Air New Zealand 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

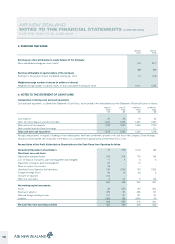

ENTITIES REPORTING

The financial statements presented are those of Air New Zealand Limited (the Company) and its subsidiaries and associates (the Group). References to

“Air New Zealand” are used where the Group and Company are similarly affected.

Air New Zealand’s primary business is the transportation of passengers and cargo on scheduled airline services.

STATUTORY BASE

Air New Zealand Limited is a company domiciled in New Zealand, registered under the Companies Act 1993 and listed on the New Zealand and

Australian Stock Exchanges. The Company is an issuer under the Financial Reporting Act 1993.

BASIS OF PREPARATION

Air New Zealand prepares its financial statements in accordance with New Zealand Generally Accepted Accounting Practice (“NZ GAAP”). NZ GAAP

consists of New Zealand equivalents to International Financial Reporting Standards (“NZ IFRS”) and other applicable financial reporting standards as

appropriate to profit-oriented entities. These financial statements comply with NZ IFRS and International Financial Reporting Standards (“IFRS”).

Air New Zealand is a profit-oriented entity.

The financial statements were approved by the Board of Directors on 27 August 2009.

Basis of measurement

The financial statements have been prepared on the historical cost basis, with the exception of certain items as identified in specific accounting policies

below and are presented in New Zealand Dollars which is the Company’s functional currency.

Use of accounting estimates and judgements

The preparation of financial statements requires the use of certain critical accounting estimates. It also requires the directors to exercise their judgement

in the process of applying the Group’s accounting policies. Estimates and associated assumptions are based on historical experience and other factors,

as appropriate to the particular circumstances. Areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates

are significant to the financial statements are disclosed under the applicable accounting policies below, and in the following notes, in particular:

Note 3: Derivative financial instruments

Note 11: Property, plant and equipment

Note 12: Intangibles

Note 16: Provisions

Note 17: Financial instruments

Note 21: Issued capital

Note 25: Contingent liabilities

Note 26: Retirement benefit obligations

Note 27: Related Parties

SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied

to all periods presented, unless otherwise stated.

Comparative information has been reclassified to achieve consistency in disclosure with the current period.

Air New Zealand has elected to early adopt all NZ IFRSs and Interpretations that had been issued by the New Zealand Financial Reporting Standards

Board as at 30 June 2009, except as noted below. The early adoption did not have a material impact on the financial statement.

NZ IAS 1 - Presentation of Financial Statements (revised) has not been adopted early. This Standard is applicable for periods commencing on or after 1

January 2009 and would result in presentational changes only.

BASIS OF CONSOLIDATION

The consolidated financial statements include those of the Company and its subsidiaries, accounted for using the purchase method, and the results of its

associates, accounted for using the equity method.

Subsidiaries are entities that are controlled either directly or indirectly, by the Company. Associates are those entities in which the Group, either directly

or indirectly, holds a significant but not a controlling interest.

All material intercompany transactions, balances and unrealised gains on transactions between group companies are eliminated on consolidation.

Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred. Unrealised gains on

transactions between the Group and its associates are eliminated to the extent of the Group’s interest in the associates.

Investments in subsidiaries and associates are recognised in the financial statements at their cost of acquisition less any provision for impairment.

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES

FOR THE YEAR TO 30 JUNE 2009

6