Texas Instruments 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Annual Report

Notice of 2015 Annual Meeting & Proxy Statement

Table of contents

-

Page 1

2014 Annual Report Notice of 2015 Annual Meeting & Proxy Statement -

Page 2

... more than our best competitors. Returns to shareholders: Our business model enables us to consistently generate more cash than we need to fund our future. In 2014, TI's free cash ï¬,ow of $3.5 billion was 27 percent of revenue, and in the years ahead we expect that rate can improve to 30... -

Page 3

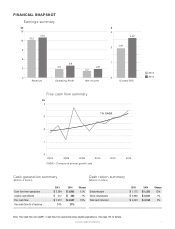

... 2013 0 Revenue Operating Profit Net Income 0 Diluted EPS 2014 2.8 1 Free cash flow summary $B 4 7% CAGR 3 2 1 0 2004 2006 2008 2010 2012 2014 CAGR - Compound annual growth rate Cash generation summary (Millions of dollars) 2013 2014 Change Cash return summary (Millions of dollars) 2013 2014... -

Page 4

...฀accounting฀policies฀and฀practices ...32 •฀ (3)฀Acquisition฀charges ...36 •฀ (4)฀Restructuring฀charges/other ...37 •฀ (5)฀Stock-based฀compensation ...38 •฀ (6)฀Profit฀sharing฀plans ...43 •฀ (7)฀Income฀taxes ...43 •฀ (8)฀Financial฀instruments... -

Page 5

... Information...63 PART III Item 10. Item 11. Item 12. Item 13. Item 14. Directors, Executive Officers and Corporate Governance ...63 Executive Compensation ...63 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...64 Certain Relationships and Related... -

Page 6

(This page intentionally left blank.) iv TEXAS IN ST RU M EN TS -

Page 7

... ï,¨ TEXAS INSTRUMENTS INCORPORATED (Exact name of Registrant as specified in its charter) Delaware (State of Incorporation) 75-0289970 (I.R.S. Employer Identification No.) 12500 TI Boulevard, Dallas, Texas (Address of Principal Executive Offices) 75243 (Zip Code) Registrant's Telephone Number... -

Page 8

...channels.฀ The life cycles of catalog products generally span multiple years, with some products continuing to sell for decades after their initial release.฀Application-specific฀standard฀products฀(ASSPs)฀are฀designed฀for฀use฀by฀a฀smaller฀number฀of฀customers฀and฀are... -

Page 9

...฀revenue฀in฀2014฀and฀includes: •฀ Revenue from our smaller product lines, such as DLP®฀products฀(primarily฀used฀in฀projectors฀to฀create฀high-definition฀images),฀ certain custom semiconductors known as application-specific integrated circuits (ASICs) and calculators... -

Page 10

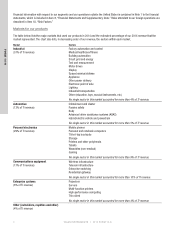

... in this market accounted for more than 4% of TI revenue. Personal electronics (29% of TI revenue) Communications equipment (17% of TI revenue) Enterprise systems (6% of TI revenue) Other (calculators, royalties and other) (4% of TI revenue) 4 Texas฀ In sTru m en T s 2014฀FOrm ฀10-K -

Page 11

...the sales network, technological innovation, product development execution, technical฀support,฀customer฀service,฀quality,฀reliability,฀price฀and฀scale.฀The฀primary฀competitive฀factors฀for฀our฀Analog฀products฀include฀ design proficiency, a diverse product portfolio... -

Page 12

...฀inventory฀programs฀in฀place฀for฀our฀largest฀customers฀ and฀distributors. Design centers Our design centers provide design, engineering and product application support as well as after-sales customer service. The design centers are strategically located around the world... -

Page 13

...suppliers฀on฀semiconductor฀manufacturing฀technology. Executive officers of the Registrant The฀following฀is฀an฀alphabetical฀list฀of฀the฀names฀and฀ages฀of฀the฀executive฀officers฀and฀those฀chosen฀to฀become฀executive฀officers฀of฀ the฀company฀and... -

Page 14

...TI฀฀ Investor Relations฀web฀site฀are฀reports฀filed฀by฀our฀directors฀ and executive officers on Forms 3, 4 and 5, and amendments to those reports. F O RM 1 0 - K Available฀on฀our฀web฀site฀at฀www.ti.com/corporategovernance฀are:฀(i)฀our฀Corporate฀Governance... -

