Telus 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

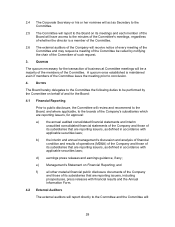

forwarded to the Chief Financial Officer for further review. Pending the Chief Financial

Officer’s affirmation, the request is then presented to the Audit Committee for its review,

evaluation and pre-approval or denial at its next scheduled quarterly meeting. If the

timing of the request is urgent, it is provided to the Audit Committee Chair for his or her

review, evaluation and pre-approval or denial on behalf of the Audit Committee (with the

full committee’s review at the next scheduled quarterly meeting). Throughout the year,

the Audit Committee monitors the actual versus approved expenditure for each of the

approved requests.

The following table is a summary of billing by Deloitte & Touche LLP, as external

auditors of TELUS, during the period from January 1, 2009 to December 31, 2009:

Type of work Deloitte & Touche %

Audit fees $3,744,786 95.8

Audit-related fees $162,500 4.2

Tax fees -- --

All other fees -- --

Total $3,907,286 100

The following table is a summary of billing by Deloitte & Touche LLP, as external

auditors of TELUS, during the period from January 1, 2008 to December 31, 2008:

Type of work Deloitte & Touche %

Audit fees $3,783,672 94.3

Audit-related fees $184,500 4.6

Tax fees $45,410 1.1

All other fees -- --

Total $4,013,582 100

MATERIAL CONTRACTS

Please see the section entitled TELUS Rights Plan on page 15 of this document for a

description of the Company’s shareholder rights plan.

In addition, TCI is a party to a three year agreement (expiry May 2012) with an arm’s-length

securitization trust associated with a major Schedule I bank, under which TCI is able to sell

an interest in certain of its trade receivables up to a maximum of $500 million. As a result of

selling the interest in certain of the trade receivables on a fully serviced basis, a servicing

liability is recognized on the date of sale and is, in turn, amortized to earnings over the

expected life of the trade receivables. TCI is required to maintain at least a BBB (low) credit

rating by DBRS Ltd. or the securitization trust may require the sale program to be wound

down. The necessary credit rating was exceeded by three levels at A (low) as of March 10,

2010.

25