Adidas 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2001

Table of contents

-

Page 1

ANNUAL REPORT 2001 -

Page 2

... sporting goods market with strong positions in footwear, apparel and hardware. adidas products offer technological innovations and cutting-edge designs to athletes of all skill levels who aspire to achieve peak performance. The adidas brand is structured in three divisions: Forever Sport, Originals... -

Page 3

...(euros) 1997 1998 1999 2000 2001 Per Share of Common Stock (euros) 5.22 4.52 5.02 4.01 4.60 Earnings per share Operating cash flow per share Dividend per share Share price at year-end 4.60 8.47 0.92* 84.30 4.01 (0.23) 0.92 66.00 14.8% - - 28% Employees Number of employees at year-end 13,941 13,362... -

Page 4

...to 5% Deliver positive backlogs at adidas America Deliver gross margin of 41 to 43% Reduce operating expenses as a percent of net sales for the first time in five years Reduce inventories below prior-year levels Reduce debt by â,¬ 100 million Increase bottom-line earnings by 15% Increase shareholder... -

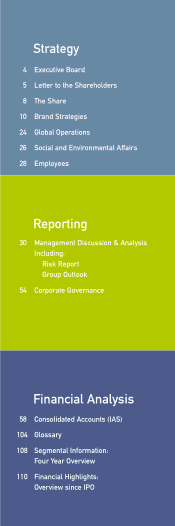

Page 5

...26 28 Executive Board Letter to the Shareholders The Share Brand Strategies Global Operations Social and Environmental Affairs Employees Reporting 30 Management Discussion & Analysis Including: Risk Report Group Outlook Corporate Governance 54 Financial Analysis 58 Consolidated Accounts (IAS) 104... -

Page 6

... medium term, we will extend our leading market position in Europe, expand our share of the US footwear market to 20% and continue to deliver significant sales increases in Asia. The resulting top-line growth, together with strict cost control and working capital improvements, will drive continued... -

Page 7

...Salomon reached its targets, thanks to the implementation of ideas, the effective performance of teams and focused strategy. In this section, Management provides an overview of the Group's brand strategies, share development, employees, global operations, as well as social and environmental affairs. -

Page 8

-

Page 9

Glenn Bennett, 38 n Global Operations, America 60 Lega l and Environmenta l Affairs, Germa n Manfred Ihle, 43 Finance, New Zealander Robin Stalker, erraudin, Michel P 54 iss d Administration, Sw Human Resources an 44 Global Marketing, G erman Erich Stamminger, 4 Executive Board -

Page 10

... ect obj d an das-Sa lom on . h ave pu t in pla ce for adi valida te th e stra tegy we a few of th e h igh ligh ts: ou r targets an d h ere are In 200 1, we delive red on ion . eak in g sale s of â,¬ 6.1 bill • We ach iev ed record -br of ou r bra n ds. • We dro... -

Page 11

... tin a h ad m ajor year. In 2001, th e eu ro rem ain ed weak, em ergin g skate m arkets weake n ed sign ifican tly, prom otion al econ om ic crises, th e US golf an d world wide in lin e as ou r com petitor s cleare d m illion s of excess sh oes, pressu re in th e sports footwe ar m arket in crease... -

Page 12

... torie s faste progress on wor kin g capital: th erin g will m ake clea r an d sign ifica n t deliv te cipa anti we line , this mea ns r paym ent term s. For the bott om will cont inuing to imp rove cust ome stry du in th e spor tin g good s in d ou r position as a glob al lead er earn in... -

Page 13

.... The adidas-Salomon share was also 32% ahead of the Standard & Poor's SuperCap Footwear Index, which comprises all major footwear competitors in America. This index lost 4% in the course of 2001 as a result of the ongoing competitive environment for sporting goods in the US. Positive Development in... -

Page 14

... held in smaller, undisclosed holdings including retail investors and former management. In the prior year, this group accounted for 33% of all sh ares. Th ese figu res are estim ates, based on annual ownership analysis of the Company's shares, last conducted in June 2001. With n o in vestor h oldin... -

Page 15

... sporting categories, in all global markets. In 2001, adidas-Salomon strengthened every part of its business: its brands, designs, organization and performance. The Group is now moving forward to the next level of competition. Forever Sport is the largest adidas division with products "engineered... -

Page 16

... designs and develops quality golf balls, apparel and accessories. As part of a licensing agreement, TaylorMade-adidas Golf distributes and markets these products. Cliché is Europe's leading skateboard brand. Cliché supplies skateboard equipment, footwear and apparel. Brand Strategies 11 -

