Texas Instruments 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2006 ANNUAL REPORT 1313

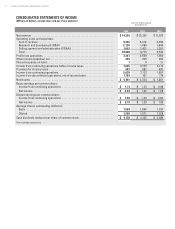

Earnings per Share (EPS): Computation and reconciliation of earnings per common share from continuing operations, on a

basic and diluted basis, are as follows (shares in millions):

2006 2005 2004

Income

from

Continuing

Operations Shares EPS

Income

from

Continuing

Operations Shares EPS

Income

from

Continuing

Operations Shares EPS

Basic EPS ..................... $ 2,638 1,528 $ 1.73 $ 2,173 1,640 $ 1.33 $ 1,691 1,730 $ 0.98

Dilutives:

Stock-based compensation

plans ...................... —32 — 31 — 38

Diluted EPS.................... $ 2,638 1,560 $ 1.69 $ 2,173 1,671 $ 1.30 $ 1,691 1,768 $ 0.96

Options to purchase 93 million, 82 million and 113 million shares of common stock were outstanding during 2006, 2005 and 2004

that were not included in the computation of diluted earnings per share because the options’ exercise price was greater than

the average market price of the common shares and, therefore, the effect would be antidilutive.

Effects of Stock-based Compensation: We have several stock-based employee compensation plans that are more fully

described in Note 9. Prior to July 1, 2005, we accounted for awards granted under those plans following the recognition and

measurement principles of Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related interpretations. No compensation cost was reflected in net income for stock options, as all options granted under

the plans have an exercise price equal to the market value of the underlying common stock on the date of the grant (except

options granted under employee stock purchase plans and acquisition-related stock option awards). Compensation cost has

previously been recognized for restricted stock units (RSUs).

Effective July 1, 2005, we adopted the fair value recognition provisions of Financial Accounting Standards Board (FASB)

Statement of Financial Accounting Standards (SFAS) No. 123(R), “Share-Based Payments,” using the modified prospective

application method. Under this transition method, compensation cost recognized for the years ended December 31, 2006 and

2005, includes the applicable amounts of: (a) compensation cost of all stock-based payments granted prior to, but not yet

vested as of, July 1, 2005 (based on the grant-date fair value estimated in accordance with the original provisions of SFAS 123

and previously presented in pro forma footnote disclosures), and (b) compensation cost for all stock-based payments granted

subsequent to July 1, 2005 (based on the grant-date fair value estimated in accordance with the new provisions of SFAS

123(R)). Results for prior periods have not been restated.

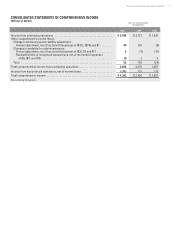

The amounts of stock-based compensation expense recognized in the periods presented are as follows:

2006 2005 2004

Stock-based compensation expense recognized:

Cost of revenue ..................................................................... $64 $32 $—

Research & development (R&D) ...................................................... 101 53 —

Selling, general & administrative (SG&A) .............................................. 167 90 18

Total ............................................................................... $332 $175 $ 18

The amounts above include the impact of recognizing compensation expense related to RSUs, nonqualified stock options and

stock options offered under the employee stock purchase plans. For the periods before our implementation of SFAS 123(R) on

July 1, 2005, only compensation expense related to RSUs was recognized and included in SG&A.

Stock-based compensation expense has not been allocated between segments, but is reflected in Corporate.