Airtran 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-looking Statements

The information contained in this section has been derived from our historical financial statements and should be read together with our historical financial statements and

related notes included elsewhere in this document. The discussion below contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve risks and uncertainties including, but not limited to: consumer

demand and acceptance of services offered by us, our ability to achieve and maintain acceptable cost levels, fare levels and actions by competitors, regulatory matters,

general economic conditions, commodity prices, and changing business strategies. Forward-looking statements are subject to a number of factors that could cause actual

results to differ materially from our expressed or implied expectations, including, but not limited to: our performance in future periods, our ability to generate working capital

from operations, our ability to take delivery of and to finance aircraft, the adequacy of our insurance coverage, and the results of litigation or investigation. Our forward-

looking statements can be identified by the use of terminology such

as “anticipates,” “expects,” “intends,” “believes,” “will” or the negative thereof, or variations thereon or comparable terminology. We undertake no obligation to publicly update

or revise

any forward-looking statement, whether as a result of new information, future events or otherwise.

Overview

All of the operations of AirTran Holdings, Inc. are conducted by our wholly-owned subsidiary, AirTran Airways, Inc., which is the second-largest affordable-fare scheduled airline in the

United States in terms of departures. We offer scheduled airline service principally serving short-haul markets, primarily from our hub at Hartsfield Atlanta International Airport in Atlanta,

Georgia. As of March 2003, we operated 68 aircraft making approximately 400 flights per day serving 40 cities throughout the eastern United States.

We have created a successful niche in selected markets by targeting price-sensitive business and leisure travelers. In addition to offering an affordable-fare alternative to higher-priced

airlines, we believe we contribute toward the overall growth of the markets we serve by stimulating demand among travelers who may otherwise utilize ground transportation or not

travel at all. Our service is intended not only to satisfy the transportation needs of our target customers, but also to provide customers with a travel experience worth repeating. The

success of this strategy is evidenced by the 9.7 million revenue passengers we carried in the year ended December 31, 2002, a 16.3 percent increase from the 8.3 million revenue

passengers we carried in the prior year ended December 31, 2001. With this traffic and revenue base, our operating margins, excluding special items, rank among the highest in the

domestic airline industry. We achieved this result with a cost structure that ranks among the best in the industry (in terms of cost per available seat mile).

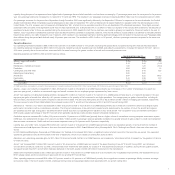

Year in Review

In 2002, we achieved a number of significant accomplishments during what continues to be one of the most challenging periods in the commercial airline industry. While the industry recorded

significant losses in 2002, we earned net income of $10.7 million. We achieved these results in an operational and financial environment characterized by significant increases in aviation insur-

ance costs, increased passenger screening costs resulting from evolving security laws and procedures, escalating fuel prices, and, in general, a recessionary domestic economic environment.

We have undertaken a number of key initiatives to strengthen our competitive position, including a fleet renewal plan. We are in the final stages of replacing and upgrading our aircraft

fleet through the acquisition of 73 Boeing 717s (B717), 50 of which we operated as of December 31, 2002, and 23 to be delivered during 2003. We were the launch customer for the

B717, which was designed specifically for efficient short-haul service and is considered among the most modern, innovative, comfortable and environmentally friendly commercial aircraft

available today. Concurrently, we are retiring the last of our fleet of McDonnell Douglas DC-9 (DC-9) aircraft in 2003. We believe the conversion to the B717s will continue to enhance our

overall image and improve our operating performance. We also offer amenities such as a Business Class, assigned seating, a frequent flier program, same concourse connections at

Hartsfield Atlanta International Airport and full participation in travel agents’ computer reservations.

Other highlights from 2002 include the following:

•Inauguration of service to five new destinations, including Kansas City, MO, Milwaukee, WI, Rochester, NY, West Palm Beach, FL, and Wichita, KS.

•Launch of AirTran JetConnect™, a new regional jet service.

•Commencement of construction on our $14.5 million, 56,700 square-foot hangar at Hartsfield Atlanta International Airport.

•Transacted more than 56 percent of our bookings via the Internet.

•Upgraded features on airtran.com including seat assignments on select fares.

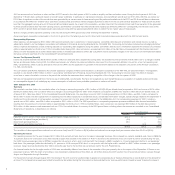

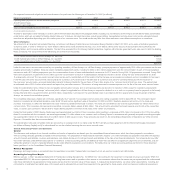

Looking forward to 2003, we expect operating revenues to grow as we increase available seat mile (ASM) capacity by more than 20 percent. By the end of the year, we anticipate operating

a single aircraft type as we retire the remaining aircraft in our DC-9 fleet. With the operation of a single aircraft type, we expect to improve our cost advantage over our competitors, prima-

rily in the areas of maintenance, fuel consumption, spare parts provisioning, simplified scheduling and lower training costs.

Many of our competitors have experienced significant financial and operational hardships, including bankruptcy protection and capacity reductions. As these competitors downsize their

operations, market opportunities may become available. We intend to follow a controlled growth plan that includes: (i) diversification of our route network to balance our predominantly

north-south route network with more east-west service; (ii) adding additional frequencies on existing routes to provide our customers with more convenient schedules from which to

choose; and (iii) utilizing our aircraft more efficiently, leveraging advances in technology, and carefully hiring and training our personnel, all of which improve productivity and increase

our cost advantage over our competitors.

Although we were able to generally offset the increased level of operating expenses in 2002 with lower maintenance and distribution costs, there can be no assurance we will be able

to continue to offset any additional expenses, particularly resulting from increases in the price of fuel, further changes to security procedures or increases in aircraft insurance costs.

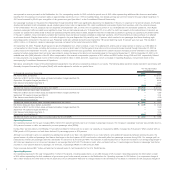

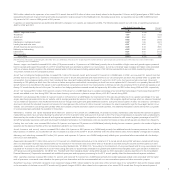

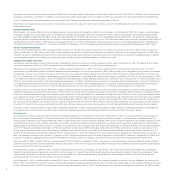

Results of Operations

2002 Compared to 2001

Summary

For the year 2002 we recorded operating income of $31.2 million, net income of $10.7 million and diluted earnings per common share of $0.15. These results reflect a credit of $0.6 million

for government grant funds received pursuant to the Air Transportation Safety and System Stabilization Act (the Stabilization Act). Our diluted earnings per common share were increased

by $0.01 upon recognition of the government grant (see Note 3 to the Consolidated Financial Statements). For the comparative period in 2001, including special items, we recorded

operating income of $35.7 million, a net loss of $2.8 million and a diluted loss per common share of $0.04. Our 2001 results were significantly affected by the terrorist attacks on the

United States that occurred on September 11, 2001 (the September 11 Events) and include: (i) special charges of $46.1 million in operating expenses that reflect reductions in aircraft

fleet values, aircraft lease termination charges; (ii) special charges of $2.5 million directly related to the September 11 Events; and (iii) a credit of $29.0 million for government grant funds

3