Telus 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

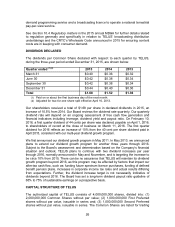

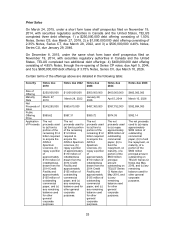

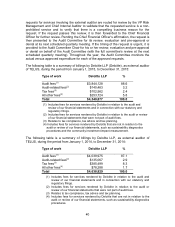

Prior Sales

On March 24, 2015, under a short form base shelf prospectus filed on November 19,

2014, with securities regulatory authorities in Canada and the United States, TELUS

completed three debt offerings: 1) a $250,000,000 debt offering consisting of 1.50%

Notes, Series CS, due March 27, 2018, 2) a $1,000,000,000 debt offering consisting of

2.35% Notes, Series CT, due March 28, 2022, and 3) a $500,000,000 4.40% Notes,

Series CU, due January 29, 2046.

On December 8, 2015, under the same short form base shelf prospectus filed on

November 19, 2014, with securities regulatory authorities in Canada and the United

States, TELUS completed two additional debt offerings: 4) $400,000,000 debt offering

consisting of 4.85% Notes, through the re-opening of Series CP notes, due April 5, 2044,

and 5) a $600,000,000 debt offering of 3.75% Notes, Series CV, due March 10, 2026.

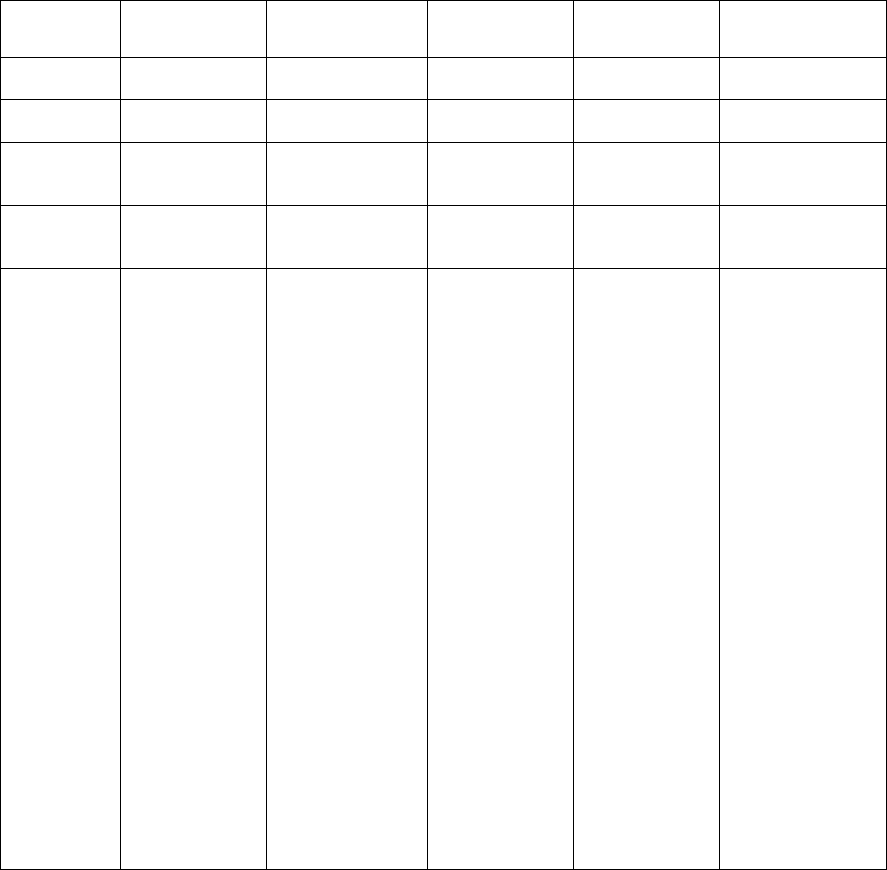

Certain terms of the offerings above are detailed in the following table:

Security

Notes due

2018

Notes due 2022

Notes due

2046

Notes due

2044

Notes due 2026

Size of

Offering

$250,000,000

$1,000,000,000

$500,000,000

$400,000,000

$600,000,000

Maturity

Date

March 27,

2018

March 28, 2022

January 29,

2046

April 5, 2044

March 10, 2026

Net

Proceeds of

Issue

$249,280,000

$993,610,000

$497,360,000

$387,752,000

$592,884,000

Public

Offering

Price

$999.62

$997.31

$999.72

$974.38

$992.14

Application

of Proceeds

The net

proceeds used

to (a) fund a

portion of the

remaining $1.2

billion required

to acquire the

AWS-3

Spectrum

Licences, (b)

repay a portion

of

approximately

$110 million of

indebtedness

drawn from the

2014 Credit

Facility and

approximately

$135 million of

outstanding

commercial

paper, and (c)

any remaining

balance used

for other

general

corporate

purposes.

The net

proceeds used to

(a) fund a portion

of the remaining

$1.2 billion

required to

acquire the

AWS-3 Spectrum

Licences, (b)

repay a portion

of approximately

$110 million of

indebtedness

drawn from the

2014 Credit

Facility and

approximately

$135 million of

outstanding

commercial

paper, and (c)

any remaining

balance used for

other general

corporate

purposes.

The net

proceeds used

to (a) fund a

portion of the

remaining $1.2

billion required

to acquire the

AWS-3

Spectrum

Licences, (b)

repay a portion

of

approximately

$110 million of

indebtedness

drawn from the

2014 Credit

Facility and

approximately

$135 million of

outstanding

commercial

paper, and (c)

any remaining

balance used

for other

general

corporate

purposes.

The net

proceeds used

to (a) repay

approximately

$956 million of

outstanding

commercial

paper, (b) to

fund the

repayment, on

maturity, of a

portion of the

$600 million

principal

amount

outstanding on

TELUS’ Series

CI Notes due

May 2016, and

(c) any

remaining

balance used

for other

general

corporate

purposes.

The net proceeds

used to (a) repay

approximately

$956 million of

outstanding

commercial

paper, (b) to fund

the repayment, on

maturity, of a

portion of the

$600 million

principal amount

outstanding on

TELUS’ Series CI

Notes due May

2016, and (c) any

remaining

balance used for

other general

corporate

purposes.