Visa 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

But we are evolving into a business

where software provides differentiation.

Having a solid network will not be

enough in the future. I have described

the capabilities that we are building

into our network and the ways

we are allowing people to access

those capabilities. To that end we

are increasing resources directed at

developing and enhancing our software-

based capabilities aggressively.

And while we believe organic

investment is the first call on our capital,

we have consistently said that the Visa

Europe acquisition is a perfect use as

well. Strengthening our global franchise

by reuniting our company with a

transaction structure that provides the

right protection as well as upside for

both sides based on net revenue targets

makes tremendous sense for us.

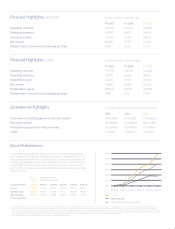

Dividend

Our recently announced 17% dividend

increase maintains the payout at our

stated target range of low 20s and

is the 7th dividend increase since

our IPO. Most importantly, we feel

it’s a strong statement that we are

increasing our dividend at the same

time we announced such a significant

transaction.

Excess Capital Return

In 2015 we repurchased $2.9 billion of

our stock. We have repurchased the

equivalent of almost 735 million shares

since our IPO and returned more than

$26 billion of capital to our shareholders

in the form of dividend payments and

share repurchases. And our board has

approved an increase in our buy back

authorization to bring the total available

to $7.8 billion as of September 30, 2015.

Capital Structure

Prior to the Visa Europe transaction, we

were limited in our ability to use our debt

capacity. Visa Europe held a put option

and we would have potentially needed to

finance an unknown purchase price within

285 days. We felt it was prudent to preserve

the flexibility in our capital structure for

this potential transaction. Now that we

have negotiated a transaction with VE, we

can implement a new capital structure for

the company. We intend to raise $15-$16

billion of debt in conjunction with the Visa

Europe Acquisition and establish a more

efficient long-term capital structure. Our

initial leverage will be between 1.4 and 1.5

times gross debt to EBITDA and we target

our long-term leverage at between 1.1

and 1.5 times gross debt to EBITDA. The

rating agencies reaffirmed our current

investment credit ratings of A + / A1

upon announcement of the transaction.

We believe this capital structure still

provides flexibility to pursue future growth

opportunities.