Vtech 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VTech Holdings Ltd Annual Report 2008

6

MANAGEMENT DISCUSSION AND ANALYSIS

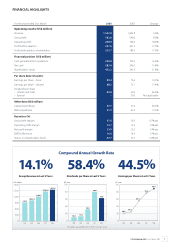

GROSS PROFIT/MARGIN

The gross pro t for the nancial year 2008 was US$583.0 million,

an increase of US$43.0 million compared to the US$540.0 million

recorded in the previous nancial year. Gross margin for the year

improved from 36.9% to 37.6%. With measures implemented to

enhance operational e ciency in the manufacturing process,

better product engineering and higher productivity, the Group

was able to improve the gross pro t margin in the nancial

year 2008, although all businesses continued to su er from the

impact of rising labour costs in China, the appreciation of the

Renminbi and raw material cost increase.

OPERATING PROFIT/MARGIN

The operating pro t for the year ended 31st March 2008 was

US$228.9 million, an increase of US$34.9 million or 18.0% over

the previous nancial year. The improvement mainly came from

an increase in gross pro t resulting from the overall growth in

revenue at the three core businesses and the improvement in

gross pro t margin. The operating pro t margin also improved

from 13.3% in the previous nancial year to 14.7% in the nancial

year 2008.

Selling and distribution costs increased by 4.1% from US$238.6

million in the previous nancial year to US$248.5 million in the

nancial year 2008. The increase was mainly attributable to the

increased spending on advertising and promotional activities

at the ELP business. However, selling and distribution costs as a

percentage of Group revenue actually decreased from 16.3% in

the previous nancial year to 16.0% in the nancial year 2008,

owing to tight control over operating costs.

Administrative and other operating expenses decreased

from US$62.2 million in the previous nancial year to US$54.3

million in the nancial year 2008. An exchange gain of US$10.7

million was recorded under administrative and other operating

expenses in the nancial year 2008 because of the appreciation

of the Euro, Sterling and the Canadian dollar against the US

dollar, as compared to a smaller exchange gain of US$3.1 million

recorded in the previous nancial year. Excluding the e ect of

exchange di erences, the administrative and other operating

expenses slightly decreased by US$0.3 million compared to

the previous nancial year. Administrative and other operating

expenses as a percentage of Group revenue, excluding the

e ect of exchange di erences, actually improved from 4.5% in

the previous nancial year to 4.2% in the nancial year 2008.

Research and development (R&D) activities are vital for the

long-term development of the Group. During the nancial year

2008, the Group spent US$51.3 million on R&D activities, which

represented around 3% of total Group revenue.

Group R&D Expenditure in Last 5 Years

Pro t Attributable to Shareholders in Last 5 Years

Group EBITDA/Revenue and EBIT/Revenue in Last 5 Years