Air New Zealand 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

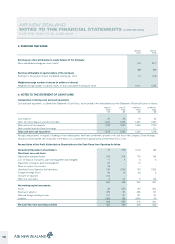

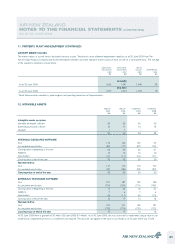

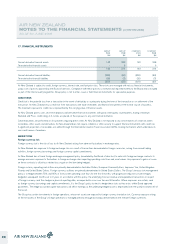

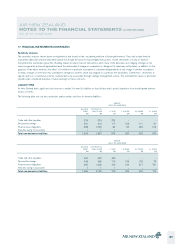

11. PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

AIRCRAFT MARKET VALUES

The market values of aircraft tend to fluctuate from year to year. The directors have obtained independent valuations as at 30 June 2009 from The

Aircraft Value Analysis Company and Ascend Worldwide Limited to ascertain indicative market values of each aircraft on a stand alone basis. The average

of the valuations obtained is shown below:

INDICATIVE

VALUATION

USD

$M

INDICATIVE

VALUATION

NZD

$M

BOOK

VALUE*

NZD

$M

DIFFERENCE

NZD

$M

@ 0.6500

As at 30 June 2009 1,066 1,641 1,548 93

@ 0.7612

As at 30 June 2008 1,377 1,810 1,797 13

* Book Value excludes simulators, spare engines and operating leased aircraft improvements.

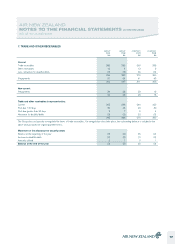

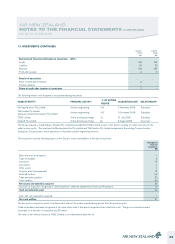

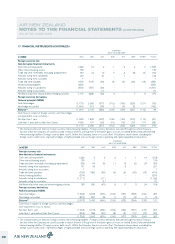

12. INTANGIBLE ASSETS

GROUP

2009

$M

GROUP

2008

$M

COMPANY

2009

$M

COMPANY

2008

$M

Intangible assets comprise:

Internally developed software 22 22 20 20

Externally purchased software 16 17 14 15

Goodwill 1 1 - -

39 40 34 35

INTERNALLY DEVELOPED SOFTWARE

Cost 110 100 107 97

Accumulated amortisation (88) (77) (87) (76)

Carrying value at beginning of the year 22 23 20 21

Additions 10 10 10 10

Amortisation (10) (11) (10) (11)

Carrying value at end of the year 22 22 20 20

Represented by:

Cost 117 110 113 107

Accumulated amortisation (95) (88) (93) (87)

Carrying value at end of the year 22 22 20 20

EXTERNALLY PURCHASED SOFTWARE

Cost 191 187 187 183

Accumulated amortisation (174) (163) (172) (162)

Carrying value at beginning of the year 17 24 15 21

Additions 7 4 7 4

Amortisation (8) (11) (8) (10)

Carrying value at end of the year 16 17 14 15

Represented by:

Cost 194 191 189 187

Accumulated amortisation (178) (174) (175) (172)

Carrying value at end of the year 16 17 14 15

At 30 June 2009 there is goodwill of $1 million (30 June 2008: $1 million). As at 30 June 2009, this was assessed for impairment using a value in use

model and no impairment provision is considered to be required. The discount rate applied in the value in use model as at 30 June 2009 was 10.0%.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2009

21