Page 15

... products into China typically represent a large portion of our revenue. Operating internationally exposes us to฀political฀and฀economic฀conditions,฀security฀risks,฀health฀conditions฀and฀possible฀disruptions฀in฀transportation,฀communications฀and฀ information technology... -

Page 16

...the฀timing฀of฀customer฀or฀distributor฀inventory฀adjustments)฀may฀adversely฀affect฀our฀results฀of฀operations฀and฀financial฀condition. Our฀results฀of฀operations฀could฀be฀adversely฀affected฀by฀our฀distributors'฀promotion฀of฀competing฀product... -

Page 17

...฀to฀support฀the฀financing฀ needs฀of฀the฀company.฀Our฀ability฀to฀fund฀our฀daily฀operations,฀invest฀in฀our฀business,฀make฀strategic฀acquisitions,฀service฀our฀debt฀ obligations฀and฀meet฀our฀cash฀return฀objectives฀requires฀continuous... -

Page 18

... of operations and financial condition and our reputation. F O RM 1 0 - K Our฀continued฀success฀depends฀in฀part฀on฀our฀ability฀to฀retain฀and฀recruit฀a฀sufficient฀number฀of฀qualified฀ employees in a competitive environment. Our continued success depends in part on... -

Page 19

...upon฀our฀financial฀condition,฀results฀of฀operations฀or฀liquidity.฀ The฀Internal฀Revenue฀Code฀requires฀that฀companies฀disclose฀in฀their฀Form฀10-K฀whether฀they฀have฀been฀required฀to฀pay฀penalties฀to฀the฀ Internal฀Revenue฀Service฀for... -

Page 20

....24 Issuer purchases of equity securities The฀following฀table฀contains฀information฀regarding฀our฀purchases฀of฀our฀common฀stock฀during฀the฀fourth฀quarter฀of฀2014. Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) Approximate Dollar... -

Page 21

...financial statements and Management's discussion and analysis of financial condition and results of operations. Texas฀ In sTru m en T s 2014฀FOrm ฀10-K 15 F O RM 1 0 - K Cash flow data Cash flows from operating activities Capital expenditures ...Free cash flow (a) ...Dividends paid ...Stock... -

Page 22

...have resulted in consistent share gains and free cash flow growth, and they put us in a unique class of companies with the ability to grow, generate cash, and return that cash to shareholders. Management's discussion and analysis of financial condition and results of operations (MD&A) should be read... -

Page 23

... strong cash flow from operations. In 2014, free cash flow was 27 percent of revenue, up 3 percentage points from a year ago. During the year, we returned $4.2 billion of cash to investors through a combination of stock repurchases and dividends. Free cash flow is a non-GAAP financial measure... -

Page 24

... products. Our business model continued to generate strong cash flow from operations, with free cash flow for 2013 of $3 billion, or 24 percent of revenue. During 2013 we returned over $4 billion of cash to investors through a combination of stock repurchases and dividends. Details฀of฀financial... -

Page 25

... of our Japan pension program from the pension trust to the government of Japan. These net amounts are all included in Other. For details on restructuring actions, see Note 4 to the financial statements. F O RM 1 0 - K Operating profit was $2.83 billion, or 23.2 percent of revenue, compared with... -

Page 26

...Cash flows from financing activities. In 2014, these exercises provided cash proceeds of $616 million compared with $1.31 billion in 2013. Stock option exercises in 2013 were higher than historical averages. We believe we have the necessary financial resources and operating plans to fund our working... -

Page 27

... the United States, we use statistical analyses, estimates and projections that affect the reported amounts and related disclosures and may vary from actual results. We consider the following accounting policies to be both those that are most important to the portrayal of our financial condition and... -

Page 28

...to customers or distributors under programs common in the semiconductor industry. These allowances are based on analysis of historical data, current economic conditions, and contractual terms and are recorded when revenue is recognized. Allowances may include volume-based incentives, product returns... -

Page 29

... captured by the statistical allowance. Examples are an end-of-life part or demand with imminent risk of cancellation. Allowances are also calculated quarterly for instances where inventoried costs for individual products are in excess of market prices for those products. Actual future write-offs of... -

Page 30

... the equity or cost method). •฀ Equity investments - includes non-marketable (non-publicly traded) equity securities. Investments in mutual funds are stated at fair value. Changes in prices of the mutual fund investments are expected to offset related changes in deferred compensation liabilities... -

Page 31

...at December 31, 2014 and 2013 ...Cash flows for each of the three years in the period ended December 31, 2014 ...Stockholders' equity for each of the three years in the period ended December 31, 2014 ...Notes to financial statements ...Report of independent registered public accounting firm ...26 28... -

