Air New Zealand 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

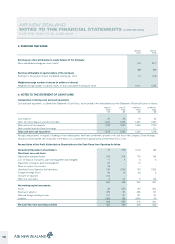

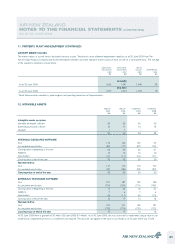

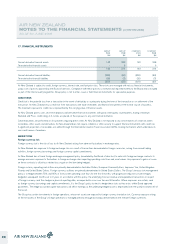

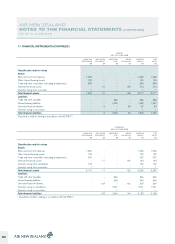

13. INVESTMENTS (CONTINUED)

Acquisition related costs recognised within Other expenses in the Statement of Financial Performance were $1 million (30 June 2008: Nil). Under the

amendments to NZ IFRS 3: Business Combinations, acquisition-related costs are required to be expensed in the periods in which the costs are incurred

whereas previously these were capitalised as part of the cost of the business combination.

Operating revenue (including finance income) and net loss after tax recognised in respect of these entities in the Statement of Financial Performance

subsequent to acquisition was $19 million and $1m respectively. If the acquisitions had been effected at the start of the financial year (1 July 2008)

total operating revenue (including finance income) for the Group would have been $4,723 million and net profit after tax $22 million.

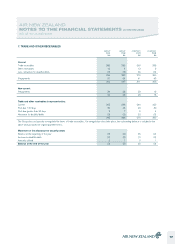

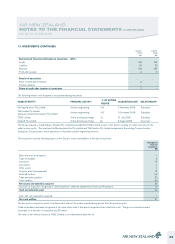

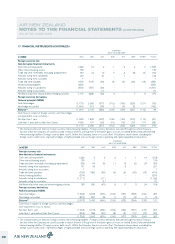

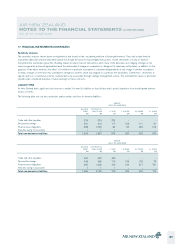

14. REVENUE IN ADVANCE

GROUP

2009

$M

GROUP

2008

$M

COMPANY

2009

$M

COMPANY

2008

$M

Current

Transportation sales in advance 622 707 614 701

Loyalty programme 98 115 98 114

Other 1 - - -

721 822 712 815

Non-current

Loyalty programme 114 109 114 109

114 109 114 109

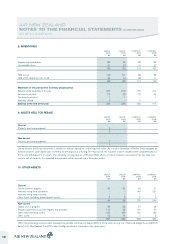

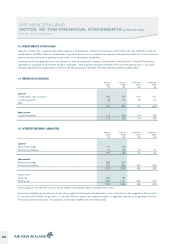

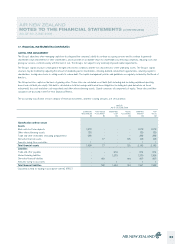

15. INTEREST-BEARING LIABILITIES

GROUP

2009

$M

GROUP

2008

$M

COMPANY

2009

$M

COMPANY

2008

$M

Current

Secured borrowings 111 103 - -

Finance lease liabilities 61 55 22 21

172 158 22 21

Non-current

Secured borrowings 280 342 - -

Finance lease liabilities 827 825 230 253

1,107 1,167 230 253

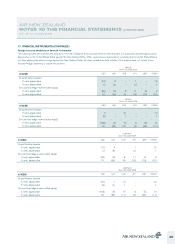

Interest rates:

Fixed rate 223 184 - -

Floating rate 1,056 1,141 252 274

1,279 1,325 252 274

All borrowings are secured over aircraft or aircraft related assets and are subject to floating interest rates.

Finance lease liabilities are secured over aircraft and are subject to both fixed and floating interest rates. Fixed interest rates ranged from 2.5 percent to

5.1 percent in 2009 (2008: 2.5 percent to 5.1 percent). Purchase options are available on expiry or, if applicable under the lease agreement, on early

termination of the finance leases. The Company’s finance lease liabilities are with related parties.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2009

24