

cancelled approximately 1,000 flights.

On September 22, 2001, President Bush signed into law the Air Transportation Safety and System Stabilization Act (the Stabilization Act) which provided, in part, for qualifying U.S airlines

and air cargo carriers to receive: up to $5 billion in compensation for direct losses, including lost revenues, incurred as a direct result of the FAA ground stop order and for incremental

losses incurred through December 31, 2001 as a direct result of the September 11 Events; up to $10 billion in federal government loan guarantees; reimbursement for certain insurance

increases; and the extension in due dates for payment of certain excise taxes. Each carrier was entitled to receive the lesser of its direct and incremental losses for the period September

11, 2001 to December 31, 2001 or its available seat mile (ASM) allocation of the $5 billion compensation. We received compensation payments of $5.0 million and $24.6 million during

2002 and 2001, respectively. In addition, we recognized income of $0.6 million and $29.0 million in 2002 and 2001, respectively, which is included in Operating Expenses – Government

Grant on the accompanying Consolidated Statements of Operations.

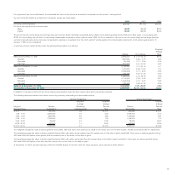

4. Commitments and Contingencies

At December 31, 2002, our contractual commitments consisted primarily of scheduled aircraft acquisitions. As of December 31, 2002, our remaining commitments with respect to B717

aircraft were for the acquisition of 23 aircraft during 2003. One of the 23 aircraft to be acquired in 2003 will be lease-financed through Boeing Capital and the remaining 22 aircraft will

be subject to operating leases through Boeing Capital. In connection with an agreement with Boeing to return approximately $21 million in 2002 and $5 million in 2003 of advance

deposits under our B717 purchase agreement and by Boeing Capital to provide the aircraft referred to above, we entered into an agreement on September 30, 2002 with Boeing Capital

that it would have the option to cause us to prepay or purchase at par the outstanding 13% Series A Senior Secured Notes, 7.75% Series B Senior Secured Convertible Notes, and

11.27% Senior Secured Notes (collectively, the “Refinancing Notes”) and the Class C EETC Certificates, Series 1999-1 (the “EETC Certificates”), including accrued interest, if any, in each

case to the extent issued to and held by Boeing, its affiliates and/or Rolls Royce plc, in the event we purchase or lease additional commercial jet aircraft in addition to: (i) the 23 B717

aircraft referred to above; (ii) the B717 aircraft currently on order from Boeing and (iii) certain replacement aircraft which are of the same type as currently in our fleet. This agreement

terminates upon the later of: (i) payment in full of the Refinancing Notes and (ii) the earlier of payment in full of the EETC Certificates or September 30, 2009. As of December 31, 2002,

the aggregate principal balance of the debt we could be so required to prepay or purchase pursuant to this agreement was approximately $124.6 million.

As of December 31, 2002, we had a total of six purchase options for B717 aircraft to be delivered in 2005. If we exercise our purchase options to acquire additional aircraft, additional

payments could be required for these aircraft during 2003 and future years. There can be no assurance that sufficient financing will be available for all aircraft and other capital expenditures

not covered by firm financing commitments.

As of December 31, 2002, our deliveries of B717 aircraft from The Boeing Company (Boeing) totaled 50 aircraft. During 2002, we took delivery of 20 new B717 aircraft that were

lease-financed by Boeing Capital through sale/leaseback transactions. During 2001, we took delivery of 14 new B717 aircraft that were financed by Boeing Capital as follows: 13 aircraft

were delivered through sale/leaseback transactions with Boeing Capital, and one was purchased with a loan provided by Boeing Capital (the loan was fully repaid in February 2001 and

the aircraft was contemporaneously sold to and then leased back from Boeing Capital).

At December 31, 2002, we had commitments to purchase aircraft fuel under fixed-price contracts and fuel cap contracts for use during 2003 of approximately $57.3 million. Subsequent

to year-end, we entered into additional fuel cap contracts for 2003 that increased our commitments to purchase fuel to $69.9 million. These contracts, used to reduce our exposure to

increases in fuel prices, cover approximately 48% of our planned fuel requirements for 2003.

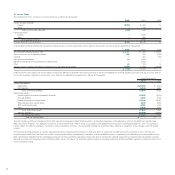

We are party to many routine contracts under which we indemnify third parties for various risks. We have not accrued any liability for any of these indemnities, as the likelihood of

payment in each case is considered remote. These indemnities consist of the following:

Certain of Airways’ debt agreements related to certain aircraft notes payable through 2014 and 2017 contain language where we have agreed to indemnify certain holders of certificates

evidencing the debt associated with such notes, as necessary, to compensate them for any costs incurred by, or any reduction in receivables due to, such certificate holders in connection

with such debt resulting from broadly defined regulatory changes that impose or modify any reserve, special deposit or similar requirements relating to any extensions of credit or other

18