Page 32

..., except share and per-share amounts) For Years Ended December 31, 2014 2013 2012 Revenue ...Cost of revenue (COR) ...Gross profit ...Research and development (R&D) ...Selling, general and administrative (SG&A) . Acquisition charges ...Restructuring charges/other ...Operating profit...Other income... -

Page 33

... 31, 2014 2013 2012 Net income ...Other comprehensive income (loss) Net actuarial gains (losses) of defined benefit plans: Adjustment, net of tax benefit (expense) of $25, ($60) and $29 ...Recognized within Net income, net of tax benefit (expense) of ($21), ($37) and ($104) . Prior service cost of... -

Page 34

... (Millions of dollars, except share amounts) December 31, 2014 2013 Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances of ($12) and ($22) Raw materials ...Work in process ...Finished goods ...Inventories ...Deferred income taxes... -

Page 35

... Statements of Cash Flows (Millions of dollars) 2014 2013 2012 Cash flows from operating activities Net income ...Adjustments to Net income: Depreciation ...Amortization of acquisition-related intangibles . Amortization of capitalized software ...Stock-based compensation ...Gains on sales... -

Page 36

... net of taxes . . Dividend equivalents paid on restricted stock units . Balance, December 31, 2012 ...2013 Net income ...Dividends declared and paid ($1.07 per share) ...Common stock issued for stock-based awards ...Stock repurchases ...Stock-based compensation...Tax impact from exercise of options... -

Page 37

...those described below in the summary of significant accounting policies and practices. Segment information Revenue: Analog ...Embedded Processing Other ...Total revenue ...Operating profit: Analog ...Embedded Processing Other ...Total operating profit ... For Years Ended December 31, 2014 2013 2012... -

Page 38

...to customers or distributors under programs common in the semiconductor industry. These allowances are based on analysis of historical data, current economic conditions, and contractual terms and are recorded when revenue is recognized. Allowances may include volume-based incentives, product returns... -

Page 39

... the customer or distributor pulls product from consignment inventory that we store at designated locations. About 60 percent of our distributor revenue is generated from sales of consigned inventory. The allowances we record against this revenue are not material. We determine the amount and timing... -

Page 40

... of earnings per common share are as follows (shares in millions): 2014 Net Income Shares EPS For Years Ended December 31, 2013 Net Income Shares EPS 2012 Net Income Shares EPS Basic EPS: Net income ...Income allocated to RSUs ...Income allocated to common stock for basic EPS calculation ...F O RM... -

Page 41

... concern, and if so, to provide related footnote disclosures. The standard is effective for annual and interim reporting periods ending after December 15, 2016. We expect it will have no impact on our financial position and results of operations. Texas฀ In sTru m en T s 2014฀FOrm ฀10-K 35 -

Page 42

...National that are included in Other for segment reporting purposes, consistent with how management measures the performance of its segments. Total acquisition-related charges are detailed below: For Years Ended December 31, 2014 2013 2012 Amortization of intangible assets . Stock-based compensation... -

Page 43

...December 31, 2014, $247 million has been paid to terminated employees for severance and benefits. Also in 2012, we announced closure of two older semiconductor manufacturing facilities in Houston, Texas, and Hiji, Japan. We recognized $200 million in cumulative restructuring charges related to these... -

Page 44

... plans. The plans generally provide for annual grants of stock options and RSUs, a one-time grant of RSUs to each new non-employee director and the issuance of TI common stock upon the distribution of stock units credited to deferred compensation accounts established for such directors. 38 Texas... -

Page 45

...-month term. Total stock-based compensation expense recognized was as follows: For Years Ended December 31, 2014 2013 2012 These amounts include expenses related to non-qualified stock options, RSUs and stock options offered under our employee stock purchase plan and are net of expected forfeitures... -

Page 46

... plans Stock option and RSU transactions under our long-term incentive and director compensation plans during 2014 were as follows: Stock Options Weighted Average Exercise Shares Price per Share RSUs Weighted Average Grant Date Fair Value per Share Shares Outstanding grants, December 31, 2013... -

Page 47

...60 39.44 45.46 The weighted average grant date fair value of options granted under the employee stock purchase plans during the years 2014, 2013 and 2012 was $7.34, $5.71 and $4.52 per share, respectively. During the years ended December 31, 2014, 2013 and 2012, the total intrinsic value of options... -

