United Healthcare 2005 Annual Report Download - page 30

Download and view the complete annual report

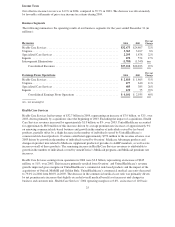

Please find page 30 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash and Investments

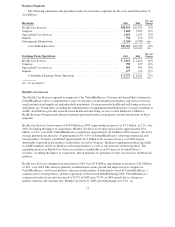

Cash flows from operating activities were $4.3 billion in 2005, an increase over $4.1 billion in 2004. The

increase in operating cash flows resulted primarily from an increase of $834 million in net income prior to

depreciation, amortization and other noncash items partially offset by a decrease of $643 million in cash flows

generated from working capital changes. We generated operating cash flows from working capital changes of

$406 million in 2005 and $1,049 million in 2004. The year-over-year decrease primarily resulted from the

Company receiving only eleven monthly Medicare premium payments during 2005 from the Centers for

Medicare and Medicaid Services (CMS) rather than the twelve monthly payments received in 2004, negatively

impacting the change in reported operating cash flows by $375 million. Additionally, there was reduced growth

in medical payables during 2005 compared to 2004 due in part to an increase in electronic claim submissions and

other disbursement process efficiencies.

We maintained a strong financial condition and liquidity position, with cash and investments of $15.0 billion at

December 31, 2005. Total cash and investments increased by $2.7 billion since December 31, 2004, primarily

due to cash and investments acquired through businesses acquired since the beginning of 2005, strong operating

cash flows and cash received from debt issuances, partially offset by common stock repurchases, cash paid for

business acquisitions and capital expenditures.

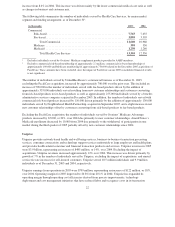

As further described under Regulatory Capital and Dividend Restrictions, many of our subsidiaries are subject to

various government regulations that restrict the timing and amount of dividends and other distributions that may

be paid to their parent companies. At December 31, 2005, approximately $270 million of our $15.0 billion of

cash and investments was held by non-regulated subsidiaries and available for general corporate use, including

acquisitions and share repurchases.

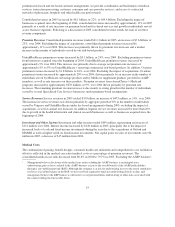

Financing and Investing Activities

In addition to our strong cash flows generated by operating activities, we use commercial paper and debt to

maintain adequate operating and financial flexibility. As of December 31, 2005 and 2004, we had commercial

paper and debt outstanding of approximately $7.1 billion and $4.0 billion, respectively. Our debt-to-total-capital

ratio was 28.6% and 27.3% as of December 31, 2005 and December 31, 2004, respectively. We believe the

prudent use of debt leverage optimizes our cost of capital and return on shareholders’ equity, while maintaining

appropriate liquidity.

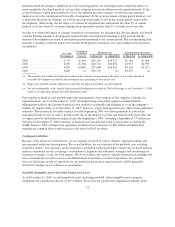

On December 20, 2005, the company acquired PacifiCare. Under the terms of the agreement, PacifiCare

shareholders received 1.1 shares of UnitedHealth Group common stock and $21.50 in cash for each share of

PacifiCare common stock they owned. Total consideration issued for the transaction was approximately $8.8

billion, composed of approximately 99.2 million shares of UnitedHealth Group common stock (valued at

approximately $5.3 billion based upon the average of UnitedHealth Group’s share closing price for two days

before, the day of and two days after the acquisition announcement date of July 6, 2005), approximately $2.1

billion in cash, $960 million cash paid to retire PacifiCare’s existing debt and UnitedHealth Group vested

common stock options with an estimated fair value of approximately $420 million issued in exchange for

PacifiCare’s outstanding vested common stock options.

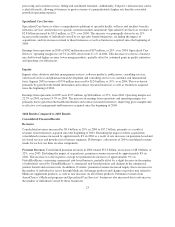

On February 24, 2006, our Health Care Services business segment acquired John Deere Health Care, Inc. (John

Deere Health). Under the terms of the purchase agreement, we paid approximately $500 million in cash in

exchange for all of the outstanding equity of John Deere Health. We issued commercial paper to finance the John

Deere Health purchase price.

On September 19, 2005, our Health Care Services business segment acquired Neighborhood Health Partnership

(NHP). Under the terms of the purchase agreement, we paid approximately $185 million in cash in exchange for

all of the outstanding equity of NHP. We issued commercial paper to finance the NHP purchase price.

On December 10, 2004, our Uniprise business segment acquired Definity Health Corporation (Definity). Under

the terms of the purchase agreement, we paid $305 million in cash in exchange for all of the outstanding stock of

Definity. We used available cash and issued commercial paper to finance the Definity purchase price.

28