United Healthcare 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

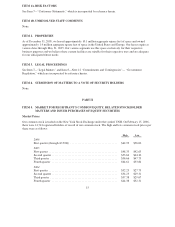

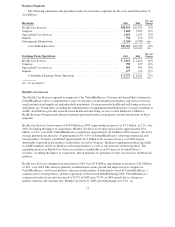

Business Segments

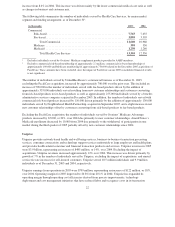

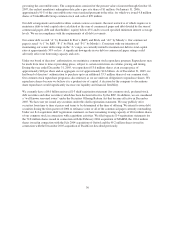

The following summarizes the operating results of our business segments for the years ended December 31

(in millions):

Revenues 2005 2004

Percent

Change

Health Care Services .................................................. $40,019 $32,673 22%

Uniprise ............................................................ 3,850 3,365 14%

Specialized Care Services .............................................. 2,806 2,295 22%

Ingenix ............................................................ 794 670 19%

IntersegmentEliminations ............................................. (2,104) (1,785) nm

Consolidated Revenues ............................................ $45,365 $37,218 22%

Earnings From Operations 2005 2004

Percent

Change

Health Care Services .................................................. $ 3,815 $ 2,810 36%

Uniprise ............................................................ 799 677 18%

Specialized Care Services .............................................. 582 485 20%

Ingenix ............................................................ 177 129 37%

Consolidated Earnings From Operations .............................. $ 5,373 $ 4,101 31%

nm - not meaningful

Health Care Services

The Health Care Services segment is composed of the UnitedHealthcare, Ovations and AmeriChoice businesses.

UnitedHealthcare offers a comprehensive array of consumer-oriented health benefit plans and services for local,

small and mid-sized employers and individuals nationwide. Ovations provides health and well-being services to

individuals age 50 and older, including the administration of supplemental health insurance coverage on behalf of

AARP. AmeriChoice provides network-based health and well-being services to state Medicaid, Children’s

Health Insurance Program and other government-sponsored health care programs and the beneficiaries of those

programs.

Health Care Services had revenues of $40.0 billion in 2005, representing an increase of $7.3 billion, or 22%, over

2004. Excluding the impact of acquisitions, Health Care Services revenues increased by approximately $3.0

billion, or 11%, over 2004. UnitedHealthcare accounted for approximately $1.6 billion of this increase, driven by

average premium rate increases of approximately 8% to 9% on UnitedHealthcare’s renewing commercial risk-

based products. Ovations contributed approximately $1.2 billion to the revenue advance over 2004 largely

attributable to growth in the number of individuals served by Ovations’ Medicare supplement products provided

to AARP members and by its Medicare Advantage products as well as rate increases on these products. The

remaining increase in Health Care Services revenues is attributable to an 8% increase in AmeriChoice’s

revenues, excluding the impact of acquisitions, driven primarily by premium revenue rate increases on Medicaid

products.

Health Care Services earnings from operations in 2005 were $3.8 billion, representing an increase of $1.0 billion,

or 36%, over 2004. This increase primarily resulted from revenue growth and improved gross margins on

UnitedHealthcare’s risk-based products, increases in the number of individuals served by UnitedHealthcare’s

commercial fee-based products, and the acquisitions of Oxford and MAMSI during 2004. UnitedHealthcare’s

commercial medical care ratio decreased to 78.2% in 2005 from 79.0% in 2004 mainly due to changes in

product, business and customer mix. Health Care Services’ 2005 operating margin was 9.5%, an

21