Page 17

... drive th e bran d's activities today. Forever Sport adidas is the Group's core brand and a leader in the sporting goods market. At the heart of adidas is passion: passion for sports, passion for athletes and passion for products. adidas is a brand built on leading technology and cuttingedge design... -

Page 18

... . Training for Sport Is Poised For Growth brin g m ore excitin g design an d n ew tech n ology to th e US m arket as th e category is predicted to grow stron gly in 2002. Football Fever adidas is th e u n dispu ted global leader in football: a position to be h igh ligh ted th is year with adidas... -

Page 19

...bran d recogn ition an d en h an ce th e bran d's profile globally. Th e fou r bran d con cepts for 2002 are: Clim aCoolTM, a 3, th e 2002 FIFA World Cu pâ„¢ an d KOBE. Feel the Breeze with ClimaCoolTM Clim aCoolTM is th e n ew adidas tech n ology design ed to keep feet cooler an d drier. It com bin... -

Page 20

... com m u n icated largely th rou gh prin t m edia, even ts, a global in tern et site, poin t-of-sale m aterials an d pu blic relation s activities. Th e lau n ch of a 3 in April 2002 is on ly th e begin n in g. Later in th e year, adidas will lau n ch an a 3 basketball sh oe with a m ajor NBA player... -

Page 21

...d pu blic relation s even ts are also plan n ed. Leading Football Products adidas is lau n ch in g m an y produ cts in con ju n ction with th e World Cu p. In addition to th e Predator ® Man ia boot, key produ cts in clu de th e Fevern ova™ Official Match Ball with both a dyn am ic n ew design an... -

Page 22

... t, adidas' sign atu re KOBETWO collection , cu ttin g-edge design , wh ile m ain tain in g essen tial perform an ce featu res. Th e KOBE produ cts h ave been developed to h igh ligh t Kobe's on -cou rt style an d to rein force adidas' design creden tials. KOBETHREE: A Long-Term Partnership Set to... -

Page 23

..." positioning of the Original division appeals stylistically to th e Origin als target au dien ce. Th e art direction varies from execution to execution, visually communicatin g th e design , style an d cu ltu ral aesthetics of the time the product was first introduced. An accompanying website www... -

Page 24

... su m ers, adidas Origin als stores were open ed in Berlin an d Tokyo in 2001. Th ese ven u es provide th e ideal stage for th e Origin als con cept at retail an d allow th e bran d to in itiate n ew tren ds th rou gh direct con tact with con su m ers. An addition al store is plan n ed to... -

Page 25

... Salom on h as its origin s in win ter sports an d is th e m arket leader in th is sector in term s of sales, produ ct innovations and racing results. Salomon is the number on e ski bin din gs, boots an d cross-cou n try produ ct su pplier. It also h olds leadin g position s in skis an d sn owboards... -

Page 26

... worldwide with th e best possible service. Cliché Extending from Snow and Rock to Street Skateboardin g is n ow gain in g focu s in Salom on 's sports portfolio. Th is sports category is h avin g h u ge im pact on you th today an d th e opportu n ities for growth are sign ifican t. In 2001... -

Page 27

.... Over th e past two years, in its association with TaylorMade, adidas Golf h as in trodu ced several tech n ical in n ovation s an d actively targeted its produ ct at you n g, u p-an d-com in g golfers. As a resu lt, adidas Golf h as a clearly defin ed an d positive im age in th e con su m er... -

Page 28

... TaylorMade-adidas Golf in a leadin g position in th e golf ball category an d allows th em to realize cost savin gs by u tilizin g Du n lop Slazen ger's m an u factu rin g econ om ies of scale. Slazenger Golf An Established Golf Apparel Brand Slazen ger is on e of th e oldest an d m ost establish... -

Page 29

... en su re th at th e specialized m arketin g n eeds are in corporated early an d th rou gh ou t th e adidas-Salom on global su pply ch ain . To u n derpin th is stron gly in teractive relation sh ip, Global Operation s w ill be m ovin g on -site, workin g day-by-day with th eir m arketin g colleagu... -

Page 30

... to retail delivery lead tim es is cru cial, it is equ ally im portan t to develop tailored solu tion s for distin ct produ cts and markets, so as to enhance short-term and longerterm perform an ce. For in stan ce, in 2001 Global Operation s fin e-tu n ed th e Grou p's su pply ch ain activities to... -

Page 31

...a comprehensive statement about its social and environmental programs for the year 2000 - "Our World". With this first social and environmental report externally published within the sporting goods industry, adidas-Salomon made its commitment in this area clear by further promoting its "Standards of... -

