Adidas 2002 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2002 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160

|

|

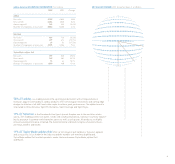

Financial Highlights

8PASSION FOR SPORT

NET SALES € in millions

1998 5,065

1999 5,354

2000 5,835

2001 6,112

2002 6,523

FINANCIAL HIGHLIGHTS

2002 2001 Change

Operating Highlights € in millions

Net sales 6,523 6,112 6.7%

Income before taxes 390 376 3.7%

Net income 229 208 9.6%

Key Ratios %

Gross margin 43.2 42.6 0.7pp

Selling, general and administrative

expenses as a percentage of net sales 34.4 33.3 1.1pp

EBITDA as a percentage of net sales 9.3 9.9 (0.6pp)

Effective tax rate 37.9 39.0 (1.1pp)

Net income as a percentage of net sales 3.5 3.4 0.1pp

Equity ratio 25.4 24.3 1.1pp

Balance Sheet Data € in millions

Total assets 4,261 4,183 1.9%

Inventories 1,190 1,273 (6.5%)

Receivables and other current assets 1,578 1,520 3.8%

Working capital 1,467 1,485 (1.2%)

Net total borrowings 1,498 1,679 (10.8%)

Shareholders’ equity 1,081 1,015 6.6%

Per Share of Common Stock €

Basic earnings per share 5.04 4.60 9.6%

Diluted earnings per share 5.04 ––

Basic earnings per share

(without goodwill amortization) 6.04 5.49 10.0%

Operating cash flow per share 11.77 8.47 1.4%

Dividend per share 1.001) 0.92 8.7%

Share price at year-end 82.30 84.30 (2.4%)

Other at year-end

Number of employees 14,716 13,941 5.6%

Number of shares outstanding 45,422,500 45,349,200 0.2%

Average number of shares 45,366,100 45,349,200 0.0%

Rounding differences may arise in percentages and totals for figures presented in

millions as calculation is always based on the figures stated in thousands.

1) Subject to Annual General Meeting approval

NET INCOME € in millions

1998 205

1999 228

2000 182

2001 208

2002 229