Page 48

... Beginning in 2013, only treasury shares were issued. Shares available for future grants and reserved for issuance are summarized below: December 31, 2014 Long-Term Incentive and Director Compensation Plans Employee Stock Purchase Plan Shares Total Reserved for issuance (a)...Shares to be issued... -

Page 49

... or more subsidiary or company-wide financial metrics. We pay profit sharing benefits primarily under the company-wide TI Employee Profit Sharing Plan. This plan provides for profit sharing to be paid based solely on TI's operating margin for the full calendar year. Under this plan, TI must achieve... -

Page 50

... and liabilities were as follows: December 31, 2014 2013 F O RM 1 0 - K Deferred income tax assets: Deferred loss and tax credit carryforwards ...Accrued expenses ...Stock-based compensation...Inventories and related reserves ...Retirement costs for defined benefit and retiree health care Other... -

Page 51

... December 31, 2014, 2013 and 2012, respectively. Uncertain tax positions We operate in a number of tax jurisdictions, and our income tax returns are subject to examination by tax authorities in those jurisdictions who may challenge any item on these tax returns. Because the matters challenged by... -

Page 52

...-for-sale securities in OI&E in our Consolidated Statements of Income. We classify certain mutual funds as trading securities. These mutual funds hold a variety of debt and equity investments intended to generate returns that offset changes in certain deferred compensation liabilities. We record... -

Page 53

... not recognize any credit losses related to available-for-sale investments for the years ended December 31, 2014, 2013 and 2012. For the years ended December 31, 2014, 2013 and 2012, the proceeds from sales, redemptions and maturities of short-term available-for-sale investments were $2.97 billion... -

Page 54

... accounted for at fair value on a recurring basis as of December 31, 2014 and 2013. We had no Level 3 assets or liabilities as of December 31, 2014 and 2013. These tables do not include cash on hand, assets held by our postretirement plans, or assets and liabilities that are measured at historical... -

Page 55

... retiree health care benefit plans. For qualifying employees, we offer deferred compensation arrangements. U.S. retirement plans Our principal retirement plans in the U.S. are a defined contribution plan; an enhanced defined contribution plan; and qualified and non-qualified defined benefit pension... -

Page 56

...Balance Sheets Expense related to defined benefit and retiree health care benefit plans was as follows: U.S. Defined Benefit 2014 2013 2012 U.S. Retiree Health Care 2014 2013 2012 Non-U.S. Defined Benefit 2014 2013 2012 Service cost ...Interest cost ...Expected return on plan assets ...Amortization... -

Page 57

.... We expect to contribute about $100 million to our retirement benefit plans in 2015. The amounts shown for underfunded U.S. defined benefit plans were for non-qualified pension plans, which we do not fund because contributions to them are not tax deductible. Texas฀ In sTru m en T s 2014฀FOrm... -

Page 58

...at December 31, 2014 and 2013, respectively, for the non-U.S. defined benefit plans. The amounts recorded in AOCI for the years ended December 31, 2014 and 2013, are detailed below by plan type: U.S. Defined Benefit Net Prior Actuarial Service Loss Credit U.S. Retiree Health Care Net Prior Actuarial... -

Page 59

... major benefit plans largely consist of low-cost, broad-market index funds to mitigate risks of concentration within market sectors. Our investment policy is designed to better match the interest rate sensitivity of the plan assets and liabilities. The appropriate mix of equity and bond investments... -

Page 60

... and cash equivalents ...Equity securities ... 65% 35% 65% 35% 49% 51% 49% 51% 73% 27% 70% 30% None of the plan assets related to the defined benefit pension plans and retiree health care benefit plan are directly invested in TI common stock. As of December 31, 2014, we do not expect to return... -

Page 61

... from plan assets and not from company assets. U.S. Defined Benefit U.S. Retiree Health Care Medicare Subsidy Non-U.S. Defined Benefit Assumed health care cost trend rates for the U.S. retiree health care benefit plan at December 31 are as follows: 2014 2013 Assumed health care cost trend rate for... -

Page 62

... and debt expense over the term of the debt. Long-term debt outstanding as of December 31, 2014 and 2013 is as follows: December 31, 2014 2013 Notes due 2014 at 1.375% ...Notes due 2015 at 3.95% (assumed with National acquisition) . Notes due 2015 at 0.45% ...Notes due 2016 at 2.375% ...Notes due... -

Page 63

.... As of December 31, 2014, we believe future payments related to these indemnity obligations will not have a material effect on our financial condition, results of operations or liquidity. 14. Supplemental financial information For Years Ended December 31, 2014 2013 2012 Other income (expense), net... -

