Airtran 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

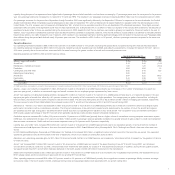

2001 we announced our intentions to retire our fleet of B737 aircraft in the third quarter of 2001 in order to simplify our fleet and reduce costs. During the third quarter of 2001, the

September 11 Events had a profound impact on aircraft values worldwide, in particular on maintenance-intensive, less fuel-efficient aircraft such as B737-200s, MD-80s, as well as our

DC-9 fleet. A significant number of the aircraft that were grounded by air carriers were of these aircraft types. We performed evaluations of the B737 and DC-9 aircraft fleets to determine,

in accordance with SFAS 121, whether future cash flows (undiscounted and without interest charges) expected to result from the use and eventual disposition of these aircraft would be

less than the aggregate carrying amount of these aircraft and related assets. As a result of the evaluation, we determined that the estimated future cash flows expected to be generated

by these aircraft would be less than their carrying amount, and therefore concluded that these aircraft were impaired as defined by SFAS 121. Consequently, the net book value of the

B737 and DC-9 aircraft fleets and related assets were reduced during 2001 by approximately $38.8 million to reflect the fair market value of these assets.

Special charges primarily represent operating costs incurred during the FAA’s ground stop order following the September 11 Events.

Government grant represents compensation in the form of grants from the federal government for direct and incremental losses associated with the 2001 terrorist events.

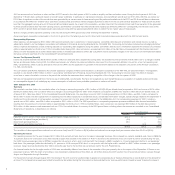

Nonoperating Expenses

Other expense, net decreased by $13.3 million (38.5 percent) primarily due to reductions in interest expense, convertible debt discount amortization and interest income, as well as

adjustments related to our fuel hedges in accordance with Statement of Financial Accounting Standards No. 133 (SFAS 133), “Accounting for Derivative Instruments and Hedging Activities.”

Interest expense decreased as a result of having reduced our outstanding debt obligations during the period. Convertible debt discount amortization represents the exercise of conversion

rights on approximately two-thirds of our 7. 75% Convertible Notes during 2001. Upon conversion, we expensed $4.3 million of the debt discount associated with this financial instrument.

Interest income decreased due to lower interest rates earned on invested cash balances. SFAS 133 adjustment income represents changes in the value of our now terminated fuel-related

derivative contracts (see Note 5 to the Consolidated Financial Statements).

Income Tax Expense (Benefit)

Income tax expense (benefit) was $(0.8) million and $3.2 million for 2002 and 2001, respectively. During 2002, we recorded income tax benefit of $0.8 million due to a change in federal

tax law as discussed below. During 2001, the differences between our effective tax rates and statutory rates result from the expected utilization of a portion of our net operating loss

(NOL) carryforwards, offset in part by alternative minimum tax (AMT) and the application to goodwill of the tax benefit related to the realization of a portion of the Airways Corporation,

Inc. NOL carryforwards.

The Job Creation and Worker Assistance Act of 2002 passed by Congress in March 2002 resulted in a retroactive suspension of the AMT NOL 90 percent limitation. This legislation

resulted in a tax benefit of $0.8 million in 2002. In accordance with Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes,” the effect of changes

in tax laws or rates is included in income in the period that includes the enactment date, resulting in recognition of the change in the first quarter of 2002.

We have not recognized any benefit from the future use of existing NOL carryforwards. We have not recognized any such benefit because our evaluation of available evidence indicates

an unacceptable degree of risk underlying any current assumption of sufficient future profitable operations to realize such benefit.

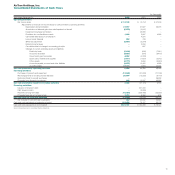

2001 Compared to 2000

Summary

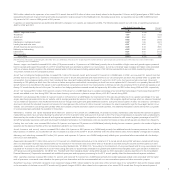

We recorded a net loss, before the cumulative effect of a change in accounting principle, of $2.1 million in 2001 ($0.03 per diluted share) compared to 2000 net income of $47.4 million

($0.69 per diluted share). The cumulative effect of a change in accounting principle for 2001, which related to our adoption of SFAS 133, was $0.7 million ($0.01 per diluted share), net

of taxes of $0.1 million (see Note 2 to the Consolidated Financial Statements). Our operating income for 2001, including special items of $19.6 million, was $35.7 million compared to

$81.2 million in 2000. The 2001 special items in operating income reflect reductions in aircraft fleet values, aircraft lease termination charges, special charges related to the September 11

Events and the entire amount of compensation we expect to receive from the U.S. government pursuant to the Stabilization Act. Our nonoperating expenses for 2001, including a

special item of $4.3 million, were $34.6 million compared to $33.7 million in 2000. The 2001 special item in nonoperating expenses represents additional debt discount amortization

resulting from the exercise of conversion rights on approximately two-thirds of our 7. 75% Convertible Notes. Upon conversion, we expensed $3.8 million of the debt discount and

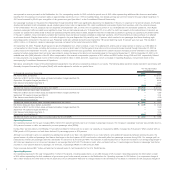

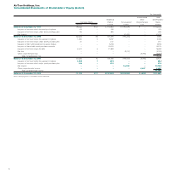

$0.5 million of debt issuance costs associated with our 7.75% Convertible Notes. A summary of the 2001 special items, including where the amounts are recorded in our Consolidated

Statements of Operations, is listed below (in millions):

Income/(Expense)

Description Operating Nonoperating Total

Reduction of B737 and DC-9 fleet values and lease termination charges (see Note 13) $(46.1) $ – $(46.1)

September 11th special charges (see Note 3) (2.5) – (2.5)

Government grant (see Note 3) 29.0 – 29.0

Debt discount amortization (see Note 7) – (4.3) (4.3)

$(19.6) $(4.3) $(23.9)

The net effect of these special items reduced our net income (loss) from $21.7 million to $(2.8) million and reduced our earnings (loss) per common share from $0.32 to $(0.04).

Operating Revenues

Our operating revenues for the year increased $41.1 million (6.6 percent) primarily due to an increase in passenger revenues. We increased our capacity (available seat miles or ASMs) by

11.6 percent due to the continuation of our fleet renewal program that resulted in the addition of 14 B717 aircraft and the retirement of four DC-9 and four B737 aircraft during the year.

Our traffic (revenue passenger miles or RPMs) increased by 9.5 percent, which, when combined with the increase in ASMs, resulted in a 1.3 percentage point decline in our passenger

load factor. Our passenger yields also declined by 2.1 percent to 14.39 cents per RPM, which, in conjunction with the higher traffic, resulted in a $43.7 million increase in our passenger

revenues. Cargo revenues declined by $2.2 million during the year due to the fact that we carried less mail for the U.S. Postal Service.

Our financial results for the first eight months of 2001 were considerably different from those of the remainder of the year primarily due to the impact of the September 11 Events on our

passenger revenues. With the intent of providing a more meaningful understanding of this effect, we will further discuss the 2001 results in two time periods as follows: January through

August, and September through December.

For the period of January through August 2001, the slowing of the U.S. economy resulted initially in greater price awareness by air travelers followed by an overall decline in the demand for

air travel. This increased price awareness tended to benefit low fare airlines during this time period, as demonstrated by our revenue performance. Despite a nearly 18 percent increase in

6