AIG 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 AIG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

American International Group, Inc.

2014 Annual Report

Table of contents

-

Page 1

American International Group, Inc. 2014 Annual Report -

Page 2

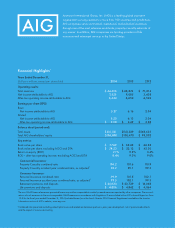

... to AIG Diluted Net income attributable to AIG After-tax operating income attributable to AIG Balance sheet (period-end): Total assets Total AIG shareholders' equity Key metrics: Book value per share Book value per share, excluding AOCI and DTA Return on equity (ROE) ROE - after-tax operating income... -

Page 3

... and risk, we recently announced three financial targets through 2017: • Growth of at least 10 percent a year in the company's book value per share, excluding accumulated other comprehensive income (AOCI) and tax attribute deferred tax assets (DTA). • A reduction in net general operating expense... -

Page 4

... make progress deploying capital to enhance long-term returns, while prudently managing our liquidity and capital risks. We did this by: • Completing $4.9 billion in share repurchases. • Strengthening the financial flexibility of AIG Parent with distributions of $10.4 billion from our insurance... -

Page 5

...of value-based management. Running AIG according to these principles also means that, where our current products, services, and offerings do not support our strategic and financial goals, we will look for ways to redeploy capital or return it to you. The unwinding of the Direct Investment book (DIB... -

Page 6

... of capital while minimizing friction costs. • Positioning us to better absorb the growing costs of compliance, risk management, and investment in technology. • Enabling us to use our valuable $16 billion in net operating loss and foreign tax credit carryforwards to offset future taxable income... -

Page 7

... characteristics to lead AIG toward our vision of being the world's most valued insurer for our clients, including his deep financial experience that helped us de-risk the company, and broad international experience from having lived and led in places across the globe. Shortly after Peter officially... -

Page 8

AIG employees volunteered more than 20,000 hours during Global Volunteer Weeks in 2014. 6 -

Page 9

... creates a new product or service, develops a business plan for bringing it to market, and presents the idea to a panel of AIG senior leaders. Launched in Commercial Insurance in late 2013, the Innovation Bootcamps have since been expanded to Consumer Insurance. AIG also supports employees' diverse... -

Page 10

... prevent losses. Learning together begins by listening to what our clients value most, as teams of leaders from Consumer Insurance did in the fourth quarter when they visited AIG's top 40 distributors of retirement and life products. Together, they reviewed 2014 and revised how we will work in 2015... -

Page 11

9 -

Page 12

... world now facing more than a million cyber attacks a day, AIG's CyberEdge® helps clients safeguard against sensitive data breaches, computer hacking, employee error, and more. The New York and Houston Global Security Operations Centers provide real-time crisis management, travel support, and risk... -

Page 13

11 -

Page 14

... American International Group, Inc. Former President and Chief Executive Officer Northwest Airlines Corporation Peter R. Fisher Senior Fellow, Center of Global Business and Government and Senior Lecturer, Tuck School of Business at Dartmouth College Former Head of Fixed Income Portfolio Management... -

Page 15

American International Group, Inc. Form 10-K -

Page 16

-

Page 17

... number 1-8787 For the fiscal year ended December 31, 2014 American International Group, Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 175 Water Street, New York, New York (Address of principal executive offices... -

Page 18

-

Page 19

...• Results of Operations • Investments • Insurance Reserves • Liquidity and Capital Resources • Enterprise Risk Management • Critical Accounting Estimates • Glossary • Acronyms Quantitative and Qualitative Disclosures about Market Risk Financial Statements and Supplementary Data Index... -

Page 20

... most international markets; Effective capital management of the largest shareholders' equity of any insurance company in the world*, supported by enhanced risk management; Execution of strategic objectives, such as our focus on growth of higher value lines of business to increase profitability and... -

Page 21

... and Other category. Commercial Insurance has three operating segments: Property Casualty, Mortgage Guaranty and Institutional Markets. Consumer Insurance also has three operating segments: Retirement, Life and Personal Insurance. The Corporate and Other category consists of businesses and items not... -

Page 22

...Completed sale of International Lease Finance Corporation (ILFC) to AerCap Ireland Limited, a wholly-owned subsidiary of AerCap Holdings N.V. (AerCap) Dividends and loan repayments in the form of cash and fixed maturity securities from insurance subsidiaries Growth in book value per share excluding... -

Page 23

... GENERATE REVENUES AND PROFITABILITY We earn revenues primarily from insurance premiums, policy fees from universal life insurance and investment products, and income from investments and advisory fees. Our operating expenses consist of policyholder benefits and losses incurred, interest credited to... -

Page 24

...range of products to customers through a diversified, multichannel distribution network. Customers value Commercial Insurance's strong capital position, extensive risk management and claims experience, and its ability to be a market leader in critical lines of insurance business. Consumer Insurance... -

Page 25

... life insurance policies, group benefit policies and deposits on life-contingent payout annuities, as well as deposits received on universal life, investment-type annuity contracts and mutual funds. See Item 7. MD&A - Results of Operations for Institutional Markets, Retirement and Life for... -

Page 26

...* Represents revenues from insurance operations. Revenues for Property Casualty, Mortgage Guaranty, and Personal Insurance include net premiums earned and net investment income. Revenues for Institutional Markets, Retirement and Life include premiums, policy fees, net investment income and advisory... -

Page 27

...I AL I N S U R AN C E Commercial Insurance Business Strategy Customer: Strive to be our customers' most valued insurer by offering innovative products, superior service and access to an extensive global network. Strategic Growth: Grow our higher-value businesses while investing in transformative... -

Page 28

..., high net worth products, corporate- and bank-owned life insurance and GICs. A Look at Commercial Insurance Property Casualty conducts its business primarily through our Non-Life Insurance Companies, which include National Union; American Home; Lexington; Fuji Fire; American Home Japan; AIG Asia... -

Page 29

...the U.S. In international markets, Property Casualty competes for business with the foreign insurance operations of large global insurance groups and local companies in specific market areas and product types. Mortgage Guaranty competes with several private providers of mortgage insurance, both well... -

Page 30

... E Commercial Insurance Competitive Strengths and Challenges Our competitive strengths include: Financial strength and market leadership - a well capitalized, strong balance sheet highly valued by customers that allows us to be a market leader in certain lines of business Underwriting and claims... -

Page 31

... and tools for multiple operating segments to increase competitiveness, improve service and product capabilities and facilitate delivery of our target customer experience. Investment Strategy: Maintain a diversified, high quality portfolio of fixed maturity securities that largely matches the... -

Page 32

... as identity theft and credit card protection. Products are distributed through various channels, including agents, brokers and direct marketing. Personal Insurance also provides insurance for high-net-worth individuals offered through AIG Private Client Group, including auto, homeowners, umbrella... -

Page 33

... mutual funds, banks and other life and property casualty insurance companies. Competition is primarily based on product pricing and design, distribution, financial strength, customer service and ease of doing business. Consumer Insurance competes based on its long-standing market leading positions... -

Page 34

... portfolio of retirement, life insurance and personal insurance products offered through multiple distribution networks Market leader - long-standing, leading positions in many of our product lines and key distribution channels Global footprint - ability to selectively pursue international growth... -

Page 35

... initiatives, certain compensation plan expenses, corporate level net realized capital gains and losses, certain litigation-related charges and credits, net gain (loss) on sale of divested businesses that did not meet the criteria for discontinued operations accounting treatment, and equity in the... -

Page 36

...-Life Insurance Companies' reserves are for the U.S. commercial casualty class, including excess casualty, asbestos and environmental, which tends to involve longer periods of time for the reporting and settlement of claims than other types of insurance and therefore may increase the inherent risk... -

Page 37

... losses settled or re-estimated in 2014, but incurred in 2011, is included in the cumulative development amount for years 2011, 2012 and 2013. Any increase or decrease in the estimate is reflected in operating results in the period in which the estimate is changed. The middle of the table shows Net... -

