United Healthcare 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12. Commitments and Contingencies

Leases

We lease facilities, computer hardware and other equipment under long-term operating leases that are

noncancelable and expire on various dates through 2026. Rent expense under all operating leases was

$152 million in 2005, $137 million in 2004 and $133 million in 2003.

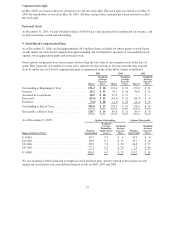

At December 31, 2005, future minimum annual lease payments, net of sublease income, under all noncancelable

operating leases were as follows: $167 million in 2006, $159 million in 2007, $128 million in 2008, $107 million

in 2009, $76 million in 2010, and $172 million thereafter.

Service Agreements

We have noncancelable contracts for certain support services, which expire on various dates through 2010.

Expenses incurred in connection with these agreements were $239 million in 2005, $265 million in 2004 and

$256 million in 2003. At December 31, 2005, future minimum obligations under our noncancelable contracts

were as follows: $151 million in 2006, $33 million in 2007, $12 million in 2008, $3 million in 2009 and $3

million in 2010.

Legal Matters

Because of the nature of our businesses, we are routinely made party to a variety of legal actions related to the

design and management of our service offerings. We record liabilities for our estimates of probable costs

resulting from these matters. These matters include, but are not limited to, claims relating to health care benefits

coverage, medical malpractice actions, contract disputes and claims related to disclosure of certain business

practices.

Beginning in 1999, a series of class action lawsuits were filed against both UnitedHealthcare and PacifiCare, and

virtually all major entities in the health benefits business. In December 2000, a multidistrict litigation panel

consolidated several litigation cases involving UnitedHealth Group and our affiliates in the Southern District

Court of Florida, Miami division. Generally, the health care provider plaintiffs allege violations of ERISA and

RICO in connection with alleged undisclosed policies intended to maximize profits. Other allegations include

breach of state prompt payment laws and breach of contract claims for failure to timely reimburse providers for

medical services rendered. The consolidated suits seek injunctive, compensatory and equitable relief as well as

restitution, costs, fees and interest payments. The trial court granted the health care providers’ motion for class

certification and that order was reviewed by the Eleventh Circuit Court of Appeals. The Eleventh Circuit

affirmed the class action status of the RICO claims, but reversed as to the breach of contract, unjust enrichment

and prompt payment claims. During the course of the litigation, there have been co-defendant settlements.

Through a series of motions and appeals, all direct claims against us have been compelled to arbitration. A trial

date has been set for April 2006. The trial court has ordered that the trial be split into separate liability and

damage proceedings. In August 2005, the capitation related claims were dismissed from litigation. On

January 31, 2006, the trial court dismissed all remaining claims against PacifiCare. A March 14, 2006 hearing

date has been scheduled for our summary judgment motion.

On March 15, 2000, the American Medical Association filed a lawsuit against the company in the Supreme Court

of the State of New York, County of New York. On April 13, 2000, we removed this case to the United States

District Court for the Southern District of New York. The suit alleges causes of action based on ERISA, as well

as breach of contract and the implied covenant of good faith and fair dealing, deceptive acts and practices, and

trade libel in connection with the calculation of reasonable and customary reimbursement rates for non-network

providers. The suit seeks declaratory, injunctive and compensatory relief as well as costs, fees and interest

payments. An amended complaint was filed on August 25, 2000, which alleged two classes of plaintiffs, an

ERISA class and a non-ERISA class. After the Court dismissed certain ERISA claims and the claims brought by

61