Telus 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

September 15, 2015. Such purchases will be made through the facilities of the TSX, the

NYSE and alternative trading platforms or otherwise as may be permitted by applicable

securities laws and regulations. This represents up to 2.7% of outstanding TELUS

Common Shares prior to the commencement of the 2016 NCIB. The Common Shares

will be purchased only when and if we consider it advisable.

On November 19, 2014, we filed a shelf prospectus, in effect until December 2016,

pursuant to which we may offer up to $3 billion of long-term debt or equity securities. As

of March 10, 2016, we can offer up to $250 million of debt or equity securities under the

existing shelf prospectus.

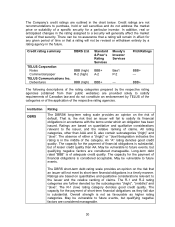

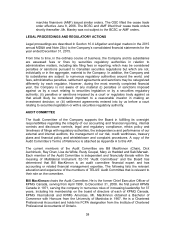

RATINGS

The following information relating to our credit ratings is provided as it relates to our

financing costs, liquidity and operations. Additional information relating to credit ratings is

contained in Section 7.5 - Liquidity and capital resource measures to Section 7.8 - Credit

ratings in the 2015 annual MD&A.

Credit ratings are important to our borrowing costs and ability to obtain short-term and

long-term financing and the cost of such financing. Credit ratings are intended to provide

investors with an independent measure of the credit quality of an issue of securities and

are indicators of the likelihood of payment and of the capacity of a company to meet its

financial commitment on the rated obligation in accordance with the terms of the rated

obligation. A reduction in the current rating on our debt by rating agencies, particularly a

downgrade below investment grade ratings or a negative change in ratings outlook could

adversely affect our cost of financing and our access to sources of liquidity and capital.

We believe our investment grade credit ratings, coupled with our efforts to maintain

constructive relationships with banks, investors and credit rating agencies, continue to

provide TELUS with reasonable access to capital markets. In addition, credit ratings may

be important to customers or counterparties when we compete in certain markets and

when we seek to engage in certain transactions including transactions involving over-

the-counter derivatives. As at December 31, 2015, TCI is a party to an agreement

expiring in December 2016, with an arm’s-length securitization trust associated with a

major Schedule I bank, under which TCI is able to sell an interest in certain trade

receivables up to a maximum of $500 million. TCI is required to maintain at least a BB

credit rating by DBRS Ltd. (DBRS) or the securitization trust may require the sale

program to be wound down.

The rating agencies regularly evaluate TELUS and TCI, and their ratings of our long-

term and short-term debt are based on a number of factors, including our financial

strength as well as factors not entirely within our control, including conditions affecting

the telecommunications industry generally, and the wider state of the economy. In May

2015, DBRS announced a downgrade to its long-term rating of TELUS, but such revised

rating is still consistent with our objective of maintaining investment grade credit ratings

in the range of BBB+ or the equivalent. DBRS had also downgraded its short-term credit

rating for TELUS, which limits our ability to access the commercial paper markets in

Canada. We expect to be able to continue to access short-term funding from other

available sources, including the U.S. commercial paper market. On November 30, 2015,

Moody’s Investors Service Inc. (Moody’s) affirmed the Company’s senior unsecured

ratings, but changed the outlook to negative from stable.