TomTom 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.p 59 / TomTom Annual Report and Accounts 2010

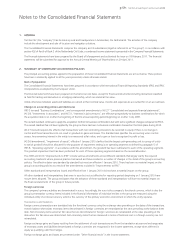

Notes to the Consolidated Financial Statements

1. GENERAL

TomTom NV (the “company”) has its statutory seat and headquarters in Amsterdam, the Netherlands. The activities of the company

include the development and sale of location and navigation solutions.

The Consolidated Financial Statements comprise the company and its subsidiaries (together referred to as “the group”). In accordance with

section 402 of Part 9 of Book 2 of the Netherlands Civil Code, a condensed income statement is presented in the Company Financial Statements.

The financial statements have been prepared by the Board of Management and authorised for issue on 18 February 2011. The financial

statements will be submitted for approval to the Annual General Meeting of Shareholders on 29 April 2011.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these Consolidated Financial Statements are set out below. These policies

have been consistently applied to all the years presented, unless otherwise stated.

Basis of preparation

The Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards (IFRS) and IFRIC

interpretations as adopted by the European Union.

The financial statements have been prepared on the historical cost basis, except for financial instruments (including derivatives) classified

as held for trading and derivatives in a hedging relationship, which are stated at fair value.

Unless otherwise indicated, assets and liabilities are carried at their nominal value. Income and expenses are accounted for on an accrual basis.

Changes in accounting policies and disclosures

IFRS 3 (revised) “Business Combinations”, and consequential amendments to IAS 27 “Consolidated and separate financial statements”,

IAS 28, “Investments in associates”, and IAS 31, “Interests in joint ventures”, are effective prospectively to business combinations for which

the acquisition date is on or after the beginning of the first annual reporting period beginning on or after 1 July 2009.

The revised standard continues to apply the acquisition method to business combinations but with some significant changes compared to IFRS 3.

The revised standard has not been applied by the group as there has been no business combination transaction that took place during 2010.

IAS 27 (revised) requires the effects of all transactions with non-controlling interests to be recorded in equity if there is no change in

control and these transactions do not result in goodwill or gains and losses. The standard also specifies the accounting when control

ceases. Any remaining interest in the entity is re-measured at fair value, and a gain or loss is recognised in profit or loss.

IAS 36 (amendment), “Impairment of assets”, effective 1 January 2010 clarifies that the largest cash-generating unit (or group of units)

to which goodwill should be allocated for the purposes of impairment testing is an operating segment as defined by paragraph 5 of

IFRS 8, “Operating segments”. In accordance with this amendment, the goodwill has been reallocated to each of the operating segments.

The goodwill impairment test has been performed for each of these operating segments based on the revised allocation.

The 2009 and 2010 “Improvements to IFRS” include various amendments across different standards that largely clarify the required

accounting treatment where previous practice had varied and have resulted in a number of changes in the detail of the group’s accounting

policies. The effective dates vary standard by standard but most are effective 1 January 2010. There has been no material impact on the

group’s accounting policies as a result of the amendments included in “Improvements to IFRS”.

Other standards and interpretations issued and effective from 1 January 2010 did not have a material impact on the group.

All other standards and interpretations that were in issue but not yet effective for reporting periods beginning on 1 January 2010 have

not yet been adopted. The group anticipates that the adoption of these standards and interpretations will have no material impact on

the financial statements of the group in future periods.

Foreign currencies

The company’s primary activities are denominated in euros. Accordingly, the euro is the company’s functional currency, which is also the

group’s presentation currency. Items included in the financial information of individual entities in the group are measured using the

individual entity’s functional currency, which is the currency of the primary economic environment in which the entity operates.

Transactions and balances

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing on the dates of the transactions.

At each balance sheet date, monetary items denominated in foreign currencies are retranslated at the rates prevailing at the balance sheet

date. Non-monetary items carried at fair value that are denominated in foreign currencies are retranslated at the rates prevailing at the

date when the fair value was determined. Non-monetary items that are measured in terms of historical cost in a foreign currency are not

retranslated.

Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at year-end exchange rates

of monetary assets and liabilities denominated in foreign currencies are recognised in the income statement, except when deferred in

equity as qualifying cash flow hedges.

Foreign exchange gains and losses are presented under “Other financial result” in the income statement.