Page 64

... Customer incentive programs and allowances Severance and related expenses ...Other ...Total ... December 31, 2014 2013 $ 101 60 337 $ 498 $ 143 158 350 $ 651 Accumulated other comprehensive income (loss), net of taxes F O RM 1 0 - K December 31, 2014 2013 Postretirement benefit plans... -

Page 65

... financial data (unaudited) Quarter 2014 1st 2nd 3rd 4th Earnings per common share: Basic earnings per common share ...Diluted earnings per common share ... $ 0.44 0.44 $ 0.63 0.62 $ 0.77 0.76 $ 0.78 0.76 Quarter 2013 1st 2nd 3rd 4th Revenue ...Gross profit ...Included in Operating profit... -

Page 66

... public accounting firm The Board of Directors and Stockholders Texas Instruments Incorporated We have audited the accompanying consolidated balance sheets of Texas Instruments Incorporated and subsidiaries (the Company) as of December 31, 2014 and 2013, and the related consolidated statements... -

Page 67

... reporting is effective based on the COSO criteria. TI's independent registered public accounting firm, Ernst & Young LLP, has issued an audit report on the effectiveness of our internal control over financial reporting, which immediately follows this report. Texas฀ In sTru m en T s 2014... -

Page 68

... of independent registered public accounting firm on internal control over financial reporting The Board of Directors and Stockholders Texas Instruments Incorporated We have audited Texas Instruments Incorporated's internal control over financial reporting as of December 31, 2014, based on criteria... -

Page 69

...proxy statement. A list of our executive officers and their biographical information appears in Part I, Item 1 of this report. F O RM 1 0 - K Code of Ethics We have adopted the Code of Ethics for TI Chief Executive Officer and Senior Finance Officers. A copy of the Code can be found on our web site... -

Page 70

...Corporation 2009 Incentive Award Plan, a plan approved by National stockholders. The company assumed the awards in connection with its acquisition of National. (2) Restricted stock units and stock units credited to directors' deferred compensation accounts are settled in shares of TI common stock on... -

Page 71

... appointment of independent registered public accounting firm" in our proxy statement for the 2015 annual meeting of stockholders is incorporated herein by reference to such proxy statement. PART IV ITEM 15. Exhibits, Financial Statement Schedules. The financial statements are listed in the index... -

Page 72

...December 31, 2011). Texas Instruments 2003 Director Compensation Plan as amended January 19, 2012. †Form of Stock Option Agreement for Executive Officers under the Texas Instruments 2009 Long-Term Incentive Plan (incorporated by reference to Exhibit 10(l) to the Registrant's Annual Report on Form... -

Page 73

... Economic, social and political conditions in the countries in which TI, its customers or its suppliers operate, including security risks, health conditions, possible disruptions in transportation, communications and information technology networks and fluctuations in foreign currency exchange rates... -

Page 74

... caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized. TEXAS INSTRUMENTS INCORPORATED By: F O RM 1 0 - K /s/ Kevin P. March Kevin P. March Senior Vice President, Chief Financial Officer and Chief Accounting Officer Date: February 24, 2015 Each person whose... -

Page 75

... Todd Whitman Christine Todd Whitman /s/ Kevin P. March Kevin P. March Director Senior Vice President; Chief Financial Officer; Chief Accounting Officer Texas฀ In sTru m en T s 2014฀FOrm ฀10-K 69 F O RM 1 0 - K Chairman of the Board; Director; President and Chief Executive Officer -

Page 76

(This page intentionally left blank.) 70 TEXAS IN ST RU M EN TS -

Page 77

...at the annual meeting. We urge you to vote your shares as promptly as possible by: (1) accessing the Internet website, (2) calling the toll-free number or (3) signing, dating and mailing the enclosed proxy. Sincerely, Dallas, Texas March 4, 2015 T ex as฀ In sT r u m en Ts 2015฀PrOxY฀sTaT em... -

Page 78

... 117 117 118 119 PROXY STATEMENT - MARCH 4, 2015 EXECUTIVE OFFICES 12500 TI BOULEVARD, DALLAS, TEXAS 75243 MAILING ADDRESS: P.O. BOX 660199, DALLAS, TEXAS 75266-0199 Voting procedures and quorum P ROX Y STATE ME NT TI's board of directors requests your proxy for the annual meeting of stockholders... -

Page 79

...the election of directors, an advisory vote regarding approval of the company's executive compensation and ratification of the appointment of our independent registered public accounting firm. Each of these matters is discussed elsewhere in this proxy statement. On each of these matters you may vote... -

