Unilever 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unilever Annual Report and Accounts 2004 17

Financial review

Basis of reporting and discussion

Our accounting policies are based on United Kingdom generally

accepted accounting principles (GAAP) and UK and Netherlands

law. These differ in certain respects from United States GAAP. The

principal differences are described on pages 155 to 159. We have

shown reconciliations to net income and capital and reserves

under US GAAP on pages 154 and 155.

For definitions of key ratios referred to in this review please refer

to page 149.

Reporting currency and exchange rates

Foreign currency amounts for results and cash flows are

translated from underlying local currencies into euros using

annual average exchange rates; balance sheet amounts are

translated at year-end rates except for the ordinary capital of the

two parent companies. These are translated at the rate prescribed

by the Equalisation Agreement of £1 = Fl. 12, and thence to

euros at the official rate of €1.00 = Fl. 2.20371 (see Corporate

Governance on page 52).

The figures quoted in the following discussion on pages 17 to 23

are in euros, at current rates of exchange, ie the average or

year-end rates of each period, unless otherwise stated.

Critical accounting policies

The accounts comply in all material respects with UK GAAP and

UK and Netherlands law. To prepare the accounts, we are

required to make estimates and assumptions, using judgement

based on available information, including historical experience.

These estimates and assumptions are reasonable and are re-

evaluated on an ongoing basis. However, actual amounts and

results could differ. Critical accounting policies are those which

are most important to the portrayal of Unilever’s financial position

and results of operations, and are described on pages 96 to 98.

Unilever complies with UK Financial Reporting Standard 18,

which requires that the most appropriate accounting policies

are selected in all circumstances. Some of these policies require

difficult, subjective or complex judgements from management,

the most important being:

Retirement benefits

We account for pensions and similar obligations in accordance

with United Kingdom Financial Reporting Standard 17 ’Retirement

Benefits’ (FRS 17). Under this standard the liabilities and assets of

the plans are recognised at fair values in the balance sheet.

Pension accounting requires certain assumptions to be made in

order to value our obligations and to determine the charges to be

made to the profit and loss account. These figures are particularly

sensitive to assumptions for discount rates, inflation rates and

expected long-term rates of return on assets. The table below sets

out these assumptions, as at 31 December 2004, in respect of the

four largest Unilever pension funds. Details of all assumptions

made are given on page 123.

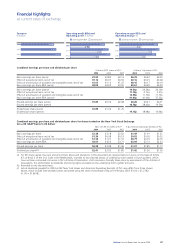

%%%%

Nether- United

UK lands States Germany

Discount rate 5.3 4.5 5.7 4.5

Inflation assumption 2.8 1.8 2.5 1.8

Expected long-term rate of return:

Equities 8.0 7.6 8.2 7.6

Bonds 5.0 4.1 4.6 4.1

Others 6.8 5.9 4.5 5.5

As required by FRS 17 these assumptions are set by reference to

market conditions at each year end. Actual experience may differ

from the assumptions made. The effects of such differences are

recognised through the statement of total recognised gains and

losses.

Share-based compensation

In line with recommendations of various standard setting bodies,

from 1 January 2003 we changed our accounting policy for share

options. We hedge our existing share option programmes by

buying shares at the time of grant and taking the financing cost

within interest. The accounting change was to include an

additional non-cash charge against operating profit to reflect the

fair value to the employee of the share options granted. The

impact of the adoption of this change was reflected by means of

prior period adjustments to the profit and loss accounts and

balance sheets. In determining the additional charge, we apply a

valuation based on modified Black-Scholes or multinomial models

spread over the vesting period of the option. The fair value so

calculated depends on certain assumptions which are described in

note 30 on page 138. The assumptions made in respect of share

price volatility and expected dividend yields are particularly

subjective. Unilever considers these and all other assumptions to

be appropriate, but significant changes in assumptions could

materially affect the charge recorded.

Provisions

Provision is made, among other reasons, for environmental and

legal matters and for employee termination costs where a legal or

constructive obligation exists at the balance sheet date and a

reasonable estimate can be made of the likely outcome.

Market development costs

Expenditure on market development costs, such as consumer

promotions and trade advertising, is charged against profit in the

year in which it is incurred. At each balance sheet date, we are

required to estimate the part of expenditure incurred but not yet

invoiced based on our knowledge of customer, consumer and

promotional activity.

Goodwill, intangible and tangible fixed assets

Impairment reviews in respect of goodwill and intangible fixed

assets are performed at least annually. More regular reviews, and

impairment reviews in respect of tangible fixed assets, are

performed if events indicate that this is necessary. Examples of

such triggering events would include a significant planned

restructuring, a major change in market conditions or technology,

expectations of future operating losses or negative cash flows.