eTrade 2015 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2015 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL POSITION AND DEPLOYMENT

We executed vigorously on the capital front during the year,

exceeding our own demanding expectations on a number

of key measures. We achieved meaningfully lower capital

requirements at the bank well ahead of plan as well as the

Street’s expectations. We generated healthy levels of capital,

distributing more than $800 million of excess to the parent,

all the while bolstering our bank’s capital position. We began

deploying capital through four major actions — two of which

we completed and two of which continued in flight in 2016.

The first was a reduction in corporate debt — closing the

chapter on a series of meaningful pay-downs and refinances

to reach our target of $1 billion outstanding, at the lowest

coupons in Company history with a vastly improved maturity

profile. The second was the termination of $4.4 billion of

costly legacy liabilities in the form of wholesale funding,

which created capacity to begin our next action — growing

the balance sheet to our targeted $49.5 billion. Finally, we

embarked on an $800 million share buyback program to

return capital directly to our owners.

Today, the Company is well positioned to continue executing

on these initiatives while vigilantly looking for additional

ways to deploy capital to benefit our owners, including

opportunities for inorganic growth.

RISK PROFILE

The Company’s significantly improved risk profile — largely

driven by hard work to bolster our enterprise risk management

framework — was further benefited by the reduction of legacy

risks associated with our loan portfolio. We hit an important

inflexion point in this regard, reducing loan reserves for

two consecutive quarters driven by better than expected

performance. The portfolio continues to dwindle in size and

importance, ending the year at a mere 15 percent of its peak

size.

Our progress and position were recognized by our regulators

and rating agencies across important dimensions. First, the

Memoranda of Understanding at both the bank and parent

were lifted. Next, reflective of our much improved risk profile

and regulatory standing, our FDIC insurance rates were cut by

more than half. We also achieved lower capital requirements at

the bank, reducing our Tier 1 leverage ratio target by 150 bps

— 50 basis points and a full year ahead of our original plan.

Each of our credit rating agencies — S&P and Moody’s —

bestowed us with investment grade ratings in 2015 for the

first time in the Company’s history. This distinction represents

the culmination of years of diligent work delivering on our

strategy of de-risking the franchise while optimizing capital.

These ratings followed a remarkable seven notches worth of

cumulative upgrades between the two agencies during the

year.

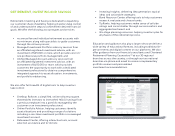

CUSTOMER EXPERIENCE

With the digital experience core to our offering, we rolled

out an attractive assortment of enhancements to our Web,

software, and mobile platforms.

On etrade.com, we launched a new welcome page for

prospective customers to better engage window shoppers

when they step into the store. The initial launch contributed

to an improvement in the funding rate for new accounts

channeled through the new welcome page. Once in the door,

customers were met with several enhanced experiences,

including: a revamped Account Overview page, which

integrates core functionality all on one page; our new

Retirement Center, which delivers engaging widgets to help

investors take charge and keep their goals on track; our new

Tax Center, which eases an annual process that is notoriously

stressful and convoluted; and TipRanks, which presents

analyst sentiment on individual stocks in an ultra-clear way,

analyzing and aggregating recommendations from thousands

of sell side analysts and financial bloggers.