Page 80

... persons named as proxies may vote for a substitute or the number of directors will be reduced accordingly. Directors RALPH W. BABB, JR. Age 66 Director since 2010 Chair, Audit Committee RONALD KIRK Age 60 Director since 2013 Member, Governance and Stockholder Relations Committee RUTH J. SIMMONS Age... -

Page 81

... as defined by the rules of The NASDAQ Stock Market (NASDAQ) and the board's corporate governance guidelines. Our board of directors has adopted a written charter for the G&SR Committee. It can be found on our website at www.ti.com/corporategovernance. It is a long-standing policy of the board to... -

Page 82

... First USA, has developed a keen appreciation for audit- and financial control-related matters. •฀ As a director of Dr Pepper Snapple Group, Inc. (2008-present) and a director of Molson Coors Brewing Company (2005-2009), has helped oversee the strategy and operations of other major multinational... -

Page 83

... CEO and senior financial officers are available on our website at www.ti.com/corporategovernance. Stockholders may request copies of these documents free of charge by writing to Texas Instruments Incorporated, P.O. Box 660199, MS 8657, Dallas, TX 75266-0199, Attn: Investor Relations. T ex as฀ In... -

Page 84

... of the board, chief executive officer or other executive officer and (c) benefits under a tax-qualified retirement plan, or non-discretionary compensation); 3. A family member of the director was employed as an executive officer by the company; 4. A family member of the director received more... -

Page 85

... TI's independent registered public accounting firm related to quality control. •฀ Reviewing TI's annual and quarterly reports to the SEC, including the financial statements and the "Management's Discussion and Analysis" portion of those reports, and recommending appropriate action to the board... -

Page 86

... regularly scheduled meetings, reports its activities to the board, and consults with the board before setting annual executive compensation. Please see page 97 for a report of the committee. In performing its functions, the committee is supported by the company's Human Resources organization. The... -

Page 87

...the company's executive officers. Pursuant to that authority, the Compensation Committee has delegated to a special committee established by the board the authority to grant a limited number of stock options and restricted stock units under the company's long-term incentive plans. The sole member of... -

Page 88

...TI's Human Resources organization. The CEO, the senior vice president responsible for Human Resources and the Secretary review the recommendations made to the committee. The CEO also votes, as a member of the board, on the compensation of non-employee directors. The compensation arrangements in 2014... -

Page 89

... the Director Plan, some directors have chosen to defer all or part of their cash compensation until they leave the board (or certain other specified times). These deferred amounts were credited to either a cash account or stock unit account. Cash accounts earn interest from TI at a rate currently... -

Page 90

... all persons who were non-employee members of the board during 2014 for services in all capacities to TI in 2014. Change in Pension Value and Nonqualified Deferred All Other Compensation Compensation Earnings (4) ($) (5) Name Fees Earned or Paid in Cash ($) (1) Stock Awards ($) (2) Option Awards... -

Page 91

... annually. PR OXY STATE ME NT Proposal regarding advisory approval of the company's executive compensation The board asks the shareholders to cast an advisory vote on the compensation of our named executive officers. The "named executive officers" are the chief executive officer, chief financial... -

Page 92

... our compensation program holds our executive officers accountable for the financial and competitive performance of TI. •฀ 2014 compensation decisions for the CEO: â-‹ Base salary was increased by 3.3 percent over 2013. â-‹ The grant date fair value of equity compensation awarded in 2014 was... -

Page 93

... awards are not part of the pension calculation. The committee's strategy for setting cash and non-cash compensation is described in the table that follows immediately below. Its compensation decisions for the named executive officers for 2014 are discussed on pages 89-94. Benefit programs... -

Page 94

... near-term financial performance as well as our progress in building long-term shareholder value. The committee aims to pay total cash compensation (base salary, profit sharing and bonus) appropriately above median if company performance is above that of competitors, and pay total cash compensation... -

Page 95

... ...Texas Instruments Incorporated ... * Trailing four-quarter revenue as reported by Thomson Reuters on February 2, 2015. Market capitalization as of December 31, 2014. Analysis of compensation determinations for 2014 Total compensation Before finalizing the compensation of the executive officers... -

Page 96

... comparing the grant date fair values and number of shares for each of the years shown in the summary compensation table. Grant Date Fair Value * Stock Options (in Shares) Restricted Stock Units (in Shares) Officer Year R. K. Templeton ... 2014 2013 2012 2014 2013 2012 2014 2013 2012 $ 9,800,034... -