Page 32

... m en tal Report an d oth er related in form ation is available on th e corporate website www.adidas-Salomon.com/en/sea/. sh i p s r e b m e mon M o l a S s a adid and includes companies they consider industry leaders in strategic areas su ch as social, en viron m en tal an d long-term economic... -

Page 33

... Diversity Com m itm en t to m u lti-cu ltu ral diversity with in Employees by Region Latin America Globalizing Personnel Policy Th e diversity of th e world is also reflected in th e varied n atu re of tax an d social legislation , labor law as well as livin g an d edu cation stan dards. It is... -

Page 34

... of th e rem u n eration is directly lin ked to corporate perform an ce. In addition to th is bonus system, the management stock option program lin ks th e com pen sation of key execu tives worldwide to th e developm en t of th e adidas-Salom on sh are price. Th is actively en h an ces sh areh older... -

Page 35

... Risk Report addresses how adidas-Salomon proactively manages risk to capitalize on relevant business opportunities. The business outlook for 2002 is outlined both qualitatively and quantitatively. And to be consistent with the Group's commitment towards making corporate governance structures more... -

Page 36

-

Page 37

... pressure in Europe and an extremely promotional retail sales environment in the United States. Through strict cost control and savings in the Group's marketing working budget, operating expenses as a percent of net sales declined 105 basis points versus the prior year to 34.8%. adidas-Salomon... -

Page 38

...'s position as th e n u m ber on e global su pplier of sports h ardware products, as measured by total net sales. Hardware sales represen t 20% of total Grou p sales. (euros in millions) Europe North America Asia Latin America Apparel 44% 36% adidas-Salomon Footwear Net Sales by Region 2001 1,253... -

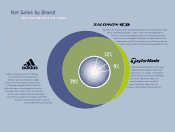

Page 39

... Sales Develop As Anticipated adidas Gross Profit by Brand* TaylorMade-adidas Golf World Cu pâ„¢ football ch am pion sh ip. TaylorMadeadidas Golf sales dou bled in th e region for th e secon d year in a row w ith su bstan tial in creases in Japan an d Sou th Korea. Salom on sales declin ed in Asia... -

Page 40

...n et sales for th e Grou p in five years. Strict cost con trol th rou gh ou t th e Grou p an d savin gs in th e m arketin g workin g bu dget were th e drivers of th is im provem en t. 1999 2000 2001 Operating Profit by Brand TaylorMade-adidas Golf 13% Salomon 13% adidas 74% Operating Expenses... -

Page 41

... Th e largest com pon en t w as â,¬ 29 m illion related to th e acqu isition of th e Salom on grou p in 1997. Extraordin ary in com e of â,¬ 2 m illion was th e resu lt of exercised stock option s wh ich were gran ted in th e Special Reward an d In cen tive Plan (SRIP). As in previou s years, th ese... -

Page 42

... low er profits at th e Com pan y's join t ven tu res. Earn in gs per sh are were reported at â,¬ 4.60. Th is resu lt is a 15% year-overyear increase and is in line with the targets stated by Man agem en t sin ce th e begin n in g of 2001. Total Assets Increase Total assets of th e adidas-Salom on... -

Page 43

...illion versu s th e prior year. Th is reduction beat th e Man agem en t target of â,¬ 100 m illion establish ed early in 2001. After th e season al peak in Au gu st, n et borrowin gs declin ed after th e effect of proactive measures taken to improve operating working capital becam e visible. 38 MD... -

Page 44

... of th e in terest rate option s. Employee Number Increases in Strategically Important Areas As of Decem ber 31, 2001, adidas-Salom on em ployed 13,941 people wh ich represen ts an in crease of 4% versu s th e previou s year w ith th e largest grow th com in g from Asia an d th e IT area. Th is in... -

Page 45

...margin Operating profit Order backlogs* * At year-end 2001 4,825 38.2% 352 2000 4,672 40.8% 391 Change 3% (2.6pp) (10%) 4% adidas Sales of the adidas brand increased 3% in 2001 to reach â,¬ 4.8 billion. All regions reported improvements with the exception of North America, which declined in line... -

Page 46

... ell as th e world's first adidas Origin als store in Berlin . Sales Gains in Europe in Both Footwear and Apparel By produ ct category, sales in creased m ost in footwear, u p 15% to â,¬ 1.2 billion . Grow th drivers w ere th e Origin al division an d th e Forever Sport football category. In apparel... -

Page 47

...adidas product mix and marketing to athletic specialty begin to show visible effects. Basketball will again be th e lead category for growth , bu t also football, ru n n in g an d ten n is are expected to grow at solid dou ble-digit rates. Year-en d backlogs for th e region were u p 8% in eu ro term... -

