TomTom 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

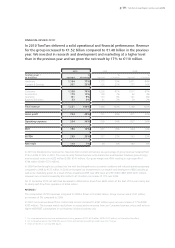

p 23 / TomTom Annual Report and Accounts 2010

NET RESULT /

The result for 2010 was €110 million, €16 million higher

than in 2009 (€94 million). This is mainly the result of the

higher gross profit and decreased borrowing costs and

lower losses on our derivative portfolio partly offset by the

increase in operating expenses.

LIQUIDITY AND CAPITAL RESOURCES /

Cash flow from operations was €265 million compared to

€430 million in 2009. Cash generated by operations results

from the operating profit of €186 million adjusted for non

cash items. In 2010 investment in working capital increased

by €26 million due to an increase in inventories and

receivables partly offset by an increase in current liabilities.

Cash flow used in investing activities consisted of capital

expenditure of €65 million (2009: €90 million), of which

€47 million was invested in technology and development

and €18 million on property, plant and equipment. Our

main investments in 2010 were in our map database, data

centres and navigation technologies.

Cash flow used in financing activities is mainly related to

the term loan repayment of €210 million.

DEBT FINANCING /

On 31 December 2010 the book value of the company’s

borrowings amounted to €588 million, a decrease of €202

million compared to the previous year (2009: €790 million).

Excluding transaction costs, which are netted against the

borrowings, gross borrowings amounted to €598 million,

down from €808 million in the previous year. The decrease

resulted from the €210 million debt repayment.

On 31 December 2010 net debt had decreased to €294

million, down from €442 million at the start of the year.

The net debt is the sum of the borrowings (€598 million),

less the cash and cash equivalents at the end of the year

(€306 million) plus financial lease commitments (€1 million).

The reduction in net debt results from another year of

strong cash generation. We reduced our leverage ratio

from 1.31 in 2009 to 0.98 in 2010.

The floating interest coupon of the loan is based on

Euribor plus a margin. The Euribor element of the interest

coupon is partly fixed with interest rate swaps until

31 December 2011.

2010 CASHFLOW DEVELOPMENT (in € millions)

200

300

350

250

500

400

450

550

600

368

186 (26)

53 (65)

(210)

306

Cash position

on 31 Dec 09

Operating result

Working capital

Other

Investments

Repayment of

borrowings

Cash position

on 31 Dec 10

REDEMPTION SCHEDULE (in € millions)

0

150

200

50

100

300

250

350

400

450

2010 2011 2012

SELLING, GENERAL AND ADMINISTRATIVE

EXPENSES (in € millions)

0

150

200

50

100

250

2007 2008 2009 2010