Page 97

...was the closing price of TI stock on January 23, 2014, the second trading day after the company released its annual and fourth quarter financial results for 2013. All grants were made under the Texas Instruments 2009 Long-Term Incentive Plan, which shareholders approved in April 2009. In addition to... -

Page 98

... products, compound annual revenue growth was 4.7 percent, which was above the median competitor comparison. â-‹ Average operating proï¬t for 2012-2014 was 23 percent, which was above the median competitor comparison. Total shareholder return (TSR) •฀ TSR was 25.1 percent, which was better... -

Page 99

... portfolio, and the diversity of markets and customers it serves. Performance summary 1-Year 3-Year Revenue growth: total TI ...Revenue growth without legacy wireless products Operating margin ...Free cash flow as % of revenue ...% of free cash flow returned to shareholders ...Increase in quarterly... -

Page 100

... table are explained in footnote 5 below.5 Salary (Annual Rate) Equity Compensation (Grant Date Fair Value) Officer Year Profit Sharing Bonus Total R. K. Templeton ... 2014 2013 2012 2014 2013 2012 2014 2013 2012 2014 2014 2013 2012 $ 1,110,000 $ 1,075,000 $ 1,040,000 $ 630,000 $ 610... -

Page 101

... in the enhanced defined contribution plan. Mr. Anderson, who joined the company in 1999, participates in the enhanced defined contribution plan. The other named executive officers have continued their participation in the defined benefit pension plan. The Internal Revenue Code (IRC) imposes certain... -

Page 102

... Health-related benefits Executive officers are eligible under the same plans as all other U.S. employees for medical, dental, vision, disability and life insurance. These benefits are intended to be competitive with benefits offered in the semiconductor industry. P ROX Y STATE ME NT Other benefits... -

Page 103

... as executive officers to reach these targets. Directly owned shares and restricted stock units count toward satisfying the guidelines. Short sales of TI stock by our executive officers are prohibited. It is against TI policy for any employee, including an executive officer, to engage in trading in... -

Page 104

... for 2014 were paid under the Texas Instruments Executive Officer Performance Plan. In accordance with SEC requirements, these amounts are reported in the Non-Equity Incentive Plan Compensation column. (2) Shown is the aggregate grant date fair value of restricted stock unit (RSU) awards calculated... -

Page 105

..." is the difference between the 2013 and 2014 present value of the pension benefit accumulated as of year-end by the named executive officer, assuming that benefit is not paid until age 65. Mr. Templeton's and Mr. Crutcher's benefits under the company's pension plans were frozen as of December 31... -

Page 106

...released its financial results for the fourth quarter and year 2013. The company released these results on January 21, 2014. (2) The stock awards granted to the named executive officers in 2014 were RSU awards. These awards were made under the company's 2009 Long-Term Incentive Plan. For information... -

Page 107

... equity awards for each of the named executive officers as of December 31, 2014. Option Awards Stock Awards Equity Incentive Equity Plan Incentive Awards: Plan Awards: Number of Market or Unearned Payout Value Market Value Shares, of Unearned of Shares or Units or Shares, Units Units of Stock... -

Page 108

... date of the grant. The chart below shows the termination provisions relating to stock options outstanding as of December 31, 2014. The Compensation Committee of the board of directors established these termination provisions to promote employee retention while offering competitive terms. Employment... -

Page 109

..., this award is reflected in the 2014 non-qualified deferred compensation table on page 106. 2014 option exercises and stock vested The following table lists the number of shares acquired and the value realized as a result of option exercises by the named executive officers in 2014 and the... -

Page 110

...executive officer's continued employment after December 31, 2014. Present Value of Accumulated Benefit ($) (6) Payments During Last Fiscal Year ($) Name (1) Plan Name Number of Years Credited Service (#) R. K. Templeton (2) ... TI Employees Pension Plan TI Employees Non-Qualified Pension Plan TI... -

Page 111

... for normal and early retirement under these plans is the same as under the qualified plan (please see above). Benefits are paid in a lump sum. A participant's benefits under Plan I and Plan II are calculated using the same formula as described above for the TI Employees Pension Plan. However, the... -

Page 112

... of the award at year-end 2014 (in both cases, the number of RSUs is multiplied by the closing price of TI common stock on the last trading date of the year)); and (c) a $37,056 gain in Mr. Templeton's deferred compensation account in 2014. Dividend equivalents are paid at the same rate as dividends... -

