Visa 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Global Opportunity

Visa Europe

In November, we were delighted to

announce that we signed a definitive

agreement to acquire Visa Europe. Visa

Europe is the only regional association

which didn’t merge into Visa Inc. in 2007

and remained a separate entity owned

by its members. We have been clear that

this was a transaction that we thought

made tremendous sense for our company

and also for Visa Europe and its members,

so we are thrilled with the prospect of

moving forward as one company.

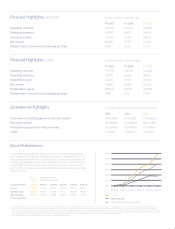

Financial Terms

We will acquire Visa Europe for an up-

front consideration of 16.5 billion euros

consisting of 11.5 billion euros in cash

and convertible preferred stock valued

at 5 billion euros. In addition, Visa

Europe member-owners will potentially

receive an earn-out payment of up to

4.0 billion euros and 0.7 billion euros

in interest. This earn-out will be based

on the achievement of net revenue

targets during the 16 fiscal quarters

following the closing of the acquisition

and provides additional upside to both

parties if those agreed targets are met.

It will be payable following the fourth

anniversary of the transaction close.

We believe the transaction is financially

attractive for both parties, with a

balanced consideration of a mix of cash,

stock and an earn-out. We expect it to

be accretive to our stand-alone revenue

and EPS growth before transition costs

beginning in FY17, the first full year of

the combination.

The preferred shares offer current

Visa Europe members a continuing

ownership stake in the company

and also serve to provide liability

protection to our Visa Inc. shareholders

in conjunction with a new loss sharing

agreement with key UK banks. The earn-

out provides additional upside potential

for both parties if net revenue targets

are achieved. We feel the balanced

consideration encourages Visa Europe’s

current owners and Visa Inc. to work

together to enhance the long-term

value of the business to the benefit of all

parties.

Strategic Importance

Combining Visa Inc. and Visa Europe is

strategically important for both of us.

We believe the combination will create

significant benefits for both European

and Visa Inc. global clients. Our clients

will benefit as we work every day to

earn their business, bringing them

At the initial conversion rate, the shares of Visa Inc. preferred stock issued in the transaction will be convertible into an aggregate of 78,654,400 shares of class A common stock, valued at approximately €5.0 billion based on the average trading

price of the class A common stock of $71.68, and the average Euro/Dollar exchange rate of 1.12750, each for the 30 trading days ended October 19, 2015. The acquisition is subject to regulatory approvals.