Access America 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

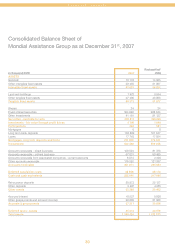

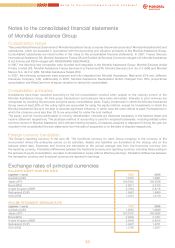

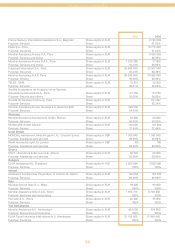

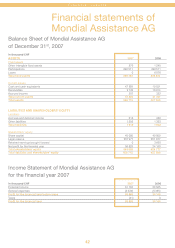

Reclassification of balance sheet of 2006

Two reclassifications in the balance sheet were performed.

Investments - fair value through profit & loss

This line item was shown under Securities- available for sale in the prior year.

Long term bank deposits

This line item was shown under Securities- available for sale in the prior year.

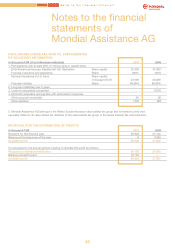

Accounting and valuation policies

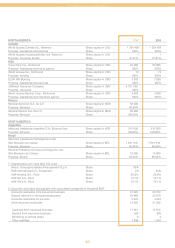

Balance Sheet

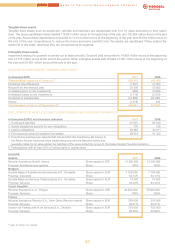

Intangible fixed assets

Intangible fixed assets include goodwill and other intangible assets such as exclusivity fees and software purchased from others

or developed in-house. Goodwill represents the difference between the purchase price of subsidiaries and the proportionate

share of their net assets valued at the current value of all assets and liabilities at the time of acquisition. Goodwill is recognised

as an asset in the balance sheet and is not amortised. The Mondial Assistance Group periodically evaluates the recoverability of

Goodwill and takes into account events or circumstances that indicate the existence of an impairment. Impairment testing for

goodwill is carried out at least annually, at the end of the year and at each reporting date, whenever there is an indication that an

asset maybe impaired. The impairment is recognized through the income statement and the reversal of an impairment loss is

prohibited.

Intangible fixed assets are measured initially at cost and are recognised if it is probable that the future economic benefits that

are attributable to the asset will flow to the Group, and the cost of the asset can be measured reliably. After initial recognition, intangible

fixed assets are measured at cost less accumulated amortisation and any accumulated impairment losses. Other intangible fixed

assets are amortised using the straight-line method over their estimated period of benefit with a maximum of 5 years.

Tangible fixed assets

Tangible fixed assets include property and other tangible fixed assets such as equipment. Property used for own use and

equipment is stated at cost and depreciated using the straight-line method over the shorter of the estimated life of the asset or

the lease term. Land is not depreciated. Buildings are depreciated over 50 years, while other tangible fixed assets are depreciated

over a period of their estimated useful life at the date of purchase. The Group recognises finance leases as assets and liabilities

in the balance sheet at the amount equal at the inception of the lease to the fair value of the leased property. Initial direct costs

incurred are included as part of the asset. Lease payments are apportioned between the finance charge and the reduction of the

outstanding liability. The finance charge is allocated to periods during the lease term so as to produce a constant periodic rate

of interest on the remaining balance of the liability for each period.

A finance lease gives rise to depreciation expense for the asset as well as a finance expense for each accounting period.

The depreciation policy for leased assets is consistent with that for other depreciable assets.

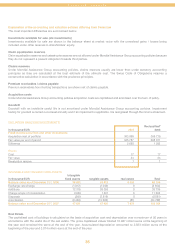

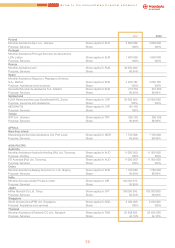

Investments

Investments include securities available for sale, investments at fair value through profit & loss, mortgages, long term bank

deposits and loans.

Securities available for sale are accounted for at fair value. Positive and negative differences between market value and cost or

amortised cost are included in a separate component of shareholders’ equity, net of deferred tax. Realised gains and losses are

principally determined by applying the average cost method.

Investments at fair value through profit & loss are accounted for at fair value. Positive and negative differences between market

value and cost or amortised cost are included in profit and loss. Mortgages, long term bank deposits and loans are valued at cost.

Accounts receivable

The accounts receivable are carried at nominal value less any necessary value adjustment.

Deferred acquisition costs

Deferred acquisition costs, which are incurred in connection with the acquisition or renewal of insurance policies, are capitalised

and amortised through the income statement over the term of the policies.

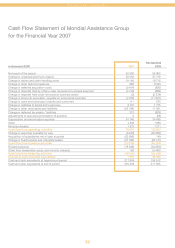

Cash and cash equivalents

This item includes balances with banks payable on demand, cash on hand and bank deposits with a maturity of three months or

less at the date of purchase.

The carrying amount of cash with banks and cash on hand corresponds to the fair value. Cash funds are stated at their face

value, with holdings of foreign notes and coins valued at year-end closing rate.

Financial results

34