Texas Instruments 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2006 ANNUAL REPORT 1717

governmental authority that are directly imposed on revenue-producing transactions between a seller and a customer, such

as sales, use, value-added and some excise taxes, on either a gross (included in revenue and costs) or a net (excluded from

revenue) basis. This standard will be effective for us in interim periods and fiscal years beginning after December 15, 2006.

We present these transactions on a net basis and, therefore, the adoption of this standard will have no impact on our financial

position and results of operations.

2. Discontinued Operations

In January 2006, we entered into an agreement to sell substantially all of the Sensors & Controls segment, excluding the RFID

systems operations, to an affiliate of Bain Capital, LLC, for $3 billion in cash. The sale was completed on April 27, 2006. The

former Sensors & Controls business acquired by Bain Capital, LLC was renamed Sensata Technologies (Sensata).

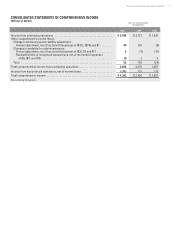

The results of operations of the former Sensors & Controls business are being presented as discontinued operations. The

following summarizes results of the discontinued operations for the years ended December 31, 2006, 2005 and 2004, included

in the consolidated statements of income:

2006 2005 2004

Net revenue ................................................................... $375 $ 1,057 $ 1,028

Operating costs and expenses ................................................... 327 825 779

Income from discontinued operations before income taxes ......................... 48 232 249

Provision for income taxes ...................................................... 19 81 79

Income from discontinued operations, net of income taxes ......................... 29 151 170

Gain on sale of discontinued operations .......................................... 2,554 — —

Provision for income taxes ...................................................... 880 — —

Gain on sale of discontinued operations, net of income taxes ....................... 1,674 — —

Total income from discontinued operations ....................................... $1,703 $151 $170

Income from discontinued operations per common share: (a)

Basic ....................................................................... $1.11 $ 0.09 $ 0.10

Diluted....................................................................... $1.09 $ 0.09 $ 0.10

(a) Earnings per share amounts from continuing and discontinued operations may not add to net income per share due to rounding.

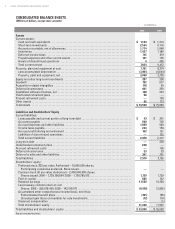

As of December 31, 2006, the remaining assets of the former Sensors & Controls business, included in assets of discontinued

operations, are attributable to pension plans in our Japan subsidiary that are expected to be settled in 2007.

Continuing Involvement: Upon closing of the sales transaction, we entered into a Transition Services Agreement (TSA) with

Sensata to provide various temporary support services that are reasonably necessary to facilitate the continuation of the

normal conduct of business of the former Sensors & Controls business such as finance and accounting, human resources,

information technology, warehousing and logistics, and records retention and storage. Such services are expected to be

provided for up to twelve months from the closing date, although certain information technology-related services may be

provided for up to two years. The fees for these services are generally equivalent to our cost. In addition, we entered into

certain cross-license agreements to allow each party to continue to use the associated technology and intellectual property

in the conduct of their respective business. However, these cross-license agreements generally do not involve the receipt or

payment of any royalties and, therefore, are not considered to be a component of continuing involvement.

Although the services provided under the TSA generate continuing cash flows between us and Sensata, the amounts are not

considered to be significant to the ongoing operations of either entity. In addition, we have no contractual ability through the

TSA or any other agreement to significantly influence the operating or financial policies of Sensata. Under the provisions of

EITF Issue No. 03-13, “Applying the Conditions of Paragraph 42 of FASB Statement No. 144 in Determining Whether to Report

Discontinued Operations,” we therefore have no significant continuing involvement in the operations of the former Sensors &

Controls business and have classified the historical results of that business as discontinued operations.