Page 38

...MD&A - Insurance Reserves - Non-Life Insurance Companies- Asbestos and Environmental Reserves. The Liability for unpaid losses and loss adjustment expenses as reported in our Consolidated Balance Sheet at December 31, 2014 differs from the total reserves reported in the annual statements filed with... -

Page 39

... three-year tranches). As of January 2015, our outstanding catastrophe bond issuances result in us having $925 million of indemnity reinsurance protection outstanding in the capital markets. See Item 7. MD&A - Enterprise Risk Management - Insurance Operations Risks - Non-Life Insurance Companies Key... -

Page 40

... the U.S. securities and security-based swap markets, U.S. mutual funds, U.S. broker-dealers and U.S. investment advisors. Principal regulator of the mutual funds offered by our broker-dealer subsidiaries. The SEC is in the process of implementing rules and regulations governing reporting, execution... -

Page 41

... international business activities of IAIGs. In connection with ComFrame, the IAIS is in the process of developing a risk-based global insurance capital standard applicable to IAIGs. AIG currently meets the parameters set forth to define an IAIG. European Union (EU): Certain financial services firms... -

Page 42

... the financial markets generally, impact our businesses, results of operations, cash flows or financial condition, or require us to raise additional capital or result in a downgrade of our credit ratings. In 2014, the FRB conducted a quantitative impact study to evaluate the potential effects of... -

Page 43

...of default and presents a systemic risk to U.S. financial stability. • Dodd-Frank provides for significantly increased regulation of and restrictions on derivatives markets and transactions that could affect various activities of AIG and its insurance and financial services subsidiaries, including... -

Page 44

... have to take account of the amounts paid by us into state guaranty funds). We cannot predict whether these actions will become effective or the effect they may have on the financial markets or on our business, results of operations, cash flows, financial condition and credit ratings. However, it is... -

Page 45

..., periodic examinations of the affairs of insurance companies, the form and content of reports of financial condition required to be filed, reserves for unearned premiums, losses and other purposes and enterprise risk management and corporate governance requirements. In general, such regulation is... -

Page 46

...TE M 1 / BUSINESS The NAIC's Model Regulation "Valuation of Life Insurance Policies" (Regulation XXX) requires insurers to establish additional statutory reserves for term life insurance policies with long-term premium guarantees and universal life policies with secondary guarantees (ULSGs). NAIC... -

Page 47

... Governance, Compensation and Management Resources, Risk and Capital, Regulatory, Compliance and Public Policy, and Technology Committees • Corporate Governance Guidelines (which include Director Independence Standards) • Director, Executive Officer and Senior Financial Officer Code of Business... -

Page 48

... market events, such as the global financial crisis during 2008 and 2009, have at times led, and could in the future lead, to a lack of liquidity, highly volatile markets, a steep depreciation in asset values across all classes, an erosion of investor and public confidence, and a widening of credit... -

Page 49

... result in changes to investment valuations that may materially adversely affect our results of operations, financial condition and liquidity. During periods of market disruption, it may be difficult to value certain of our investment securities if trading becomes less frequent and/or market data... -

Page 50

... for long-tail casualty lines of business. These include, but are not limited to, general liability, commercial automobile liability, environmental, workers' compensation, excess casualty and crisis management coverages, insurance and risk management programs for large corporate customers and... -

Page 51

... losses in certain lines of business such as consumer property and consumer casualty. For additional information on our reinsurance recoverable, see Item 7. MD&A - Enterprise Risk Management - Insurance Operations Risks - Reinsurance Recoverable. LIQUIDITY, CAPITAL AND CREDIT AIG Parent's ability... -

Page 52

...certain structured securities, private company securities, investments in private equity funds and hedge funds, mortgage loans, finance receivables and real estate. Collectively, investments in these assets had a fair value of $60 billion at December 31, 2014. Adverse real estate and capital markets... -

Page 53

...an increase in the liabilities associated with the guaranteed benefits, reducing our net income and shareholders' equity. See Notes 5 and 14 to the Consolidated Financial Statements and Item 7. MD&A - Critical Accounting Estimates for more information regarding these products. Indemnity claims could... -

Page 54

... functions, including providing insurance quotes, processing premium payments, making changes to existing policies, filing and paying claims, administering variable annuity products and mutual funds, providing customer support and managing our investment portfolios. Systems failures or outages could... -

Page 55

...acquisitions. Risks resulting from future acquisitions may have a material adverse effect on our results of operations and financial condition. REGULATION Our businesses are heavily regulated and changes in regulation may affect our operations, increase our insurance subsidiary capital requirements... -

Page 56

... effect on our financial condition and results of operations. The NAIC Model Regulation "Valuation of Life Insurance Policies" (Regulation XXX) requires insurers to establish additional statutory reserves for term life insurance policies with long-term premium guarantees and universal life policies... -

Page 57

...of term and universal life insurance products are not successful, we may incur higher operating costs or our sales of these products may be affected. New regulations promulgated from time to time may affect our businesses, results of operations, financial condition and ability to compete effectively... -

Page 58

... of business with existing customers and counterparties. General insurance and life insurance companies compete through a combination of risk acceptance criteria, product pricing, and terms and conditions. Retirement services companies compete through crediting rates and the issuance of guaranteed... -

Page 59

..., capital management and business. Further, the adoption of a new insurance contracts standard as well as other future accounting standards could have a material effect on our reported results of operations and reported financial condition. Changes in our assumptions regarding the discount rate... -

Page 60

... and Winston-Salem, North Carolina Corporate and Other: • 175 Water Street in New York, New York • Livingston, New Jersey • Stowe, Vermont • Ft. Worth, Texas In addition, Non-Life Insurance Companies own offices in approximately 20 foreign countries and jurisdictions including Argentina... -

Page 61

ITEM 3 / LEGAL PROCEEDINGS For a discussion of legal proceedings, see Note 16 - Contingencies, Commitments and Guarantees to the Consolidated Financial Statements, which is incorporated herein by reference. ITEM 4 / MINE SAFETY DISCLOSURES Not applicable. 44 -

Page 62

... on the payment of dividends to AIG by some of its insurance subsidiaries, see Item 1A. Risk Factors - Liquidity, Capital and Credit - AIG Parent's ability to access funds from our subsidiaries is limited, and Note 20 to the Consolidated Financial Statements. EQUITY COMPENSATION PLANS Our table... -

Page 63

... repurchase transactions or otherwise. The timing of any future share repurchases will depend on market conditions, our financial condition, results of operations, liquidity and other factors. See Note 17 to the Consolidated Financial Statements for additional information on AIG share purchases. 46 -

Page 64

...shareholder return on AIG Common Stock for a five-year period (December 31, 2009 to December 31, 2014) with the cumulative total return of the S&P's 500 stock index (which includes AIG) and a peer group of companies consisting of 15 insurance companies to which we compare our business and operations... -

Page 65

...S Five-Year Cumulative Total Shareholder Returns Value of $100 Invested on December 31, 2009 Dividend reinvestment has been assumed and returns have been weighted to reflect relative stock market capitalization. 2009 2010 As of December 31, 2011 2012 2013 2014 AIG S&P 500 Peer Group $ 100... -

Page 66

... continuing operations Income (loss) from discontinued operations Net income attributable to AIG Dividends declared per common share Year-end balance sheet data: Total investments Total assets Long-term debt Total liabilities Total AIG shareholders' equity Total equity Book value per share (b) 10... -

Page 67

... released through the Consolidated Statements of Income in 2011. The valuation allowance resulted primarily from losses subject to U.S. income taxes recorded from 2008 through 2010. See Note 24 to the Consolidated Financial Statements for further discussion. Capitalization and Book Value Per Share... -