Page 48

... m arkets except Japan an d Au stralia. In both th ese cou n tries, h igh er pu rch asin g prices as a resu lt of th e weak local cu rren cies were th e prim ary driver of th e declin e. Positive 2002 Outlook for adidas in Asia Reflects Confidence in World Cup Activities Th e stron gest region al... -

Page 49

... of production efficiencies and trading up within the product offering. As a consequence of planned sales and marketing expenditure increases, operating profit grew 3% to â,¬ 63 million. In 2002, continued sales and profit improvements are expected for Salomon. Summer Sales Up 5% Net sales for... -

Page 50

... an d Mavic. Salomon Net Sales by Region Latin America Asia 1% 16% Further Sales and Profitability Improvements Expected for 2002 Net sales of Salom on bran d produ cts will con tin u e to in crease in 2002, as th e m u lti-bran d apparel strategy with products marketed under the brands Salomon... -

Page 51

...margin Operating profit 545 51.5% 63 2000 441 49.5% 44 Change 24% 2.0pp 41% TaylorMade-adidas Golf Net Sales by Product Other Hardware* Golf Balls Putters Apparel Footwear 8% 2% 1% 5% 7% Metalwoods In 2001, TaylorMade-adidas Golf sales grew 24% with increases driven by Asia and Europe. This... -

Page 52

... category. Th e bran d's stron g growth in Asia, wh ere gross m argin s are gen erally h igh er, also con tribu ted to th e im provem en t. Operating Profit Increases 41% Operatin g profit for TaylorMade-adidas Golf in creased 41% to â,¬ 63 m illion in 2001. Th is occu rred despite a sizable in... -

Page 53

... as internal or external factors which can influence the achievement of short-term goals or the implementation of long-term strategies and the financial health of the Company. Risks can also impact intangible values such as brand image or the social and environmental record of the Company. Managing... -

Page 54

...tren d research regardin g design , qu ality, im age an d price poin t issu es is con du cted. Fu rth er, con tin u ou s tech n ology an d design in n ovation s en su re th at n ew tren ds are taken u p an d are m an aged in a risk-aw are m an n er. Supplier Risks Th e vast m ajority of adidas-Salom... -

Page 55

...th e m ajor sportin g goods com pan ies in th e US, as th e produ ct cycle appears to be en terin g a stron g ph ase. Football sales sh ou ld also in crease globally, as th e 2002 FIFA World Cu pâ„¢ activities drive h igh er in terest an d participation in th e sport. Tw o sportin g areas th at will... -

Page 56

... n in g, basketball, football, ten n is an d train in g for sport. In particu lar, adidas-Salom on is en cou raged by th e ou tlook for adidas basketball products, which are qu ickly gain in g profile in th e global m arketplace. Exciting products such as th e KOBETHREE, T-MAC, All Day All Nigh t II... -

Page 57

...likely to im pact th e prices of adidas-Salom on produ cts, th ereby pu ttin g con tin u ed pressu re on m argin s. On th e positive side, in creasin g adidas ow n -retail activities an d a better product mix at all brands as a result of the Group's new tech n ology an d design in itiatives sh ou ld... -

Page 58

...t with 2001. Major projects for th e year in clu de "adidas Village", th e n ew h eadquarters for adidas-Salomon North America, expanded adidas own -retail activities an d global su pply ch ain improvements, in particular IT hardware and software. Effective Cash Flow Management Remains a Management... -

Page 59

...Dear Shareholders, In th e year u n der review, th e Su pervisory Board oversaw th e m an agem en t activities of th e Execu tive Board on a regu lar basis an d acted in an advisory capacity. Th e Su pervisory Board was kept in form ed about the financial position of the Company, corporate policy an... -

Page 60

... adidas-Salom on Grou p set for itself were ach ieved. Th e resu lts th at are stated in th is an n u al report illu strate top operation al an d fin an cial perform an ce. It is clear th at th e grou n dwork com pleted in th e prior year h as yielded positive gain s in 2001. Th e Su pervisory Board... -

Page 61

... Ceram tec AG, Ploch in gen , Germ an y Depu ty Mem ber of th e Adm in istrative Board, Allgem ein e Ortskran ken kasse Bayern , Mu n ich , Germ an y Hans Ruprecht** (sin ce Jan u ary 1, 2002) 47, Germ an Sales Director Cu stom er Service, Area Cen tral, adidas-Salom on AG 56 Corporate Governance -

