Telus 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

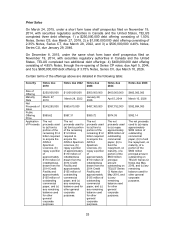

TELUS shares held by directors and executive officers

As at March 7, 2016, the directors and executive officers of TELUS, as a group,

beneficially owned, directly or indirectly, or exercised control or direction over 810,108

Common Shares, which represented approximately 0.14% of the outstanding Common

Shares.

Cease trade orders, bankruptcies, penalties or sanctions

Other than as disclosed below, for the 10 years ended March 10, 2016, we are not aware

that any current director or executive officer of TELUS had been a director or executive

officer of any issuer which, while that person was acting in that capacity, or within a year of

that person ceasing to act in that capacity, became bankrupt or made a proposal under any

legislation relating to bankruptcy or insolvency or was subject to or instituted any

proceedings, arrangement or compromise with creditors or had a receiver, receiver manager

or trustee appointed to hold its assets.

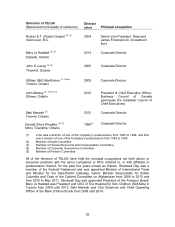

John Lacey was appointed to the board of directors of Stelco Inc. (Stelco) as a

nominee of Tricap Management Limited (Tricap) in March 2006. Stelco had filed for

bankruptcy protection under the Companies’ Creditors Arrangement Act (CCAA) in

January 2004. Mr. Lacey’s appointment as a director was part of a court supervised

restructuring, from which Stelco emerged on March 31, 2006 and pursuant to which

Tricap had the right to appoint four of Stelco’s nine directors.

John Manley was a director of Nortel Networks Corporation and Nortel Networks

Limited (together, the Nortel Companies) when the Nortel Companies and certain

other Canadian subsidiaries initiated creditor protection proceedings under the

CCAA in Canada on January 14, 2009. Certain U.S. subsidiaries filed voluntary

petitions in the United States under Chapter 11 of the U.S. Bankruptcy Code, and

certain European, Middle Eastern and African subsidiaries made consequential

filings in Europe and the Middle East. These proceedings are ongoing. Mr.

Manley resigned as a director of the Nortel Companies on August 10, 2009.

Other than as disclosed below, for the 10 years ended March 10, 2016, we are not aware

that any current director or executive officer of TELUS had been a director, chief

executive officer or chief financial officer of any issuer which was the subject of a cease

trade or similar order while that person was acting in that capacity, or was subject to

such an order issued after the director or executive officer ceased to be a director, chief

executive officer or chief financial officer and resulted from an event that occurred while

that person was acting in that capacity, or any order which denied such company access

to any exemption under securities legislation for a period of more than 30 consecutive

days.

John Manley was a director of the Nortel Companies when the Nortel Companies

announced on March 10, 2006, the need to restate certain of their previously

reported financial results and the resulting delay in the filing of certain 2005

financial statements by the required filing dates. The Ontario Securities

Commission (OSC) issued a final management cease trade order on April 10,

2006, prohibiting all of the directors, officers and certain current and former

employees, including Mr. Manley, from trading in securities of the Nortel

Companies until two business days following the receipt by the OSC of all of the

filings the Nortel Companies were required to make under Ontario securities

laws. The British Columbia Securities Commission (BCSC) and the Autorité des