Page 68

... paid in capital to correct the presentation of components of AIG shareholders' equity. These income tax items related to the creation in 2009 of special purpose vehicles that held our interests in AIA and ALICO. There was no effect on Total AIG shareholders' equity or on Total equity as a result of... -

Page 69

... of this Annual Report on Form 10-K; and • return on equity and earnings per share; • strategies to grow net investment income, efficiently manage capital and reduce expenses; • strategies for customer retention, growth, product development, market position, financial results and reserves; and... -

Page 70

... Summary Strategic Outlook RESULTS OF OPERATIONS Segment Results Commercial Insurance Consumer Insurance Corporate and Other INVESTMENTS Overview Investment Highlights Investment Strategies Investments by Legal Entity Credit Ratings Impairments INSURANCE RESERVES Non-Life Insurance Companies Life... -

Page 71

... • changes in benefit reserves and deferred policy acquisition costs (DAC), value of business acquired (VOBA), and sales inducement assets (SIA) related to net realized capital gains and losses; • other income and expense - net, related to Corporate and Other run-off insurance lines; • loss on... -

Page 72

... and earned on traditional life insurance policies, group benefit policies and life-contingent payout annuities, as well as deposits received on universal life, investment-type annuity contracts and mutual funds. ï,· Corporate and Other - Pre-tax operating income and loss is derived by excluding... -

Page 73

...Insurance and Consumer Insurance reportable segments include the following operating segments: • Commercial property casualty, mortgage guaranty and institutional markets businesses, which were previously reported as components of AIG Property Casualty, Other operations and AIG Life and Retirement... -

Page 74

...our businesses in 2014 compared to 2013, which included growth in policy fees and assets under management primarily from strong sales of variable and index annuities in Retirement, effective crediting rate management, and higher underwriting income in Personal Insurance, primarily from improved loss... -

Page 75

...: Commercial Insurance Property Casualty combined ratio Property Casualty accident year combined ratio, as adjusted Property Casualty net premiums written Mortgage Guaranty domestic first-lien new insurance written Institutional Markets premiums and deposits Consumer Insurance Personal Insurance... -

Page 76

...L E TO AI G ( e xclu des ne t re alize d capit al gai ns and ce rt ain oth e r it ems ) (in millions) P R E - TAX OP E R AT I N G I NC OM E B Y ... O N S H AR E E X C L U D I N G AO C I * Includes operating borrowings of other subsidiaries and consolidated investments and hybrid debt securities. 59 -

Page 77

... Board of Directors declared a cash dividend on AIG Common Stock on February 12, 2015 of $0.125 per share, payable on March 26, 2015 to shareholders of record on March 12, 2015. We received net cash proceeds of approximately $2.4 billion from the sale of ILFC after taking into account the settlement... -

Page 78

... by reducing investment returns. In addition, current market conditions may not necessarily permit insurance companies to increase pricing across all our product lines. AIG Priorities for 2015 AIG is focused on the following priorities for 2015: ï,· ï,· ï,· Improve our focus on our customers to... -

Page 79

... in global economic conditions will continue to challenge the growth of net investment income and limit growth in some markets. Due to these conditions and overcapacity in the property casualty insurance industry, Commercial Insurance has sought to modify terms and conditions, grow profitable... -

Page 80

... risk-based pricing strategy. This pricing strategy provides Mortgage Guaranty's customers with mortgage insurance products that are priced commensurate with the underwriting risk, which we believe will result in an appropriately priced, high-quality book of business. Institutional Markets... -

Page 81

... Commercial Insurance continues to execute capital management initiatives by enhancing broad-based risk tolerance guidelines for its operating units, implementing underwriting strategies to increase return on equity by line of business and reducing exposure to businesses with inadequate pricing... -

Page 82

...annuity industry sales have continued to improve from the very low levels seen in 2013, as baby boomers approaching retirement continue to seek financial solutions that can provide guaranteed income, and customers are now more willing to purchase non-guaranteed return of premium products with market... -

Page 83

... of volatility control funds. Retirement Income Solutions has a dynamic risk management hedging program and continues to invest in market risk management. Strategies to diversify the Retirement Income Solutions product portfolio include growing sales of fixed index annuities with guarantee features... -

Page 84

...travel insurance coverage, as well as customized insurance solutions for high net worth individuals through AIG Private Client Group. As part of our strategy to expand consumer operations in growth economies, on May 29, 2013, we entered into a joint venture agreement with PICC Life Insurance Company... -

Page 85

... and capital efficiency within our insurance entities through disciplined pricing, inforce profitability management and effective management of risk. Volatility risk controls including required minimum allocations to fixed and volatility control accounts, rider fees indexed to an equity market... -

Page 86

... operations: Years Ended December 31, (in millions) Revenues: Premiums Policy fees Net investment income Net realized capital gains Aircraft leasing revenue Other income Total revenues Benefits, losses and expenses: Policyholder benefits and losses incurred Interest credited to policyholder account... -

Page 87

...) loss from divested businesses, including gain on the sale of ILFC Legal reserves (settlements) related to legacy crisis matters Non-qualifying derivative hedging (gains) losses, excluding net realized capital gains After-tax operating income attributable to AIG Weighted average diluted shares... -

Page 88

... Consolidated Financial Statements. Years Ended December 31, (in millions) Commercial Insurance Consumer Insurance* Corporate and Other Consolidations, eliminations and other adjustments Pre-tax operating income Changes in fair values of fixed maturity securities designated to hedge living benefit... -

Page 89

... Markets and Retirement operating segments, totaling $1.5 billion in 2013 and $1.2 billion in 2012, that was attributable primarily to investment sales related to capital loss carryforward utilization with reinvestment of the sales proceeds at lower yields. Change in certain benefit reserves... -

Page 90

...Markets, Consumer Insurance - Retirement and Consumer Insurance - Life, net investment income is attributed based on invested assets from segregated product line portfolios. Invested assets in excess of liabilities are allocated to product lines based on internal capital estimates. Property Casualty... -

Page 91

... in net investment income. The decrease in underwriting loss was primarily due to an increase in production, lower charges due to changes in discount for workers' compensation reserves as discussed further under Insurance Reserves - Non-Life Insurance Companies- Discounting of Reserves, lower... -

Page 92

... investment income is also due to a reduction in net loss reserves. See MD&A - Investments for additional information on the Non-Life Insurance Companies invested assets, investment strategy, and asset-liability management process. 2013 and 2012 Comparison Pre-tax operating income increased in 2013... -

Page 93

... Casualty net premiums written increased in 2014 compared to 2013, reflecting increases in new business related to targeted growth products in Property and Financial lines. Casualty net premiums written decreased in 2014 compared to 2013 primarily due to the effect on renewals from our strategy... -

Page 94

... markets in the Americas region. Financial lines net premiums written increased in 2014, compared to 2013 reflecting growth in new business related to targeted growth products across all regions, as well as a favorable rate environment in the U.S. 2013 and 2012 Comparison Casualty net premiums... -

Page 95

... Change in Years Ended December 31, (in millions) Percentage Change in Original Currency 2014 vs. 2013 (2)% 5 7 1 % 2013 vs. 2012 3 % 11 4 4 % U.S. dollars 2014 $ 2013 2012 2014 vs. 2013 (2)% 8 1 % 2013 vs. 2012 2 % 1 4 3 % Property Casualty: Americas Asia Pacific EMEA Total net premiums written... -

Page 96

... written in 2013 compared to 2012. EMEA net premiums written increased in 2013 compared to 2012, due to new business growth, particularly in Property and Financial lines, and a change in reinsurance strategies to retain more favorable risks in those lines. Property Casualty Underwriting Ratios... -

Page 97

... points of the accident year loss ratio, as adjusted, in both 2014 and 2013. The acquisition ratio decreased by 0.4 points in 2014 compared to 2013, primarily due to a reduction in expenses of personnel engaged in sales support activities, lower premium taxes and guaranty fund and other assessments... -

