Whirlpool 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Given the generally negative and highly volatile global economic climate and the challenges and

uncertainties in the global credit markets, we are proactively taking steps to assure flexibility in future

credit availability. We believe that our operating cash flow, together with access to sufficient sources of

liquidity, will be adequate to meet our ongoing funding requirements. We are in compliance with the

financial covenants of debt agreements with lenders for all periods presented.

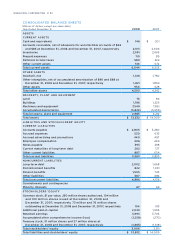

On August 1, 2008, we amended certain retiree medical benefits associated with

our Newton, Iowa manufacturing facility to be consistent with those benefits provided by the Whirlpool

Corporation Group Benefit Plan. This amendment resulted in a reduction in the postretirement benefit

obligation of $229 million with a corresponding increase to other comprehensive income, net of tax,

within equity of our Consolidated Balance Sheet at December 31, 2008.

In June 2004, our Board of Directors authorized a share repurchase program

of up to $500 million. During 2007, we repurchased 3.8 million shares at an aggregate purchase price

of $368 million and during the three months ended March 31, 2008, we repurchased 1.1 million shares

at an aggregate purchase price of $97 million under this program. At March 31, 2008, there were no

remaining funds authorized under this program.

On April 23, 2008, our Board of Directors authorized a new share repurchase program of up to $500 million.

Share repurchases are made from time to time on the open market as conditions warrant. During 2008,

we repurchased 1.9 million shares at an aggregate purchase price of $150 million under this program.

At December 31, 2008, there were $350 million remaining funds authorized under this program.

We expect to meet our cash needs for 2009 from cash flows from continuing operations, cash and

equivalents and financing arrangements. Our cash and equivalents were $146 million at December 31, 2008

as compared to $201 million at December 31, 2007.

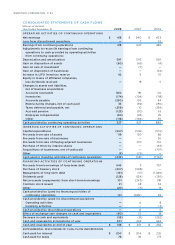

Cash provided by continuing

operating activities in 2008 was $327 million, a decrease of $600 million compared to the year ended

December 31, 2007. Cash provided by continuing operations for 2008 reflects lower cash earnings

primarily from our North America and Europe segments as compared to 2007. Cash provided by

continuing operations also reflects lower accounts payable due to adjusting volume based on demand

and higher pension contributions. The above decreases in cash flows were partially offset by a

decrease in accounts receivable and lower restructuring spending. Cash provided by continuing

operating activities in 2007 was $927 million, an increase of $47 million compared to the year ended

December 31, 2006. Cash provided by continuing operations for 2007 reflected higher earnings primarily

from our Latin America and Europe segments as compared to 2006. Cash provided by continuing operations

also reflected cash consumed from increased inventories as a result of lower than anticipated demand

in North America during the fourth quarter of 2007 as well as support for higher sales volumes in Latin

America and product transitions in the U.S. The increased inventory balances in 2007 were more than

offset by improved trade receivable collections, improved accounts payable terms as well as lower

global taxes. Cash provided by continuing operations was negatively impacted by increased spending

associated with a Maytag dishwasher recall.

Cash used in investing activities

from continuing operations was an outflow of $433 million in 2008 compared to an outflow of $331 million

last year. The increase in cash used in investing activities was primarily due to the prior year receipt

of proceeds from the sale of certain Maytag discontinued businesses of $100 million, lower proceeds

from the sale of assets in 2008, and higher capital spending. Cash used in investing activities from

continuing operations in 2007 was an outflow of $331 million compared to an outflow of $1.2 billion

during 2006. The decrease was primarily due to cash disbursed to acquire Maytag, net of cash acquired

of $797 million and the purchase of minority interest shares of a Brazil subsidiary in the amount of

$53 million during 2006. Offsetting cash used in investing activities from continuing operations were

proceeds received from the sale of certain Maytag discontinued businesses of $100 million.

The goal of our global operating platform is to enhance our competitive position in the global home

appliance industry by reducing costs, driving productivity and quality improvements, and accelerating

our rate of innovation. We plan to continue our comprehensive worldwide effort to optimize our

regional manufacturing facilities, supply base, product platforms and technology resources to better