Whirlpool 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

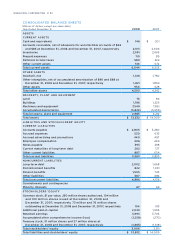

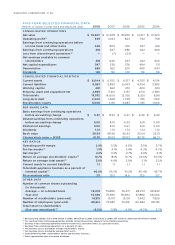

The graph below depicts the yearly dollar change in the cumulative total stockholder return on our

common stock with the cumulative total return of Standard & Poor's (S&P) Composite 500 Stock Index,

the S&P Household Appliances Group Index and the cumulative total return of the S&P 500 Household

Durables Index for the years 2004 through 2008.* The graph assumes $100 was invested in December 31,

2003, in Whirlpool common stock, the S&P 500 and the S&P Household Appliances Group. Beginning in

2008, and going forward, Whirlpool Corporation intends to replace the S&P Household Appliances Group

with the S&P 500 Household Durables Index. Whirlpool Corporation believes the durables index provides

a broader and more appropriate comparator group than the S&P Household Appliances Index.

* Cumulative total return is measured by dividing: (1) the sum of (a) the cumulative amount of the dividends for the measurement period,

assuming dividend reinvestment, and (b) the difference between share price at the end and at the beginning of the measurement period by

(2) the share price at the beginning of the measurement period.

Base

Period

Years

Ending

This document contains forward-looking statements that speak only as of this date. Whirlpool disclaims any obligation to

update these statements. Forward-looking statements in this document may include, but are not limited to, statements regarding

expected earnings per share, cash flow, productivity and material and oil-related prices. Many risks, contingencies and

uncertainties could cause actual results to differ materially from Whirlpool Corporation's forward-looking statements. Among

these factors are: (1) changes in economic conditions which affect demand for our products, including the strength of the

building industry and the level of interest rates; (2) the effects of the global economic crisis on our customers, suppliers and the

availability of credit; (3) Whirlpool's ability to continue its relationship with significant trade customers, including Sears Holding

Corporation in North America (accounting for approximately 11% of Whirlpool's 2008 consolidated net sales of $18.9 billion) and

the ability of these trade customers to maintain or increase market share; (4) intense competition in the home appliance industry

reflecting the impact of both new and established global competitors, including Asian and European manufacturers; (5) the ability

of Whirlpool to manage foreign currency fluctuations; (6) litigation including product liability and product defect claims;

(7) the ability of Whirlpool to achieve its business plans, productivity improvements, cost control, leveraging of its global operating

platform, and acceleration of the rate of innovation; (8) fluctuations in the cost of key materials (including steel, oil, plastic,

resins, copper and aluminum) and components and the ability of Whirlpool to offset cost increases; (9) the ability of suppliers

of critical parts, components and manufacturing equipment to deliver sufficient quantities to Whirlpool in a timely and cost-

effective manner; (10) health care cost trends and regulatory changes that could increase future funding obligations for pension

and post retirement benefit plans; (11) Whirlpool's ability to obtain and protect intellectual property rights; (12) global, political

and/or economic uncertainty and disruptions, especially in Whirlpool's significant geographic regions, including uncertainty

and disruptions arising from natural disasters or terrorist attacks; (13) the effects of governmental investigations or related

actions by third parties; (14) the impact of labor relations; (15) our ability to attract, develop and retain executives and other

qualified employees; (16) the cost of compliance with environmental and health and safety regulations. Additional information

concerning these and other factors can be found in Whirlpool Corporation's filings with the Securities and Exchange Commission,

including the most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K.