Airtran 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

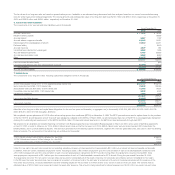

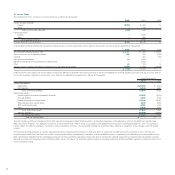

Frequent Flyer Program

We accrue the estimated incremental cost of providing free travel for awards earned under our A+ Rewards Program.

Stock-Based Compensation

We grant stock options for a fixed number of shares to our officers, directors, key employees and consultants. We account for stock option grants in accordance with Accounting

Principles Board Opinion No. 25 (APB 25), “Accounting for Stock Issued to Employees,” and accordingly recognize compensation expense only if the market price of the underlying

stock exceeds the exercise price of the stock option on the date of grant.

Statement of Financial Accounting Standards No. 123 (SFAS 123), “Accounting for Stock-Based Compensation,” provides an alternative to APB 25 in accounting for stock-based

compensation issued to employees. However, we will continue to account for stock-based compensation in accordance with APB 25. See Note 11.

Financial Derivative Instruments

We have utilized derivative instruments, including crude oil and heating oil based derivatives, to hedge a portion of our exposure to jet fuel price increases. These instruments have

consisted primarily of fixed-price swap agreements and collar structures. Prior to 2001, periodic settlements under the agreement were recognized as a component of fuel expense

when the underlying fuel hedged was used. However, beginning January 1, 2001, we adopted Statement of Financial Accounting Standards No. 133 (SFAS 133), “Accounting for

Derivative Instruments and Hedging Activities,” which changed the way we account for financial derivative instruments. See Notes 2 and 5.

Upon early termination of a derivative contract, gains and losses deferred in other comprehensive income (loss), would continue to be reclassified to earnings as the related fuel is used.

Gains and losses deferred in other comprehensive gain (loss) related to derivative instruments hedging forecasted transactions would be recognized into earnings immediately when the

anticipated transaction is no longer likely to occur.

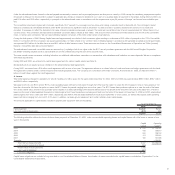

Recently Issued Accounting Standards

In June 2002, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 146 (SFAS 146), “Accounting For Costs Associated with Exit

or Disposal Activities.” SFAS 146 nullifies Emerging Issues Task Force Issue No. 94-3, “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity.”

SFAS 146 requires that a liability for a cost associated with an exit or disposal activity be recognized and measured initially at fair value only when the liability is incurred. SFAS 146 is

effective for exit or disposal activities that are initiated after December 31, 2002. The adoption of SFAS 146 is not expected to have a material impact on our financial position, results

of operations or cash flows.

In November 2002, the FASB issued Interpretation 45 (FIN 45), “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness

of Others.” FIN 45 requires a guarantor to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken in issuing the guarantee. FIN 45 also expands

the disclosures required to be made by a guarantor about its obligations under certain guarantees that it has issued. Initial recognition and measurement provisions of FIN 45 are applicable

on a prospective basis to guarantees issued or modified. The disclosure requirements are effective immediately. We are currently analyzing the effect of FIN 45 on our financial position,

results of operations and cash flows. See Note 4.

In January 2003, the FASB issued Interpretation 46 (FIN 46), “Consolidation of Variable Interest Entities.” FIN 46 requires that companies that control another entity through interests

other than voting interests should consolidate the controlled entity. FIN 46 applies to variable interest entities created after January 31, 2003, and to variable interest entities in which

an enterprise obtains an interest in after that date. The related disclosure requirements are effective immediately. We are currently analyzing the effect of FIN 46 on our financial position,

results of operations and cash flows.

Reclassification

Certain 2001 and 2000 amounts have been reclassified to conform to 2002 classifications.

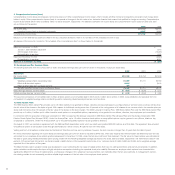

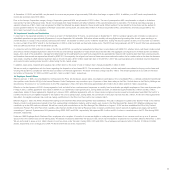

2. Accounting Changes

Effective January 1, 2001, we adopted SFAS 133 which requires us to record all financial derivative instruments on our balance sheet at fair value. Derivatives that are not designated as

hedges must be adjusted to fair value through income. If a derivative is designated as a hedge, depending on the nature of the hedge, changes in its fair value that are considered to be

effective, as defined, either offset the change in fair value of the hedged assets, liabilities or firm commitments through earnings or are recorded in “Accumulated other comprehensive

loss”

until the hedged item is recorded in earnings. Any portion of a change in a derivative’s fair value that is considered to be ineffective, as defined, is recorded immediately in “SFAS 133

adjustment” in the Consolidated Statements of Operations.

We have used financial derivative instruments to hedge our exposure to jet fuel price increases and have accounted for these derivatives as cash flow hedges, as defined. In accordance

with SFAS 133, we must comply with detailed rules and strict documentation requirements prior to beginning hedge accounting. As required by SFAS 133, we have assessed the

effectiveness of each of our individual hedges on a quarterly basis. We have also examined the effectiveness of our entire hedging program on a quarterly basis utilizing statistical analysis.

This analysis involved utilizing regression and other statistical analysis that compared changes in the price of jet fuel to changes in the prices of the commodities used for hedging

purposes (crude oil and heating oil). If these statistical techniques did not produce results within certain predetermined confidence levels, we could have lost our ability to utilize hedge

accounting, which could have caused us to recognize all gains and losses on financial derivative instruments in earnings in the periods following the determination that we no longer

qualified for hedge accounting. This could have, in turn, depending on the materiality of periodic changes in derivative fair values, increased the volatility of our future earnings. We do

not enter into fuel-hedging contracts for trading purposes.

Upon adoption of SFAS 133, we recorded the fair value of our fuel derivative instruments in the Consolidated Balance Sheets and a deferred gain of $1.3 million, net of tax, in

“Accumulated other comprehensive loss.” See Note 9 for further information on other comprehensive loss. The 2001 adoption of SFAS 133 has resulted in more volatility in our

financial statements than in the past, due to the changes in market values of our derivative instruments and some ineffectiveness that has been experienced in our fuel hedges.

See Note 5 for further information on our derivatives and fuel price risk management.

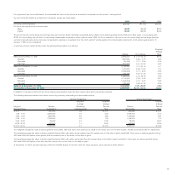

Effective January 1, 2002, we adopted Statement of Financial Accounting Standards No. 141 (SFAS 141), “Business Combinations” and SFAS 142. SFAS 141 requires business

combinations initiated after June 30, 2001 to be accounted for using the purchase method of accounting. It also specifies the types of acquired intangible assets that are required to

be recognized and reported separate from goodwill. SFAS 142 requires that goodwill and certain intangibles no longer be amortized, but instead tested for impairment at least annually.

17