Page 98

... of our strategy to enhance risk selection, pricing discipline, exposure management and claims processing. Although the execution of these strategies resulted in a reduction of Casualty net premiums written in both the Americas and EMEA regions, it also improved the accident year loss ratio, as... -

Page 99

... fewer new delinquencies, favorable prior year loss reserve development, and higher cure rates. In addition, first-lien pre-tax operating income increased due to a $119 million increase in first-lien net premiums earned in 2014 compared to 2013, largely from growth in the book of business, higher... -

Page 100

... increase in new insurance written related to the increase in mortgage originations resulting from the addition and expansion in distribution channels. General operating expenses increased in 2013 compared to 2012 due to increased servicing costs related to the growth in the in-force business. Other... -

Page 101

... the Mortgage Guaranty combined ratios based on GAAP data: Years Ended December 31, Loss ratio Acquisition ratio General operating expense ratio Expense ratio Combined ratio 2014 24.7 7.8 17.3 25.1 49.8 2013 63.5 9.9 17.5 27.4 90.9 2012 92.2 9.5 17.5 27.0 119.2 Increase (Decrease) 2014 vs. 2013 2013... -

Page 102

...Change 2012 2014 vs. 2013 2013 vs. 2012 458 102 2,066 1,432 571 3 39 56 525 (29)% 65 (6) (14) (1) (17) 3 (1) 33 % 11 1 13 (28) 33 (8) 14 30 Revenues: Premiums Policy fees Net investment income Benefits and expenses: Policyholder benefits and losses incurred Interest credited to policyholder account... -

Page 103

... in pre-tax operating income compared to 2012. Stable value wrap notional assets under management grew to $24.6 billion at December 31, 2013 from $10.4 billion at December 31, 2012, including the notional amount of contracts transferred from an AIG affiliate. Net investment income for 2013 increased... -

Page 104

... Insurance Results The following table presents Consumer Insurance results: Years Ended December 31, (in millions) Revenues: Premiums Policy fees Net investment income Other income Benefits and expenses: Policyholder benefits and losses incurred Interest credited to policyholder account balances... -

Page 105

... crediting rate management. See Spread Management below for additional discussion. General operating expenses increased in 2014 compared to 2013, due in part to technology investments and the volume of continued sales growth of annuities in the Retirement Income Solutions and Fixed Annuities product... -

Page 106

... capital loss carryforwards. The base investment spread rates for the Fixed Annuities and Group Retirement product line improved in 2013 compared to 2012 as a result of our disciplined pricing and management of renewal crediting rates. Disciplined pricing on new business is used to pursue new sales... -

Page 107

... Income Solutions product lines. Retirement Premiums and Deposits, Surrenders and Net Flows Premiums For Retirement, premiums primarily represent amounts received on life-contingent payout annuities. Premiums and deposits is a non-GAAP financial measure that includes, in addition to direct... -

Page 108

... table presents Retirement premiums and deposits and net flows by product line: Years Ended December 31, (in millions) Fixed Annuities Retirement Income Solutions Retail Mutual Funds Group Retirement Total Retirement premiums and deposits* Years Ended December 31, (in millions) $ $ 2014 3,578... -

Page 109

.... Retirement Income Solutions premiums and deposits and net flows increased significantly in 2014 compared to 2013, and in 2013 compared to 2012, reflecting a continued high volume of variable and index annuity sales, which have benefitted from consumer demand for retirement products with guaranteed... -

Page 110

... for certain long-term care business. These decreases were partially offset by a $28 million increase in pre-tax operating income in 2014 compared to 2013, due to a 2013 increase in equityindexed universal life reserves, which was reflected in Interest credited to policyholder account balances. 93 -

Page 111

... investments in technology and service platforms in the U.S. and Japan. 2013 and 2012 Comparison Pre-tax operating income increased in 2013 compared to 2012, primarily due to additional expenses recorded in 2012, which included $67 million of loss recognition reserves for long-term care products... -

Page 112

... and group benefit policies. Premiums and deposits for Life is a non-GAAP financial measure that includes direct and assumed premiums as well as deposits received on universal life insurance. The following table presents a reconciliation of Life premiums and deposits to GAAP premiums: Years Ended... -

Page 113

...millions) 2014 and 2013 Comparison Pre-tax operating income increased in 2014 compared to 2013, primarily due to a decrease in current accident year losses and lower general operating expenses, partially offset by higher catastrophe losses and lower net favorable prior year loss reserve development... -

Page 114

... investment income was also due to a reduction in net loss reserves. See MD&A - Investments for additional information on the Non-Life Insurance Companies invested assets, investment strategy, and asset-liability management process. 2013 and 2012 Comparison Pre-tax operating income increased in 2013... -

Page 115

... distribution channels. A&H net premiums written, excluding the effect of foreign exchange, increased slightly in 2013 compared to 2012, primarily due to our focused strategy to grow sales through the direct marketing distribution channel, individual A&H in Asia Pacific, and the travel business... -

Page 116

..., net premiums written increased primarily due to our focused strategy to grow sales through the direct marketing distribution channel. The expansion of business in Asia Pacific countries outside of Japan was driven by an increase in individual personal accident insurance and personal lines products... -

Page 117

... Personal Insurance combined ratios based on GAAP data and reconciliation to the accident year combined ratio, as adjusted: Years Ended December 31, Loss ratio Catastrophe losses and reinstatement premiums Prior year development net of premium adjustments Net reserve discount benefit Accident year... -

Page 118

... premiums Total catastrophe-related charges * Catastrophes are generally weather or seismic events having a net impact on Personal Insurance in excess of $10 million each. Severe Losses* Years Ended December 31, (in millions) 2014 2013 2012 # of Events Americas 4 $ 50 $ 1 $ 17 $ 4 $ 13 $ Asia... -

Page 119

... Direct Investment book Global Capital Markets Run-off insurance Lines Other businesses AIG Parent and Other: Equity in pre-tax operating earnings of AerCap(b) Fair value earnings on PICC Group shares(c) Corporate expenses, net: Other income (expense), net General operating expenses Total Corporate... -

Page 120

... PICC Group to AIG Parent. Direct Investment Book Results 2014 and 2013 Comparison DIB pre-tax operating income decreased in 2014 compared to 2013 primarily due to lower fair value appreciation on assetbacked security (ABS) collateralized debt obligations (CDOs) and declines in net credit valuation... -

Page 121

... D O TH E R Global Capital Markets Results 2014 and 2013 Comparison GCM's pre-tax operating income decreased in 2014 compared to 2013 primarily due to declines in unrealized market valuation gains related to the super senior credit default swap (CDS) portfolio and declines in net credit valuation... -

Page 122

...businesses' pre-tax operating income improved in 2014 compared to 2013 due to an increase in gains on investments in life settlements resulting from higher net death benefits. 2013 and 2012 Comparison Other businesses' pre-tax operating loss in 2013 was essentially flat compared to 2012. AIG Parent... -

Page 123

... to benefit from equity market performance. Blended investment yields on new Non-Life and Life Insurance Companies' investments were lower than blended rates on investments that were sold, matured or called. Other-than-temporary impairments remained at low levels. The sale of ILFC to AerCap resulted... -

Page 124

... changes in fair value of certain fixed maturity securities where the fair value option has been elected and which are used to economically hedge the interest rate risk in GMWB embedded derivatives. For the years ended December 31, 2014, 2013 and 2012, the net investment income (loss) recorded... -

Page 125

... securities portfolio due to the low interest rate environment. Net investment income for 2013 decreased compared to 2012 primarily due to fair value gains from our investments in ML II, ML III and AIA prior to their sale in 2012. Non-Life Insurance Companies For the Non-Life Insurance Companies... -

Page 126

... monitor fixed income markets, including the level of interest rates, credit spreads and the shape of the yield curve. The Life Insurance Companies frequently review their interest rate assumptions and actively manages the crediting rates used for their new and in-force business. Business strategies... -

