Unilever 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unilever Annual Report and Accounts 2004 09

Chairmen’s statement

(continued)

2004

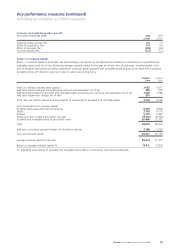

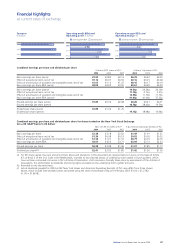

2004 was clearly a very disappointing year for Unilever. Underlying

sales growth was 0.4%, with leading brands growth of 0.9%.

Operating margin BEIA was 15.2%, 0.6% lower than in 2003.

This reflects a decline in price, slightly higher advertising and

promotion expenditure and unrecovered overheads following

disposals. The impact of increased commodity costs in the year

was fully offset by procurement savings. In spite of lower operating

profit, earnings per share BEIA grew by 5%, boosted by lower tax

and financing costs. Net borrowing costs were reduced by 19% in

the year with both net debt and interest rates lower than last year.

The financing costs of pensions were also lower.

The fourth quarter saw a planned step-up in restructuring costs

with the start of the implementation of the overheads simplification

project, One Unilever, announced in mid-2004. In addition, a charge

of €650 million (€591 million at current exchange rates) was

taken for the impairment of goodwill for Slim•Fast. The weight

management category declined significantly in the second half of

2004 reflecting a declining interest by consumers in the more

extreme low-carb diet. Consumers as yet have not been attracted

back to the more conventional weight management programmes

such as Slim•Fast; recovery will therefore take longer than expected

and will be from a substantially smaller base. A €177 million

(€169 million at current exchange rates) provision was made for

the potential repayment of certain sales tax credits in Brazil.

Cash flow, however, was again strong, which together with the

weaker US dollar enabled net debt to be reduced to €9.7 billion

at current exchange rates. This has enabled an increased dividend

pay-out for 2004 and the announcement of a share buy-back

programme for 2005.

Board changes

At the Annual General Meetings in May four of our Directors will

be retiring. Clive Butler, Keki Dadiseth, and André van Heemstra

have all had long and distinguished careers as Unilever executives.

Clive has been a Director since 1992 and most recently served as

Corporate Development Director. Keki joined the Boards in 2000

and has been a Divisional Director for the HPC business since

2001. André has been Personnel Director since joining the Boards

in 2000.

Also retiring is Claudio Gonzalez, one of our Non-Executive

Directors. We would like to thank them all for their valuable

contribution during their years of service.

Ralph Kugler has been nominated for election as an Executive

Director at the Annual General Meetings in May. He is currently

Business President – Home and Personal Care – Europe.

Looking to the future

We expect a tough environment in 2005. Market growth will

continue to be constrained by a difficult retail environment in the

developed world and no let-up in the level of competitiveness we

face in developing and emerging markets.

Our overriding objective is to return the business to healthy

growth.

2005 is the 75th anniversary of the foundation of Unilever. With

the changes we have put in place, with a small and committed

leadership team, with dedicated and talented people, we are

confident that Unilever will deliver another 75 years of sustained

growth and increased shareholder value through serving the

needs of our consumers and customers around the globe.

We remain completely committed to delivering Total Shareholder

Return in the top third of our peer group. We will measure our

progress by Free Cash Flow generation and an improvement in

the Return on Invested Capital. We believe these are the best

measures of value creation: in addition, they allow us to retain

the flexibility to build the long-term health of your business in

changing circumstances.

2004 was a testing year but together we have come through it

as a strong team. We would like to thank all of our employees

around the world for their loyalty and effort. We are fortunate

in having such talented and diverse people. We know we can

count on their continued support and redoubled efforts in

2005 and beyond.

Antony Burgmans Patrick Cescau

Chairmen of Unilever