Page 113

...and the earliest date of payment is the first day of the second calendar month following the month of death. Like the balances under the non-qualified defined benefit pension plans, deferred compensation balances are unsecured obligations of the company. For amounts earned and deferred prior to 2010... -

Page 114

... the paid leave and end when the executive officer has reached the earlier of age 55 with at least 20 years of employment or age 60 (bridge to retirement). The bridge to retirement will be credited to years of service under the qualified and non-qualified pension plans described above. Stock options... -

Page 115

... the named executive officer does not request payment of his disability benefit until age 65. The assumptions used in calculating these amounts are the same as the age-65 lump-sum assumptions used for financial reporting purposes for the company's audited financial statements for 2014 and are... -

Page 116

...and the closing price of TI common stock as of December 31, 2014 ($53.47), multiplied by the number of shares under such options as of December 31, 2014. (5) Value of the benefit payable in a lump sum to the executive officer's beneficiary calculated as required by the terms of the plan assuming the... -

Page 117

...Audit-related services were $797,000 in 2014 and $685,000 in 2013. The services provided in exchange for these fees included employee benefit plan audits, certification procedures relating to compliance with local-government or other regulatory standards for various non-U.S. subsidiaries, and access... -

Page 118

... of the common stock of the company. Persons generally "beneficially own" shares if they have the right to either vote those shares or dispose of them. More than one person may be considered to beneficially own the same shares. Name and Address Shares Owned at December 31, 2014 Percent of Class... -

Page 119

... TI common stock by directors, the named executive officers and all executive officers and directors as a group. Each director and named executive officer has sole voting power (except for shares obtainable within 60 days, shares subject to RSUs and shares credited to deferred compensation accounts... -

Page 120

... shares in deferred compensation accounts are issued following a director's termination of service. Related person transactions The company has no reportable related person transactions. Because we believe that company transactions with directors and executive officers of TI or with persons related... -

Page 121

...a director's independence; the availability of other sources for comparable products or services; the terms of the arrangement; and the terms available to unrelated third parties or to employees generally. The primary consideration is whether the transaction between TI and the related person (a) was... -

Page 122

..., on or before November 5, 2015. Proposals are to be sent to: Texas Instruments Incorporated, 12500 TI Boulevard, MS 8658, Dallas, TX 75243, Attn: Secretary. If you wish to submit a proposal at the 2016 annual meeting (but not seek inclusion of the proposal in the company's proxy material), we must... -

Page 123

... company's Annual Report on Form 10-K for the year ended December 31, 2014, that was filed with the SEC without charge by writing to Investor Relations, P.O. Box 660199, MS 8657, Dallas, TX 75266-0199. Our Form 10-K is also available in the "Investor Relations" section of our website at www.TI.com... -

Page 124

Directions and other annual meeting information Directions From DFW airport: Take the North Airport exit to IH-635E. Take IH-635E to the Greenville Avenue exit. Turn right (South) on Greenville. Turn right (West) on Forest Lane. Texas Instruments will be on your right at the second traffic light. ... -

Page 125

... (compound annual growth rate) is calculated using the formula: (Ending Value/Beginning Value)1/number of years-1. Percentage of Revenue For Years Ended December 31, 2014 2013 2012 Free Cash Flow as a Percentage of Revenue (Millions of dollars) For Years Ended December 31, 2014 2013 2012 Total... -

Page 126

(This฀page฀intentionally฀left฀blank.) 120 TEXAS IN ST RU M EN TS -

Page 127

(This฀page฀intentionally฀left฀blank.) TEXAS IN ST RU M EN TS 121 -

Page 128

(This฀page฀intentionally฀left฀blank.) 122 TEXAS IN ST RU M EN TS -

Page 129

..., 2014. The total shareholder return assumes $100 invested at the beginning of the period in TI common stock, the S&P 500 Index and the S&P Information Technology Index. It also assumes reinvestment of all dividends. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN Among Texas Instruments Incorporated... -

Page 130

... cash flow is a non-GAAP financial measure. For a definition of and the reason for using this measure, see page 20 of this Annual Report. For Twelve Months Ended December 31, 2014 2013 Change Cash flows from operations (GAAP) ...Capital expenditures ...Free cash flow (non-GAAP) ...Revenue ...Cash... -

Page 131

...company's annual report to the Securities and Exchange Commission on Form 10-K is available on the Investor Relations website at www.ti.com/ir. Copies of the Form 10-K, including a list of exhibits and any exhibit speciï¬cally requested, are available without charge by writing to: Texas Instruments... -

Page 132

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com An equal opportunity employer © 2015 Texas Instruments Incorporated TI-30003