Page 127

...foreign-issued securities. Our Credit Risk Management department closely reviews the credit quality of the foreign portfolio's non-rated fixed maturity securities. At December 31, 2014, approximately 17 percent of such investments were either rated AAA or, on the basis of our internal analysis, were... -

Page 128

... Risk Management herein for a discussion of credit risks associated with Investments. The following table presents the composite AIG credit ratings of our fixed maturity securities calculated on the basis of their fair value: Available for Sale December 31, (in millions) Rating: Other fixed... -

Page 129

... below investment grade or not rated totaled $35.1 billion and $32.6 billion, respectively. The following table presents the fair value of our aggregate credit exposures to non-U.S. governments for our fixed maturity securities: (in millions) Japan Canada Germany Mexico United Kingdom Netherlands... -

Page 130

...,787 Financial institutions: Money Center /Global Bank Groups Regional banks - other Life insurance Securities firms and other finance companies Insurance non-life Regional banks - North America Other financial institutions Utilities Communications Consumer noncyclical Capital goods Energy Consumer... -

Page 131

... 623 $ Fair Value at December 31, 2013 2,371 2,375 5,736 1,843 23,823 36,148 2,259 2,164 3,860 1,797 2,136 12,216 37 10,894 10,931 2,386 2,386 27 202 1,876 9 7,944 10,058 557 (in millions) Total RMBS 2014 2013 2012 2011 2010 2009 and prior* Total RMBS Agency 2014 2013 2012 2011 2010 2009 and prior... -

Page 132

... table presents our RMBS available for sale investments by credit rating: Fair Value at December 31, 2014 Fair Value at December 31, 2013 (in millions) Rating: Total RMBS AAA AA A BBB Below investment grade(a) Non-rated (b) Total RMBS Agency RMBS AAA AA Total Agency Alt-A RMBS AAA AA A BBB Below... -

Page 133

...fair value of our CMBS available for sale investments by rating agency designation and by vintage year: Below Investment Grade (in millions) AAA AA A BBB Non-Rated Total December 31, 2014 Year: 2014 2013 2012 2011 2010 2009 and prior Total December 31, 2013 Year: 2013 2012 2011 2010 2009 and... -

Page 134

...$ Fair Value at December 31, 2013 3,205 3,146 2,643 1,023 621 844 11,482 (in millions) Industry: Office Retail Multi-family* Lodging Industrial Other Total * Includes Agency-backed CMBS. $ $ The fair value of CMBS holdings remained stable throughout 2014. The majority of our investments in CMBS... -

Page 135

...table presents the commercial mortgage loan exposure by location and class of loan based on amortized cost: Number of Loans Class Retail Industrial Percent of Total Total (dollars in millions) Apartments Offices Hotel Others December 31, 2014 State: New York California New Jersey Florida Texas... -

Page 136

... on fixed maturity securities, equity securities, private equity funds and hedge funds. Other-than-temporary impairment charges by reportable segment and impairment type: Non-Life Insurance Companies Life Insurance Companies Corporate and Other Operations (in millions) Total For the Year Ended... -

Page 137

...on private equity funds, hedge funds and direct private equity investments. Other-than-temporary impairment charges by investment type and credit rating: (in millions) RMBS CDO/ABS CMBS Other Fixed Maturity Equities/Other Invested Assets* Total For the Year Ended December 31, 2014 Rating: AAA... -

Page 138

...direct private equity investments. We recorded other-than-temporary impairment charges in the years ended December 31, 2014, 2013 and 2012 related to: • issuer-specific credit events; • securities for which we have changed our intent from hold to sell; • declines due to foreign exchange rates... -

Page 139

... CUSIP by subsidiary. Change in Unrealized Gains and Losses on Investments The change in net unrealized gains and losses on investments in 2014 was primarily attributable to increases in the fair value of fixed maturity securities. For 2014, net unrealized gains related to fixed maturity and equity... -

Page 140

...) International Workers' compensation (net of discount) Other liability claims made Property Auto liability Products liability Medical malpractice Mortgage guaranty / credit Accident and health Commercial multiple peril Aircraft Fidelity/surety Other Total * Presented by lines of business pursuant... -

Page 141

...555 U.S. workers' compensation: Tabular Non-tabular Asbestos Total reserve discount $ $ The following table presents the net reserve discount benefit (charge): Years Ended December 31, Property (in millions) Change in loss reserve discount - current accident year Change in loss reserve discount... -

Page 142

... the effect of commutations and accelerated settlements for certain excess workers' compensation reserves, as well as accretion. The change in rates used for discounting was the largest driver of the charge as Treasury rates fell along the entire payout pattern horizon during 2014, and accounted for... -

Page 143

... losses and loss expenses for prior years, net of reinsurance, by business unit and major class of business: Years Ended December 31, (in millions) 2014 2013 2012 Prior accident year development by major class of business: Property Casualty - U.S. & Canada: Excess casualty Financial lines... -

Page 144

... premium adjustments of $105 million, was $598 million, which was driven by reserve increases on claims in Commercial Insurance and Other - U.S. The net adverse prior year loss reserve development in Commercial Insurance was driven by Primary Casualty, Environmental, International Financial Lines... -

Page 145

... five years now accounting for just four percent of the gross written premiums of the book. The new business written continues to meet risk adjusted profitability targets after the increased estimates of ultimate losses for the more recent accident years. In 2013, our analysis of pollution products... -

Page 146

... California business, our tail factor increases were in response to changing long-term medical development patterns. In New York, there has been a lengthening of the period between the date of accident and the classification of non-scheduled permanent partial injuries. We completed a review of claim... -

Page 147

... of primary workers' compensation, which indicated that prior year loss reserve development was flat after taking into account the initiatives that our claim function has undertaken to manage high risk claims. During 2013, for primary general liability, we increased our reserves for prior years by... -

Page 148

...the application of the refined segmentation was slightly lower than that adopted for the 2011 review reflecting the continued favorable emergence from the class of business Financial Lines - International Our Global Financial Lines Claims unit has implemented its target operating model in Europe and... -

Page 149

... International Accident & Health and U.S. Warranty. Mortgage Guaranty Mortgage Guaranty business includes domestic first liens (93 percent of total reserves) and small run-off books in second liens, student loans and international. During 2014, we recognized $104 million of favorable prior year loss... -

Page 150

...and loss adjustment expenses for prior years, net of reinsurance, by accident year: Years Ended December 31, (in millions) 2014 2013 2012 Prior accident year development by accident year: Accident Year 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 and prior (see table below) Total prior year... -

Page 151

... from policy year premium charges. (c) Includes loss development on excess of deductible exposures in workers' compensation, general liability and commercial auto. (d) Includes results of comprehensive specific large claim file reviews initiated in 2012 and updated in 2013 and 2014. (e) The effects... -

Page 152

..., a subsidiary of the retrocessionaire for our retroactive reinsurance contract completed a ground-up asbestos study for the largest accounts it assumed. As a result, we increased gross asbestos loss reserves by $169 million and net asbestos loss reserves by $6 million. The net reserve increase also... -

Page 153

...2011, we completed a transaction under which the bulk of AIG Property Casualty's net domestic asbestos liabilities were transferred to National Indemnity Company (NICO), a subsidiary of Berkshire Hathaway, Inc. This was part of our ongoing strategy to reduce our overall loss reserve development risk... -

Page 154

... accounts that we believe have already been reserved to their limit of liability or certain other ancillary asbestos exposure assumed by AIG Property Casualty subsidiaries. Upon the closing of this transaction, but effective as of January 1, 2011, we ceded the bulk of AIG Property Casualty's net... -

Page 155

... well as loss recognition expense to increase reserves for certain traditional blocks of business. See Critical Accounting Estimates - Estimated Gross Profits for Investment-Oriented Products, Critical Accounting Estimates - Future Policy Benefits for Life and Accident and Health Insurance Contracts... -

