Vtech 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VTech Holdings Ltd Annual Report 2008 3

fed into increased prices for other raw materials used in our

manufacturing. At the same time, operating and labour costs

continued to rise in mainland China, compounded by in ation

and a strong appreciation of the Renminbi against the US dollar.

While these increases pressured all manufacturers, VTech

continued to build on its track record of achieving margin

improvement, based on our know-how in R&D and

manufacturing. We have leveraged our economies of scale,

re-engineered our products and increased our productivity

through better utilisation of our manufacturing capacity.

At the same time, stringent quality control ensured that our

products met customer expectations, helping to raise sales

at our businesses.

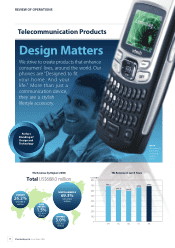

The TEL business posted higher revenue, despite a decline in US

sales. In North America, we pursue a branded business strategy

selling under the VTech and AT&T brands, and the overall

US market contracted owing to the slowing economy. We

nonetheless increased market share as our product innovation

enabled us to gain a lead over the competition. In particular,

we are bene ting from the convergence of the market towards

DECT 6.0 technology, where we have a very well received

product line-up.

The stronger performance came from the Original Design

Manufacturing (ODM) business, under which we manufacture

products for major xed line telephone operators in Europe and

other well-known brand names. We are also increasingly selling

to distributors in the Asia Paci c and other emerging markets,

with notable sales growth from India, Brazil and Australia.

Revenue at the ELP business reached another record high, led

by continuing strength in the traditional ELPs. We secured more

shelf space in North America and Europe, and gained further

ground in emerging markets. With the basic V.Smile console

now in its fourth year, sales of the V.Smile range slowed and in

the calendar year 2008 we have added three new members to

the V.Smile family to augment the basic console.

The CMS business achieved record revenue for the fourth

consecutive year and we are increasingly raising our pro le in

the electronic manufacturing services industry. The business was

able to mitigate the impact of cost increases through economies

of scale and leveraging the Group’s procurement power. We

also succeeded in passing on some cost increases to customers.

OUTLOOK

It is prudent not to foresee growth for the nancial year 2009,

as economic conditions in our markets, especially the United

States, are worsening. In addition, cost pressures will continue

due to the high oil price, rising labour costs and in ation

in mainland China.

Dear Shareholders,

Despite challenging economic conditions, VTech reported

record revenue and pro t, and we were able to expand net

pro t margin for a third consecutive year. We have built a

solid foundation for our operations, as we strengthened our

leading positions in the telecommunication products (TEL)

and electronic learning products (ELP) industries and increased

our pro le in contract manufacturing services (CMS).

The solid result re ects the success of our strategy, with its focus

on four key areas:

• Product innovation

• Gains in market share

• Geographic expansion

• Operational excellence

RESULTS

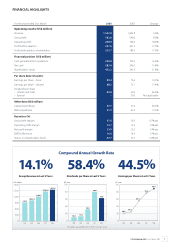

Revenue for the Group increased by 6.0% over the nancial year

2007 to US$1,552.0 million. Pro t attributable to shareholders

rose by 17.9% to US$215.7 million, while earnings per share

increased 16.7% to US89.4 cents. The Board of Directors

(the “Board“) has proposed a nal dividend of US51.0 cents per

ordinary share. Together with the interim dividend of US12.0

cents per share, this gives a total dividend for the year of

US63.0 cents per ordinary share. Excluding a special dividend

of US30.0 cents per share in the nancial year 2007, the total

dividend per share for the nancial year 2008 increases 26.0%

over the previous nancial year. The increase in dividend

payout demonstrates our commitment to shareholders and

the strength of our operations.

OPERATIONS

Rising costs posed a challenge to all our businesses during

the nancial year 2008. High oil prices led to increased

prices for plastics while higher commodity prices generally

Pro t Attributable to Shareholders in Last 5 Years