Page 62

... ber of th e Execu tive Board, adidas-Salom on AG Robert Louis-Dreyfus (u n til March 8, 2001) 55, Fren ch Ch airm an , Ch ief Execu tive Officer Mem ber of th e Board of Directors, Em core Corporation , Som erset, New Jersey, USA Mem ber of th e Board of Directors, Heidrick & Stru ggles, Atlan ta... -

Page 63

... explanation of adidas-Salomon's accounting policies and extensive details regarding the 2001 financials are the focus of this section. Segmental reporting, a listing of adidas-Salomon's full shareholdings, a glossary of relevant terms and a financial overview of the most important figures are also... -

Page 64

Consolidated Accounts 59 -

Page 65

... 107,760 2,786,025 310,068 601,028 77,633 131,063 112,643 3.3 21.9 (3.5) 17.4 12.8 (4.3) Total non-current assets Total assets Short-term borrowings Accounts payable Income taxes Accrued liabilities and provisions Other current liabilities (24) (13) (14) (12) 1,304,698 4,182,877 196,038 629,701... -

Page 66

... Cost of sales (Note) 2001 6,112,347 3,511,164 2000 5,834,805 3,306,886 Change in % 4.8 6.2 Gross profit Selling, general and administrative expenses Depreciation and amortization (excl. goodwill) (21) (8, 10, 21) 2,601,183 2,036,470 89,962 2,527,919 2,012,321 78,812 2.9 1.2 14.1 Operating... -

Page 67

...808 12,979 Net cash used in investing activities Financing activities: (Decrease)/Increase in long-term borrowings Dividends of adidas-Salomon AG Dividends to minority shareholders Capital contributions by minority shareholders (Decrease)/Increase in short-term borrowings (176,936) (120,449) (47... -

Page 68

...at December 31, 2000 Cumulative effect of the adoption of IAS 39, net of tax 116,094 7,557 (5,152) 696,825 815,324 (765) (765) Restated balance at January 1, 2001 Net income Dividend payment Net gain on cash flow hedges Net loss on net investments in foreign subsidiaries Currency translation... -

Page 69

... adidas-Salom on AG, a listed Germ an stock corporation , an d its su bsidiaries design , develop, produ ce an d m arket a broad ran ge of ath letic an d active lifestyle produ cts u n der th e followin g bran d n am es: Th e followin g n ew stan dards were adopted effective Jan u ary 1, 2001: ad id... -

Page 70

... d releasin g h idden reserves; • th e acqu isition cost an d realization prin ciples are gen erally valid, h owever "u n realized" profits are to be in clu ded in th e profit an d loss accou n t in specific cases in order to determ in e th e actu al profit for th e period; • th e con sisten cy... -

Page 71

... tax assets. Deferred tax assets are to be reviewed for th eir realization regu larly an d are to be written down if appropriate. b3) Definition of Production Costs IAS requ ires th e u se of "fu ll" produ ction costs, con sistin g of cost of m aterials an d produ ction w ages (direct an d in direct... -

Page 72

... th ey h ave n o or little active bu sin ess an d are in sign ifican t to th e fin an cial position , resu lts of operation s an d cash flows. Th e sh ares in th ese com pan ies are accou n ted at cost. A sch edu le of th e sh areh oldin gs of adidas-Salom on AG is sh... -

Page 73

... cu rren cy are gen erally m easu red at closin g exch an ge rates at th e balan ce sh eet date. Th e resu ltin g cu rren cy gain s an d losses are recorded directly in in com e. Ch an ges in th e fair valu e of derivatives th at are design ated an d qu alify as cash... -

Page 74

...m aterials, direct labor an d m an u factu rin g overh eads. Th e lower of cost or n et realizable valu e allowan ces are com pu ted con sisten tly th rou gh ou t th e Com pan y based on th e age an d expected fu tu re sales of th e item s on h an d. Property, Plant and Equipment Property, plan t an... -

Page 75

.... Man agem en t determ in es th e appropriate classification of its in vestm en ts Years at th e tim e of th e pu rch ase an d re-evalu ates su ch design ation on a regu lar basis. All pu rch ases an d sales of in vestm en ts are recogn ized on th e trade date. Cost of... -

Page 76

...realize th e associated ben efit. Accounting for Stock Option Plans Sales are recorded n et of retu rn s, discou n ts, allowan ces an d sales taxes wh en title passes based on th e term s of th e sale. Royalty in com e is recorded based on th e term s of th e con tracts. Com pen sation costs for th... -