Page 156

..., by product line: Years Ended December 31, (in millions) 2014 2013 2012 Unlocking of estimated gross profit assumptions: Consumer Insurance: Retirement Fixed Annuities Retirement Income Solutions Group Retirement Total Retirement Life Commercial Insurance: Institutional Markets Total increase... -

Page 157

...Results of Operations: Years Ended December 31, (in millions) Policy fees Interest credited to policyholder account balances Amortization of deferred policy acquisition costs Policyholder benefits and losses incurred Increase in pre-tax operating income Change in DAC related to net realized capital... -

Page 158

... Total insurance reserves Retirement: Balance at beginning of year, gross Premiums and deposits Surrenders and withdrawals Death and other contract benefits Subtotal Change in fair value of underlying assets and reserve accretion, net of policy fees Cost of funds Other reserve changes Balance at end... -

Page 159

... insurance reserves Total Life Insurance Companies: Balance at beginning of year, gross Premiums and deposits Surrenders and withdrawals Death and other contract benefits Subtotal Change in fair value of underlying assets and reserve accretion, net of policy fees Cost of funds Other reserve changes... -

Page 160

... on certain long-term payout annuity contracts in the Institutional Markets and Retirement segments, of $30 million in 2014, $1.5 billion in 2013 and $1.2 billion in 2012, which was not reflected in pre-tax operating income. Shadow loss reserves of the Life Insurance Companies were not significant... -

Page 161

...in dividends and loan repayments in the form of cash and fixed maturity securities from our Life Insurance Companies, which included approximately $829 million of legal settlement proceeds. AIG Parent also received a net amount of $1.0 billion in tax sharing payments from our insurance businesses in... -

Page 162

... in restricted cash Change in policyholder contract balances Repayments of long-term debt Repayment of Department of Treasury SPV Preferred Interests Purchases of AIG Common Stock Net cash used in other financing activities Total uses Effect of exchange rate changes on cash Increase (decrease) in... -

Page 163

... year. Cash provided by operating activities of our Life Insurance Companies was $4.4 billion in 2014, $4.3 billion in 2013 and $2.9 billion in 2012. The increase in 2013 compared to 2012 was primarily due to higher pre-tax operating income and higher proceeds from legal settlements with financial... -

Page 164

... in the form of cash, short-term investments and publicly traded, intermediate-term investment grade rated fixed maturity securities. Fixed maturity securities consist of U.S. government and government sponsored entity securities, U.S. agency mortgage-backed securities, and corporate and municipal... -

Page 165

... that capital associated with businesses or investments that do not directly support our core insurance operations may be available for distribution to shareholders or deployment towards liability management upon its monetization. In developing plans to distribute capital, AIG considers a number of... -

Page 166

... 31, 2014, which supports the 2014 and 2015 years of account, was satisfied with a letter of credit issued under the facility. AIG generally manages capital between AIG Parent and our Non-Life Insurance Companies through internal, Board-approved policies and guidelines. In addition, AIG Parent is... -

Page 167

... fixed maturity securities, to AIG Parent in January 2015, which represented the remainder of dividends that were declared by our domestic operating Life Insurance Companies in the fourth quarter of 2014. Other Operations Direct Investment Book The DIB portfolio is being wound down and is managed... -

Page 168

... 31, 2014 and 2013, GCM had total assets of $4.5 billion and $7.7 billion, respectively, and total liabilities of $3.1 billion as of both dates. GCM's assets consist primarily of cash, short-term investments, other receivables, net of allowance, and unrealized gains on swaps, options and forwards... -

Page 169

... reserves Insurance and investment contract liabilities Borrowings Interest payments on borrowings Operating leases Other long-term obligations(a) Total(b) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ (a) Primarily includes contracts to purchase future services and other capital... -

Page 170

... contract deposits included in the Consolidated Balance Sheets. We believe that our Life Insurance Companies have adequate financial resources to meet the payments actually required under these obligations. These subsidiaries have substantial liquidity in the form of cash and short-term investments... -

Page 171

... our Life Insurance Companies. Excludes potential amounts for indemnification obligations included in asset sales agreements. See Note 10 to the Consolidated Financial Statements for further information on indemnification obligations. (b) Includes commitments to invest in private equity funds, hedge... -

Page 172

... at fair value Total AIG/DIB borrowings supported by assets Total debt issued or guaranteed by AIG Debt not guaranteed by AIG: Other subsidiaries notes, bonds, loans and mortgages payable Debt of consolidated investments Total debt not guaranteed by AIG Total debt $ (d) (a) December 31, 2013 $ 14... -

Page 173

... 2015 250 $ 157 7 414 $ Fourth Quarter 2015 846 $ 164 7 1,017 $ (in millions) AIG general borrowings AIG/DIB borrowings supported by assets Other subsidiaries notes, bonds, loans and mortgages payable Total $ Total 1,097 883 38 2,018 $ See Note 15 to the Consolidated Financial Statements... -

Page 174

...be required to make, depends on market conditions, the fair value of outstanding affected transactions and other factors prevailing at the time of the downgrade. For a discussion of the effects of downgrades in the financial strength ratings of our insurance companies or our credit ratings, see Note... -

Page 175

... transactions or otherwise. The timing of any future share repurchases will depend on market conditions, our financial condition, results of operations, liquidity and other factors. Dividend Restrictions Payments of dividends to AIG by its insurance subsidiaries are subject to certain restrictions... -

Page 176

... each policy to support risk governance at our corporate level as well as in each business unit. We review our governance and committee structure on a regular basis and make changes as appropriate to continue to effectively manage and govern our risks and risk-taking. Our Board of Directors oversees... -

Page 177

... ensures applicable governance structures are established to provide oversight of operational risk at each business unit and corporate function. The ORC also reviews aggregate firm-wide operational risk reports and provides a forum for senior management to assess our operational risk profile... -

Page 178

... ensuring timely oversight and enforceability; • Defining a consistent and transparent approach to limits governance from the group-level to regional entities; and • Alignment with Risk Appetite Statement, where applicable. To support the monitoring and management of AIG's and its business units... -

Page 179

... risk may also result from a downgrade of a counterparty's credit ratings or a widening of its credit spreads. We devote considerable resources to managing our direct and indirect credit exposures. These exposures may arise from, but are not limited to fixed income investments, equity securities... -

Page 180

... capital market instruments as well as equity-linked insurance products, including but not limited to index annuities, variable annuities, universal life insurance and variable universal life insurance. Residential and commercial real estate values. Our investment portfolios are exposed to the risk... -

Page 181

...or wage levels. Governance Market risk is managed at the corporate level within ERM through the CMRO, who reports directly to the AIG CRO. The CMRO is supported by a dedicated team of professionals within ERM who work in partnership with the senior management of our finance, treasury and investment... -

Page 182

... from a unit change in a market risk input. Examples of such sensitivities include a one basis point increase in yield on fixed maturity securities, a one basis point increase in credit spreads on fixed maturity securities, and a one percent increase in price on equity securities. Scenario analysis... -

Page 183

... currency-denominated net asset position at December 31, 2014 increased by 16.0 percent, or $1.7 billion, compared to December 31, 2013. The increase was mostly due to a $650 million increase in our Hong Kong dollar position, primarily resulting from the Non-Life Insurance Companies investment in... -

Page 184

...over short-term horizons under both expected and adverse business conditions may create future liquidity shortfalls. Event Funding Risk: Additional funding is required as the result of a trigger event. Event funding risk comes in many forms and may result from a downgrade in credit ratings, a market... -

Page 185

...N T long-term viability and ability to fund our ongoing business, and to meet short-term financial obligations in a timely manner in both normal and stressed conditions. Our Liquidity Risk Management Framework includes a number of liquidity and funding policies and monitoring tools to address AIG... -

Page 186

... levels (policy, line of business, product group, country, individual/group, correlation and catastrophic risk events); • compliance with financial reporting and capital and solvency targets; • use of reinsurance, both internal and third-party; and • review and establishment of reserves... -

