Texas Instruments 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2006 ANNUAL REPORT 5

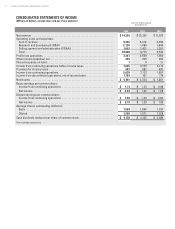

6 Consolidated Statements of Income

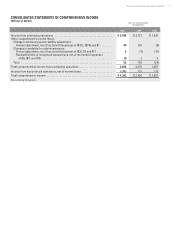

7 Consolidated Statements of Comprehensive Income

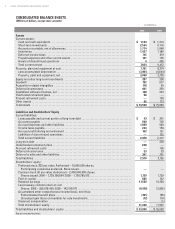

8 Consolidated Balance Sheets

9 Consolidated Statements of Cash Flows

10 Consolidated Statements of Stockholders’ Equity

11 Notes to Financial Statements

- Description of Business and Significant

Accounting Policies and Practices

- Discontinued Operations

- Cash Equivalents and Short-term Investments

- Equity and Other Long-term Investments

- Goodwill and Other Acquisition-related Intangibles

- Debt and Lines of Credit

- Financial Instruments and Risk Concentration

-Stockholders’ Equity

39 Report of Independent Registered Public Accounting Firm

40 Report by Management on Internal Control over

Financial Reporting

41 Report of Independent Registered Public Accounting Firm

on Internal Control over Financial Reporting

42 Summary of Selected Financial Data

43 Management’s Discussion and Analysis of

Financial Condition and Results of Operations

- Overview

- Results of Operations

-Prior Results of Operations

- Financial Condition

- Liquidity and Capital Resources

56 Quarterly Financial Data

57 Common Stock Prices and Dividends

Comparison of Total Shareholder Return

Safe Harbor Statement

FINANCIAL STATEMENTS TABLE OF CONTENTS

-Stock-based Compensation

- Postretirement Benefit Plans

-Profit Sharing and Savings Plans

-Segment and Geographic Area Data

-Income Taxes

- Commitments and Contingencies

-Supplemental Financial Information

-Subsequent Event

- Long-term Contractual Obligations

-Critical Accounting Policies

- Changes in Accounting Standards

- Quantitative and Qualitative Disclosures

about Market Risk

5

5

8

9