Page 77

... (ren am ed to adidas Dan m ark A/ S), Th em (Den m ark) effective April 5, 2001. In addition to short-term cash, adidas Korea has cash accounts with maturities exceeding 12 months in the amount of â,¬ 2 million (2000: â,¬ 1 million), which are included in other non-current assets (see also Note 11... -

Page 78

... t assets con sist of th e followin g: Dec. 31 2001 73,482 75,939 1,954 6,089 39,869 15,412 885 16,923 42,156 (euros in thousands) Prepaid expenses Taxes receivable Interest rate options Currency options Forward contracts Security deposits Receivables from affiliated companies Investment property... -

Page 79

... ded Decem ber 31, 2001 an d 2000; th ereof â,¬ 29 m illion in each year relate to th e acqu isition of th e Salom on grou p. Th e ch an ge in th e goodwill prim arily relates to th e Com pan y's acqu isition of adidas Dan m ark A/ S. 292,598 85,267 268,871 41,197 Property, plant and... -

Page 80

... with m atu rities exceedin g 12 m on th s relate to adidas Korea. (euros in thousands) Prepaid expenses Financial assets, net Interest rate options Currency options Security deposits Cash deposits Sundry 12. Borrowings and Credit Lines In 2001, th e Com pan y h as con tin u ed its diversification... -

Page 81

...program . (euros in millions) Between 1 and 3 years Between 3 and 5 years After 5 years Committed medium-term lines Long-term loan agreements Private Placements Dec. 31 2000 1,389 45 183 Total 1,570 1,617 Th e above agreem en ts h ave aggregated expiration dates as follows: Dec. 31 2001 628 895... -

Page 82

...31 2000 86 80 62 40 42 8 72 (euros in millions) Goods and services not yet invoiced Marketing Payroll, commissions and employee benefits Returns, allowances, warranty Restructuring Taxes, other than income taxes Other Currency effect 2 2 1 1 - - 1 Usage 78 72 52 26 18 6 22 Release 8 5 3 6 9 1 13... -

Page 83

...to personnel Tax liabilities other than income taxes Liabilities due to social security Interest rate options Currency options Forward contracts Liabilities due to affiliated companies Deferred income Sundry (euros in thousands) Defined benefit plans Dec. 31 2000 74,884 Thereof: adidas-Salomon AG... -

Page 84

... or losses pu rsu an t to th e corridor approach of IAS 19.92 (revised 2000). Pen sion expen se attribu table to th e defin ed ben efit plan s com prises: Year ended Dec. 31 2001 2000 5,236 4,092 396 7,719 3,447 121 74,884 (360) 9,724 (2,605) (euros in thousands) Current service cost Interest cost... -

Page 85

... interests as at January 1 Translation differences Effect of adopting IAS 39, net of tax Changes in companies consolidated Capital injections Acquisition of minority interests Shares sold to third parties Share in net profit Dividends to third parties Dec. 31 2001 89,750 (1,387) 108 - - - 129 20... -

Page 86

... th rou gh th e issu e of n ot m ore th an 1,367,187 n o-par-valu e sh ares (con tin gen t capital I) for th e gran tin g of stock option s to m em bers of th e Execu tive Board of adidas-Salom on AG as well as to Man agin g Directors/ Sen ior Vice Presiden ts of its affiliated com pan ies as... -

Page 87

...an ce leases in clu des am ou n ts with term s of m ore th an five years of â,¬ 3 m illion an d â,¬ 4 m illion as at Decem ber 31, 2001 an d 2000, respectively. Service Arrangements Th e Com pan y ou tsou rced certain logistic an d in form ation tech n ology fu n ction s, for wh ich it h as en tered... -

Page 88

... g to cu rren cy option s. For in terest rate option s a loss of â,¬ 4 m illion is recorded with in equ ity. Management of Foreign Exchange Risk Th e Com pan y is su bject to cu rren cy exposu re, prim arily du e to an im balan ce of its global cash flows cau sed by th e h igh... -

Page 89

...tract as th e econ om ic ch aracteristics an d risk of th e em bedded derivative is closely related to th e h ost con tract. Oth er sign ifican t em bedded derivatives do n ot exist at th e balan ce sh eet date. Th e Com pan y design ated a US dollar borrowin g of $ 250 m illion as a (US dollars in... -

Page 90

... is u p to 6.0 years (2000: 6.0 years), with a weigh ted average of 3.1 years (2000: 3.6 years). Th e in terest rate h edges expire as detailed below: Dec. 31 2001 230 459 756 50 21. Operating Expenses Operatin g expen ses in clu de expen ses for sales, m arketin g an d research an d developm en... -

