United Healthcare 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

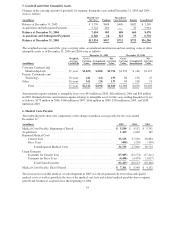

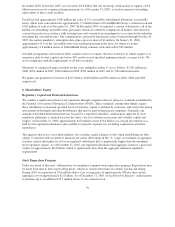

4. Cash, Cash Equivalents and Investments

As of December 31, the amortized cost, gross unrealized gains and losses, and fair value of cash, cash

equivalents and investments were as follows (in millions):

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

2005

Cash and Cash Equivalents ............................... $5,421 $— $— $5,421

Debt Securities — Available for Sale ....................... 9,011 60 (52) 9,019

Equity Securities — Available for Sale ..................... 217 45 (1) 261

Debt Securities — Held to Maturity ....................... 281 — — 281

Total Cash and Investments .......................... $14,930 $ 105 $ (53) $14,982

2004

Cash and Cash Equivalents ................................ $ 3,991 $ — $— $ 3,991

Debt Securities — Available for Sale ........................ 7,723 205 (9) 7,919

Equity Securities — Available for Sale ....................... 199 10 (2) 207

Debt Securities — Held to Maturity ......................... 136 — — 136

Total Cash and Investments ............................ $12,049 $ 215 $ (11) $12,253

As of December 31, 2005 and 2004, respectively, debt securities consisted of $2,256 million and $1,551 million

in U.S. Government and Agency obligations, $4,554 million and $2,932 million in state and municipal

obligations, and $2,490 million and $3,572 million in corporate obligations. At December 31, 2005, we held

$767 million in debt securities with maturities of less than one year, $3,469 million in debt securities with

maturities of one to five years, $2,808 million in debt securities with maturities of five to 10 years and $2,256

million in debt securities with maturities of more than 10 years.

As of December 31, 2005 we had only $5 million of investments, mainly corporate obligations, in a continuous

unrealized loss position for 12 months or greater. Gross unrealized losses of $53 million were primarily a result

of changes in interest rates and relate to debt securities with an aggregate fair value of $3.8 billion at December

31, 2005. We evaluate the credit rating of the state and municipal obligations and the corporate obligations and

do not believe that there has been any significant deterioration since purchase. The contractual cash flows of any

U.S. Government and Agency obligations are either guaranteed by the U.S. Government or an agency of the U.S.

Government. The equity securities were evaluated for duration of unrealized loss and other market factors. After

taking into account these and other factors, we determined the unrealized losses on our investments were

temporary and, as such, no impairment was required.

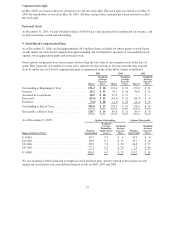

We recorded realized gains and losses on sales of investments, excluding the UnitedHealth Capital disposition

described below, as follows:

For the year ended

December 31,

(in millions) 2005 2004 2003

Gross Realized Gains ........................................................ $54 $37 $45

Gross Realized Losses ........................................................ (50) (18) (23)

Net Realized Gains (Losses) ............................................... $4 $19 $22

During the first quarter of 2004, we realized a capital gain of $25 million on the sale of certain UnitedHealth

Capital investments. With the gain proceeds from this sale, we made a cash contribution of $25 million to the

United Health Foundation in the first quarter of 2004. The realized gain of $25 million and the related

contribution expense of $25 million are included in Investment and Other Income in the accompanying

Consolidated Statements of Operations.

53