Vtech 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VTech Holdings Ltd Annual Report 2008 7

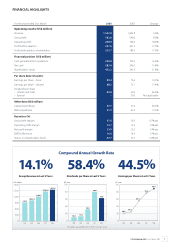

NET PROFIT AND DIVIDENDS

The pro t attributable to shareholders for the year ended

31st March 2008 was US$215.7 million, an increase of US$32.8

million as compared to the previous nancial year. The ratios of

EBIT and EBITDA to revenue were 14.7% and 16.6% respectively.

Basic earnings per share for the year ended 31st March 2008

were US89.4 cents as compared to US76.6 cents in the previous

nancial year. During the year, the Group declared and paid an

interim dividend of US12.0 cents per share, which aggregated

to US$29.1 million. The directors have proposed a nal dividend

of US51.0 cents per share, which will aggregate to US$124.2

million. The total dividend for the year amounts to US63.0 cents

per share. Excluding a special dividend of US30.0 cents per

share in the nancial year 2007, the total dividend per share

for the nancial year 2008 increases 26.0% over the previous

nancial year.

LIQUIDITY AND FINANCIAL RESOURCES

Shareholders’ funds as at 31st March 2008 were US$452.3

million, a 31.8% increase from the US$343.3 million reported for

the nancial year 2007. The net assets per share increased by

29.2% from US$1.44 to US$1.86.

As at 31st March 2008, the net cash plus currency-linked

deposits with principal protected had increased to US$300.1

million, up 21.7% from US$246.5million at the previous year-end.

The Group is substantively debt-free, except for an insigni cant

amount in the form of a xed-interest bearing equipment loan

which is denominated in Euro and repayable within one year.

TREASURY POLICIES

The objective of the Group’s treasury policies is to manage its

exposure to uctuation in foreign currency exchange rates

arising from the Group’s global operations. It is our policy not

to engage in speculative activities. Forward foreign exchange

contracts are used to hedge certain exposures.

WORKING CAPITAL

The stock balance as at 31st March 2008 increased by 6.7%

over the balance at 31st March 2007 to US$132.4 million.

The increase in stock level is primarily to meet anticipated

sales orders in the rst quarter of the nancial year 2009. The

turnover days increased from 68 days to 72 days. The trade

debtors balance as at 31st March 2008 was US$182.2 million as

compared to US$178.7 million in the previous nancial year. The

turnover days were 65 days, the same as in the previous nancial

year. The increase in trade debtors balance as at 31st March

2008 was mainly due to an increase in revenue in the fourth

quarter when compared with the corresponding period of the

previous nancial year. The increase in sales at the TEL business

in Europe also led to a higher trade debtors balance because

European customers of our ODM business tend to have a longer

settlement period.

CAPITAL EXPENDITURE

For the year ended 31st March 2008, the Group invested

US$47.1 million in the construction of buildings, purchase of

plant and machinery, equipment, computer systems and other

tangible assets. All of these capital expenditures were nanced

from internal resources.

CAPITAL COMMITMENTS AND CONTINGENCIES

The Group will incur capital expenditure of US$32.0 million

in the nancial year 2009 for ongoing business operations. In

addition, we are planning to further invest US$25.2 million to

build the third manufacturing facilities in Qingyuan, northern

Guangdong province in the next three years.

All of these capital expenditures will be nanced from

internal resources.

As of the nancial year end date, the Group had no material

contingencies.

As at 31st March 2008 and 2007 2008

US$ million

2007

US$ million

Cash 285.4 246.5

Less: Total interest bearing

liabilities ––

Net cash position 285.4 246.5

Currency-linked deposits 14.7 –

300.1 246.5

As at 31st March 2008 and 2007

All gures are in US$ million unless

stated otherwise 2008 2007

Stocks 132.4 124.1

Average stocks as a percentage

of Group revenue 8.3% 8.8%

Turnover days 72 days 68 days

Trade debtors 182.2 178.7

Average trade debtors as a

percentage of Group revenue 11.6% 11.7%

Turnover days 65 days 65 days