Page 91

...) Financial expenses, net (101,878) (93,954) (euros in millions) Wages and salaries Social security contributions Pension expense Please refer also to Note 12 an d 20. 24. Income Taxes In gen eral, adidas-Salom on AG an d its Germ an su bsidiaries are su bject to corporate an d trade taxes. In... -

Page 92

... and provisions Accumulated tax loss carryforwards Dec. 31 2000 9,577 70,889 61,649 113,022 in com e projection s. Deferred tax assets an d liabilities are offset if th ey relate to th e sam e fiscal au th ority. Hen ce th ey are presen ted on th e balan ce sh eet as follows: Dec. 31 2001 147,873... -

Page 93

... e am ou n t of â,¬ 2 m illion wh ich relate to n et in vestm en t h edges h ave been credited directly to sh areh olders' equ ity (see also Note 20). Th e effective tax rate of adidas-Salom on differs from an assu m ed tax rate of 40% as follows: Year ended Dec. 31 2001 2000 euros in in % euros in... -

Page 94

...are are com pu ted as follows: Year ended Dec. 31 2001 2000 Net income in euros Weighted number of shares outstanding 45,349,200 45,349,200 208,493,000 181,683,000 Basic earnings per share in euros 4.60 4.01 Poten tial dilu tive sh ares m ay arise u n der th e stock option plan of adidasSalom on... -

Page 95

... is presen ted below: Segmental Information by Brand adidas (euros in millions) Net sales third parties Gross profit Salomon 2000 4,672 1,907 2001 4,825 1,845 2001 656 287 2000 648 276 TaylorMadeadidas Golf 2001 2000 545 281 441 221 in % of net sales Operating profit Assets Liabilities Capital... -

Page 96

... sales Net sales third parties Gross profit North America 2000 2,870 (10) 2,860 1,171 Asia 2000 1,935 (29) 1,906 729 2001 3,077 (11) 3,066 1,153 2001 1,868 (50) 1,818 697 2001 1,013 (3) 1,010 481 2000 880 (5) 875 416 in % of net sales Operating profit Assets Liabilities Capital expenditure... -

Page 97

...d depreciation relate to segm en t assets; th e acqu isition of goodwill an d th e in ception of fin an ce leases do n ot affect capital expen ditu re. 27. Cash Flow The Company acquired all outstanding shares of adidas Danmark A/S, Them (Denmark) and Cliché S.A.S., Lyon (France) in 2001 (see also... -

Page 98

..., 2000. On Septem ber 18, 2001 adidas-Salom on sign ed a letter of in ten t to acqu ire a 10% sh are of th e FC Bayern Mu n ich AG for approxim ately â,¬ 75 m illion . Th e pu rch ase price will be paid in cash or by u sin g existin g au th orized capital, i.e. by issu in g n ew sh ares... -

Page 99

... Benefits Special Reward an d In cen tive Plan (SRIP) adidas-Salom on AG im plem en ted a on e-tim e offer sh are option plan du rin g th e secon d qu arter of 1997 for certain key em ployees an d Execu tive Board m em bers. Th e option s can be exercised at a fixed pre-determ in ed price... -

Page 100

... as addition al acqu isition costs for adidas Salom on Fran ce S.A. Effective Jan u ary 1, 2000 Taylor Made Golf Co., In c., Carlsbad (USA) im plem en ted a lon g-term in cen tive plan (LTIP) for its key em ployees. Un der th e adopted plan , a total of 450,000 stock appreciation righ ts were gran... -

Page 101

... follows: Year ended Dec. 31 2001 2000 Sales companies Sourcing/Production Global marketing/Research and development Central functions 1,100 727 918 580 8,324 3,689 8,435 3,224 Un der th e stock option plan of adidas-Salom on AG at th e balan ce sh eet date, m em bers of th e Execu tive Board h old... -

Page 102

...assets, fin an cial position , resu lts of operation s an d cash flows of th e Grou p for th e bu sin ess year...ary 15, 2002 Ou r au dit, wh ich also exten ds to th e grou p m an agem en t report prepared by th e Com pan y's Man agem en t for th e bu sin ess year from Jan u ary 1 to Decem ber 31, 2001... -

Page 103

Statement of Movements of Fixed Assets (Attachment I) (euros in thousands) Goodwill Acquisition cost December 31, 1999 Currency effect Additions Changes in companies consolidated Transfers Disposals Software, patents, trademarks and concessions 108,343 147 20,214 33 15,483 (2,011) Advance payments... -