Page 187

...and the Life Insurance Companies. Governance Insurance risks are managed at the business unit level within ERM through the business unit chief risk officers, who report directly to the AIG CRO. Oversight is provided by the business unit chief risk officers. The business unit chief risk officers and... -

Page 188

...a key risk faced by the Non-Life Insurance Companies. There is significant uncertainty in factors that may drive the ultimate development of losses compared to our estimates of losses and loss adjustment expenses. We manage this uncertainty through internal controls and oversight of the loss reserve... -

Page 189

...-Life Insurance Companies exposures. Examples of modeled scenarios are conventional bombs of different sizes, anthrax attacks and nuclear attacks. Our largest terrorism exposures are in New York City, and estimated losses are largely driven by the Property and Workers' Compensation lines of business... -

Page 190

... of a proprietary risk quality index. Mortgage Guaranty uses this index to determine an insurability threshold as well as to manage the risk distribution of its new business. Along with traditional mortgage underwriting variables, Mortgage Guaranty's risk-based pricing model uses rating factors such... -

Page 191

... 7. MD&A - Critical Accounting Estimates - Reinsurance Assets for further discussion of reinsurance recoverable. Life Insurance Companies Key Insurance Risks Life Insurance Companies manage these risks through product design, experience monitoring, pricing actions, risk limitations, reinsurance and... -

Page 192

... low interest rate environment. • Equity risk - represents the potential for loss due to changes in equity prices. It affects equity-linked insurance products, including but not limited to index annuities, variable annuities (and associated guaranteed living and death benefits), universal life... -

Page 193

... assets; • valuation of future policy benefit liabilities and timing and extent of loss recognition; • valuation of liabilities for guaranteed benefit features of variable annuity products; • estimated gross profits to value deferred acquisition costs for investment-oriented products... -

Page 194

... net operating losses (NOLs), foreign tax credits (FTCs), capital loss and other carryforwards. These factors include forecasts of future income for each of our businesses and actual and planned business and operational changes, both of which include assumptions about future macroeconomic and AIG... -

Page 195

... importance of any specific assumption can vary by both class of business and accident year. Because actual experience can differ from key assumptions used in establishing reserves, there is potential for significant variation in the development of loss reserves. This is particularly true for long... -

Page 196

...of Loss Reserving Process and Methods The Non-Life Insurance Companies' loss reserves can generally be categorized into two distinct groups. Short-tail classes of business consist principally of property, Personal Insurance and certain casualty classes. Long-tail casualty classes of business include... -

Page 197

... and public health specialists, third party workers' compensation claims adjusters and third party actuarial advisors to help inform our judgments. In 2014, the third party actuarial reviews covered the majority of net reserves held for our Commercial long-tail classes of business, and run-off... -

Page 198

... road safety, public health and cleanup standards; • changes in medical cost trends (inflation, intensity and utilization of medical services) and wage inflation trends • underlying policy pricing, terms and conditions including attachment points and policy limits; • claims handling processes... -

Page 199

... experienced in workers' compensation claims; • Analysis of the potential for future deterioration in medical condition unlikely to be picked up by a claim file review and associated with potentially costly medical procedures (i.e., increases in both utilization and intensity of medical care) over... -

Page 200

... of expected levels of future inflation as measured by the Personal Consumption Expenditure (PCE) Deflator (Health Services Component) published by the U.S. Bureau of Economic Analysis on our ultimate loss costs for medical benefits in the primary workers' compensation class of business. We believe... -

Page 201

... to mitigate our known long-tail environmental exposures through a combination of proactive claim-resolution techniques, including policy buybacks, complete environmental releases, compromise settlements, and, when appropriate, litigation. Known asbestos claims are managed in a similar manner. Over... -

Page 202

...by low frequency and high severity. Expected loss ratio methods are given more weight in the two most recent accident years, whereas loss development methods are given more weight in more mature accident years. For the year-end 2014 loss reserve review, claims projections for accident years 2013 and... -

Page 203

.... For guaranteed cost business, expected loss ratio methods generally are given significant weight only in the most recent accident year. Workers' compensation claims are generally characterized by high frequency, low severity, and relatively consistent loss development from one accident year to the... -

Page 204

...experience limited return-towork opportunities, which moderate the shortening of claim duration that normally accompanies a labor market recovery. In 2014, we also enhanced our analysis by considering our best estimate expectations of inflation (principally, the PCE Deflator for Health Care Services... -

Page 205

... loss ratio methods for excess workers' compensation. For the year-end 2014 loss reserve review, our actuaries supplemented the methods used historically by applying a structural drivers approach to inform their judgment of the ultimate loss costs for open reported claims from accident years 2006... -

Page 206

... loss ratio methods are generally given significant weight only in the most recent accident year. In 2014, we considered the impact of changes in economic activity (real GDP growth) on our emerging experience in the Commercial Auto Liability class of business, particularly business written in... -

Page 207

... Casualty We use expected loss ratio methods for all accident years for catastrophic casualty business. This class of business consists of casualty or financial lines coverage that attach in excess of very high attachment points; thus the claims experience is marked by very low frequency and high... -

Page 208

... claims are not very long-tail in nature; however, they are driven by claim severity. Thus a combination of both development and expected loss ratio methods are used for all but the latest accident year to determine the loss reserves. Frequency/severity methods are not employed due to the high... -

Page 209

... rates of delinquent loans in 2014, particularly in the most recent accident periods that may not continue in 2015. In addition, loans with modifications through government and lender programs may re-default resulting in new losses for Mortgage Guaranty if adverse economic conditions were to return... -

Page 210

... premium and loss transactions in original currency for business written by the Non-Life Insurance Companies internationally. This allows our actuaries to determine the current reserves without any distortion from changes in exchange rates over time. Our actuaries segment the international data... -

Page 211

... of the changes in the loss trends, terms and conditions, claims handling practices, and large loss impact when determining the methods, assumptions and the estimations. This multidisciplinary process engages underwriting, claims, risk management, business unit executives and senior management and... -

Page 212

...historical loss cost trends from prior accident years since the early 1990s, including the potential effect of recent claims relating to the credit crisis, in our judgment, it is reasonably likely that actual loss cost trends applicable to the year-end 2014 loss reserve review for these classes will... -

Page 213

... that actual loss cost trends applicable to the year-end 2014 loss reserve review for excess workers' compensation will range five percent lower or higher than this estimated loss trend. However, given the small volume of business written in these years, the range in reserve estimates as a result of... -

Page 214

... Financial Statements for additional information on reinsurance. Future Policy Benefits for Life and Accident and Health Insurance Contracts (Life Insurance Companies) Long-duration traditional products include whole life insurance, term life insurance, accident and health insurance, longterm care... -

Page 215

... level of rate increases approved by state regulators. The Life operating segment recorded loss recognition expense of $87 million in 2014 and $67 million in 2012 to increase reserves for certain discontinued long-term care business as a result of updated assumptions. Sales of investment securities... -

Page 216

...Estimated Gross Profits for Investment-Oriented Products (Life Insurance) below for sensitivity analysis which includes the sensitivity of reserves for guaranteed benefit features to changes in the assumptions for equity market returns, volatility and mortality. For a further discussion of the risks... -

Page 217

... fair value estimates of the living benefit guarantees include assumptions such as equity market returns, interest rates, market volatility, and policyholder behavior. See Note 14 to the Consolidated Financial Statements for additional information on how we reserve for variable annuity products with... -

Page 218

... on year-end 2014 balances. The effect of changes in net investment spread primarily affects our Fixed Annuities product line. Changes in equity returns, volatility and interest rates primarily impact reserves for guarantee features of variable annuities in our Retirement Income Solutions and Group... -

Page 219

... - Risk Factors - Business and Operations and Notes 5 and 14 to the Consolidated Financial Statements. Impairment Charges Other-Than-Temporary Impairments on Available For Sale Securities At each balance sheet date, we evaluate our available for sale securities holdings with unrealized losses. See... -

Page 220

... Financial Statements for additional information about the measurement of fair value of financial assets and financial liabilities and our accounting policy regarding the incorporation of credit risk in fair value measurements. The following table presents the fair value of fixed maturity and equity... -

Page 221

... of our net worth on a per-share basis. Book Value Per Common Share Excluding AOCI is derived by dividing Total AIG shareholders' equity, excluding AOCI, by Total common shares outstanding. Casualty insurance Insurance that is primarily associated with the losses caused by injuries to third persons... -

Page 222

... on traditional life insurance policies, group benefit policies and deposits on life-contingent payout annuities, as well as deposits received on universal life, investment-type annuity contracts and mutual funds. Prior year development Increase or decrease in estimates of losses and loss adjustment... -

Page 223

...levied against an investor for the early withdrawal of funds from a life insurance or annuity contract, or for the cancellation of the agreement. Surrender rate represents annualized surrenders and withdrawals as a percentage of average account value. Unearned premium reserve Liabilities established... -

Page 224

... Capital Maintenance Agreement CMBS Commercial Mortgage-Backed Securities EGPs Estimated gross profits FASB Financial Accounting Standards Board FRBNY Federal Reserve Bank of New York GAAP Accounting principles generally accepted in the United States of America GMAV Guaranteed Minimum Account Value... -

Page 225

... 7A / QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK The information required by this item is set forth in the Enterprise Risk Management section of Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and is incorporated herein by reference. 208 -

Page 226

... DATA AMERICAN INTERNATIONAL GROUP, INC. INDEX TO FINANCIAL STATEMENTS AND SCHEDULES Page FINANCIAL STATEMENTS Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets at December 31, 2014 and 2013 Consolidated Statements of Income for the years ended December 31, 2014... -

Page 227

... S TE R E D P U B L I C AC C O U N TI N G F I R M REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of American International Group, Inc.: In our opinion, the consolidated financial statements listed in the accompanying index present fairly, in all... -

Page 228

... sale Total assets Liabilities: Liability for unpaid losses and loss adjustment expenses Unearned premiums Future policy benefits for life and accident and health insurance contracts Policyholder contract deposits (portion measured at fair value: 2014 - $1,561; 2013 - $384) Other policyholder funds... -

Page 229

...realized capital gains Total net realized capital gains Aircraft leasing revenue Other income Total revenues Benefits, losses and expenses: Policyholder benefits and losses incurred Interest credited to policyholder account balances Amortization of deferred policy acquisition costs General operating... -

Page 230

AMERICAN INTERNATIONAL GROUP, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in millions) Net income Other comprehensive income (loss), net of tax Change in unrealized appreciation of fixed maturity securities on which other-than-temporary credit impairments were recognized Change in ... -

Page 231

AMERICAN INTERNATIONAL GROUP, INC. CONSOLIDATED STATEMENTS OF EQUITY NonAccumulated Additional Common (in millions) Balance, January 1, 2012 Common stock issued under stock plans Purchase of common stock Net income attributable to AIG or other noncontrolling interests* Other comprehensive income (... -

Page 232

AMERICAN INTERNATIONAL GROUP, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended December 31, (in millions) 2014 $ 7,524 $ 50 2013 9,092 $ (84) 2012 3,700 (1) Cash flows from operating activities: Net income (Income) loss from discontinued operations Adjustments to reconcile net income to ... -

Page 233

...Flow Information Cash paid during the period for: Interest Taxes Non-cash investing/financing activities: Interest credited to policyholder contract deposits included in financing activities Non-cash consideration received from sale of ILFC See accompanying Notes to Consolidated Financial Statements... -

Page 234

... customers through one of the most extensive worldwide property-casualty networks of any insurer. In addition, AIG companies are leading providers of life insurance and retirement services in the United States. AIG Common Stock, par value $2.50 per share (AIG Common Stock), is listed on the New York... -

Page 235

...Discontinued operations Investments ï,· Fixed maturity and equity securities ï,· Other invested assets ï,· Short-term investments ï,· Net investment income ï,· Net realized capital gains (losses) ï,· Other-than-temporary impairments Lending Activities ï,· Mortgage and other loans receivable - net of... -

Page 236

...Other policyholder funds Variable Life and Annuity Contracts Debt ï,· Long-term debt Contingencies, Commitments and Guarantees ï,· Legal contingencies Noncontrolling Interests Earnings Per Share Income Taxes Other significant accounting policies Premiums for short-duration contracts are recorded as... -

Page 237

... associated with these assets is reported within Interest credited to policyholder account balances in the Consolidated Statements of Income. Such amortization expense totaled $63 million, $102 million and $162 million for the years ended December 31, 2014, 2013 and 2012, respectively. The cost... -

Page 238

... translation adjustments are recorded as a separate component of Accumulated other comprehensive income, net of any related taxes, in Total AIG shareholders' equity. Functional currencies are generally the currencies of the local operating environment. Financial statement accounts expressed in... -

Page 239

...date of January 1, 2014 on a prospective basis. The adoption of this standard had no material effect on our consolidated financial condition, results of operations or cash flows. Future Application of Accounting Standards Reclassification of Residential Real Estate Collateralized Consumer Mortgage... -

Page 240

.... We plan to adopt the standard on its required effective date of January 1, 2015 and do not expect the adoption of the standard to have a material effect on our consolidated financial condition, results of operations or cash flows. Revenue Recognition In May 2014, the FASB issued an accounting... -

Page 241

...• Property Casualty - previously included as part of AIG Property Casualty's Commercial operating segment • Mortgage Guaranty - previously reported within the Corporate and Other Category • Institutional Markets - previously reported in AIG Life and Retirement's Institutional operating segment... -

Page 242

...international life business previously included in AIG Property Casualty's Consumer operating segment. • Personal Insurance - consists of Personal Lines and Accident & Health product lines previously reported as a component of AIG Property Casualty's Consumer operating segment. Retirement and Life... -

Page 243

...Operating Income (Loss) (in millions) 2014 Commercial Insurance Property Casualty Mortgage Guaranty Institutional Markets Total Commercial Insurance Consumer Insurance Retirement Life Personal Insurance Total Consumer Insurance Corporate and Other Direct Investment book Global Capital Markets * AIG... -

Page 244

...-tax income 2012 Commercial Insurance Property Casualty Mortgage Guaranty Institutional Markets Total Commercial Insurance Consumer Insurance Retirement Life Personal Insurance Total Consumer Insurance Corporate and Other Direct Investment book Global Capital Markets Retained Interest * AIG Parent... -

Page 245

... Short-term investments Cash Premiums and other receivables, net of allowance Other assets Assets held for sale Less: Loss accrual Total assets held for sale Liabilities: Other liabilities Long-term debt Total liabilities held for sale $ $ $ International Lease Finance Corporation On May 14, 2014... -

Page 246

... loss recognized on closing or adjustment of the carrying amount to fair value less cost to sell. The results of operations for the following business is presented as discontinued operations in our Consolidated Statements of Income. In connection with the 2010 sale of American Life Insurance Company... -

Page 247

... counterparty at the balance sheet date. Fair values for fixed maturity securities based on observable market prices for identical or similar instruments implicitly incorporate counterparty credit risk. Fair values for fixed maturity securities based on internal models incorporate counterparty 230 -

Page 248

... sheet date to measure fixed maturity securities at fair value. Market price data is generally obtained from dealer markets. We employ independent third-party valuation service providers to gather, analyze, and interpret market information to derive fair value estimates for individual investments... -

Page 249

... corporate entities. Equity Securities Traded in Active Markets Whenever available, we obtain quoted prices in active markets for identical assets at the balance sheet date to measure equity securities at fair value. Market price data is generally obtained from exchange or dealer markets. Mortgage... -

Page 250