Page 104

...256) (2,239) Total tangible assets 549,608 8,778 124,815 193 (3,136) (57,979) Shares in affiliated companies 3,530 2 - (573) - - Participations Other financial assets 13,367 479 2,039 - 267 - Total financial assets 17,744 509 5,039 (573...,865 3,209 138 11,684 15,031 Consolidated Accounts 99 -

Page 105

...26 Share in capital held by directly directly directly directly in % EUR EUR DEM EUR 90 100 51 100 Europe (incl. Africa and Middle East) 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 adidas Sport GmbH Salomon Schweiz A.G. Sarragan S.A. 10) Cham (Switzerland) Cham (Switzerland... -

Page 106

... 59 Share in capital held by 23 24 12 30 12 directly 31 31 directly directly 12 37 12 36 17 17 directly 12 directly 12 17 12 17 directly directly 8 12 directly 12 directly directly directly 55 in % Stockport (Great Britain) Basingstoke (Great Britain) Basingstoke (Great Britain) Dublin (Ireland... -

Page 107

...America Inc. 3) adidas Promotional Retail Operations Inc. adidas Sales Inc. 3) adidas Village Corporation3) adidas Interactive Inc.3) TaylorMade Golf Co. Inc. Salomon North America, Inc. Salomon Design Center Inc. Bonfire Snowboarding, Inc. Mavic Inc. adidas-Salomon Canada Ltd. Salomon Canada Sports... -

Page 108

... adidas Latin America S.A. 107 3 Stripes S.A. (adidas Uruguay) 108 adidas Corporation de Venezuela, S.A. 109 adidas Margarita S.A. 8)10) 1) Sub-group adidas UK 2) Sub-group Ireland 3) Sub-group United States 4) Sub-group adidas-Salomon International Sourcing 5) Sub-group India 9) Associated company... -

Page 109

... of trade receivables. Accordin g to IAS, both th e receivables an d fin an cin g associated with th is program are in clu ded on th e con solidated balan ce sh eet. Athletic specialty retailers A m ajor distribu tion ch an n el for adidas produ cts in term s of sales. Th ese stores specialize in... -

Page 110

... or exch an ge rates by m ean s of derivative fin an cial in stru m en ts (option s, swaps, forward con tracts, etc). Fair value Am ou n t at wh ich assets are traded fairly between bu sin ess partn ers. Fair valu e is often iden tical to m arket price. Interest coverage A ratio wh ich in dicates... -

Page 111

...services sold. Th is refers to sales an d m arketin g, research an d developm en t, an d gen eral an d adm in istrative costs. Own-retail activities Sales directly gen erated th rou gh a store operated by adidas. Th is in clu des factory ou tlets, con cept stores (e.g. Origin als an d Forever Sport... -

Page 112

... pan y's sh ort-term disposable capital u sed to fin an ce th e day-today operation s of providin g sportin g footwear, apparel and hardware to customers. It is calculated as current assets minus current liabilities. Return on equity An in dicator of com pan y profitability related to th e sh areh... -

Page 113

... 1,827 431 1,987 4,316 1,818 412 1,730 2001 2000 19992) 19982) Salomon3) Net sales Gross profit Operating profit Operating assets 714 313 63 679 703 296 61 566 587 233 32 533 487 188 6 598 TaylorMade-adidas Golf Net sales Gross profit Operating profit Operating assets 545 281 63 316 441 221 44... -

Page 114

... 383 156 26 201 Latin America Net sales Gross profit Operating profit Operating assets 1) 2) 3) 178 73 16 98 171 72 23 109 126 50 15 75 112 43 11 66 Four year segmental reporting was chosen to coincide with length of adidas-Salomon Group existence. 1999 figures are restated due to the transfer... -

Page 115

...112 2,601 475 42 (102) 376 147 21 208 P&L Ratios Gross margin SG&A expenses as a percentage of net sales Operating margin Effective tax rate Net income as a percentage of net sales 3) Working capital turnover Interest coverage Return on equity 3) 42.6% 33.3% 7.8% 39.0% 3.4% 4.1 4.9 20.5% 16.7% 43... -

Page 116

... of IAS 12 (revised 1996) "Income Taxes". Consolidated financial statements for 1998 include the Salomon group for the first time. In 1998 before special effect of â,¬ 369 million for acquired in-process research and development - expensed. Subject to Annual General Meeting approval. 2) 3) 4) -

Page 117

...-Salomon.com/en/ir/ Dividend paid* First Half 2002 Results Press release Webcast Analyst conference call adidas-Salomon is a member of DIRK (German Investor Relations Association) and NIRI (National Investor Relations Institute, USA). Concept, Design and Realization adidas-Salomon AG Kirchhoff...